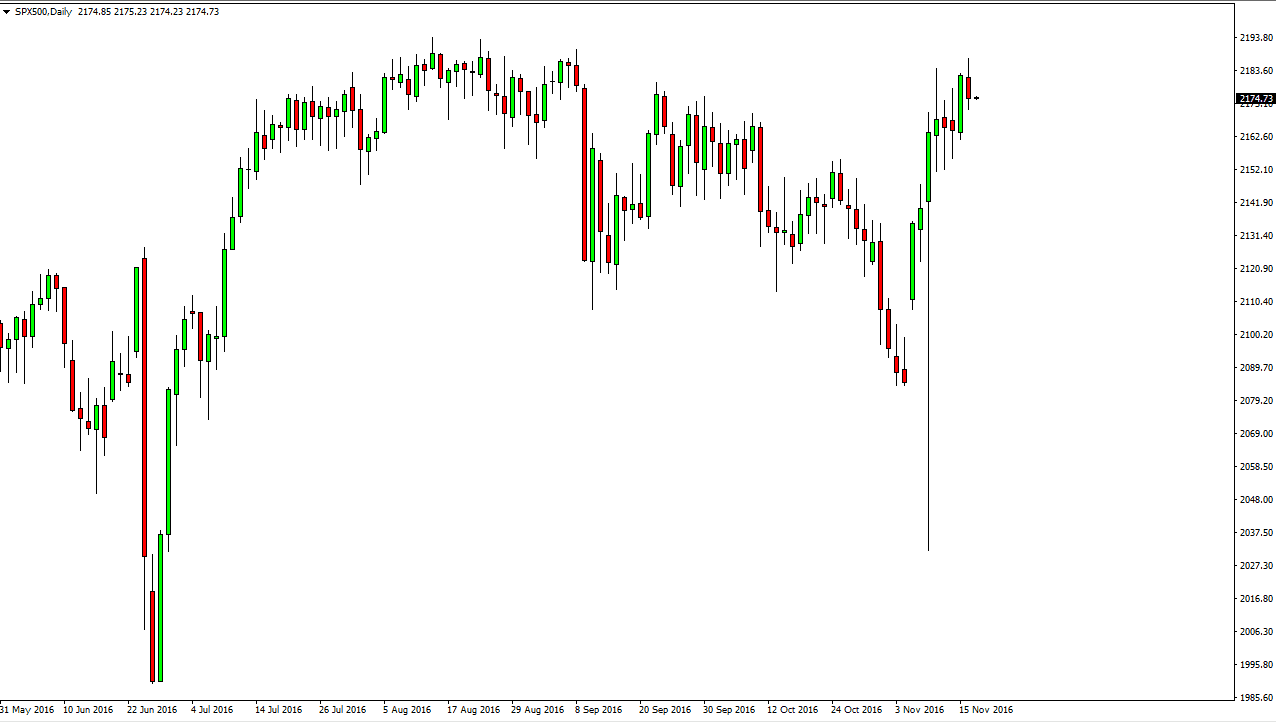

S&P 500

The S&P 500 had a slightly negative session on Wednesday, as we are a bit overextended at this point. I believe that sooner or later the markets may pullback in order to find more support below. Perhaps the 2150 level below could be massively supportive. Any type of s a supportive candle is going to be an opportunity to go long, as I feel that it’s only a matter of time before the 2200 level above is broken to the upside. I think that the United States will be the place where most money flows two, and of course the S&P 500 has shown so much strength after the shock election of Donald Trump.

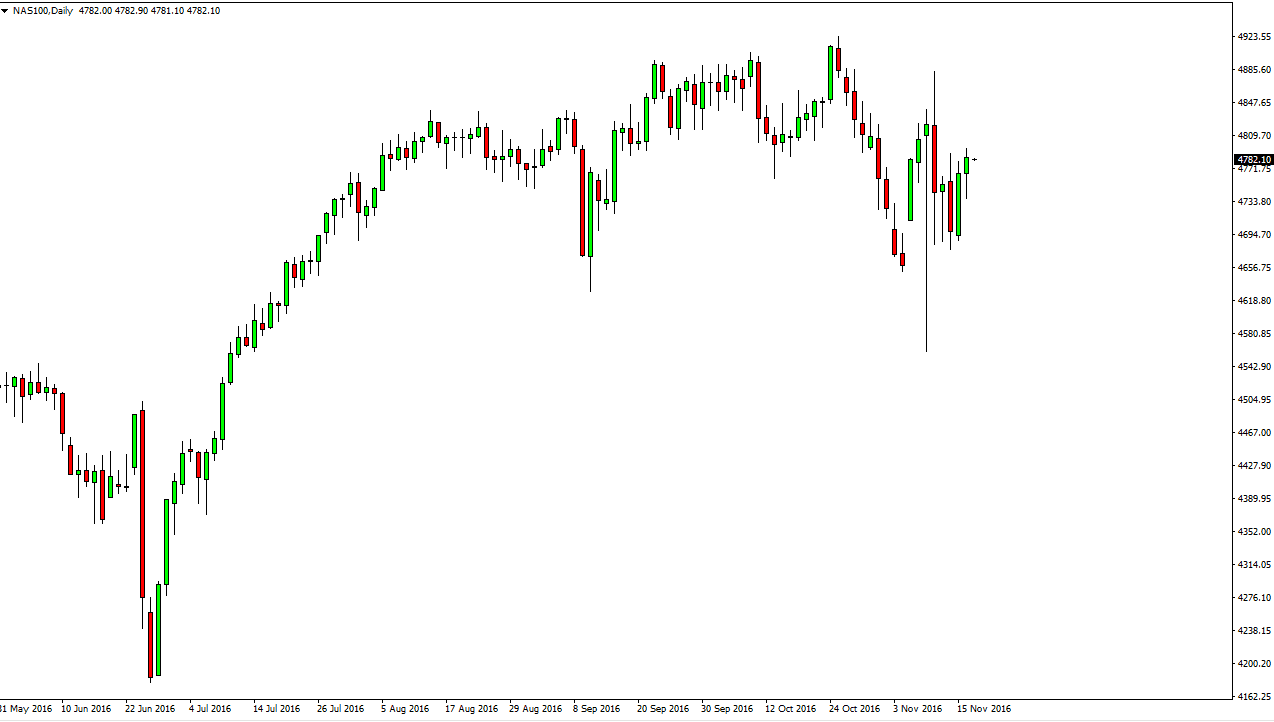

NASDAQ 100

The NASDAQ 100 initially fell during the course of the session on Wednesday, but turned back around to form a hammer which of course is a very bullish sign. Because of this, I believe that the market will then reach towards the honeys yet again, perhaps the 4900 level. If we can break above their, the market and then should reach towards the 5000 handle. Because of this, pullbacks will continue to be supported, and with that it’s likely that the buyers will return yet again.

I have no interest in shorting this market and I believe that the 4700 level below is massively supportive, and most certainly the 4600 level below is as well. Ultimately, this is a market that should continue to be supported in general, as money continues to flow from the European Union and of course the United Kingdom heading towards the United States. I have no interest in shorting, at least not until we breakdown below the aforementioned 4600 level. Ultimately, this is a market that should continue to be supported every time we pullback, and the noise should continue to be prevalent in this market but given enough time I think the buyers will win.