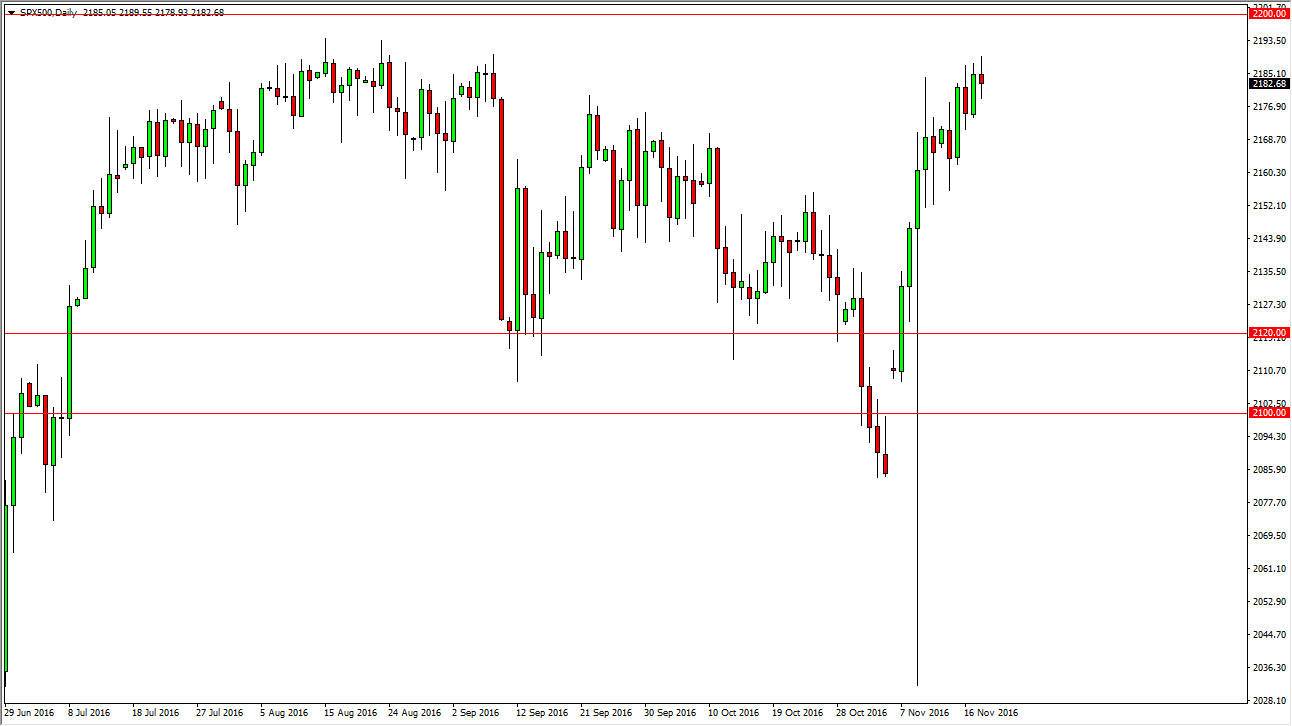

S&P 500

The S&P 500 had a fairly quiet session on Friday, as we continue to hover around the 2180 handle. I believe that this market is trying to build up enough pressure to break out to the upside, as the 2200 level laws should be massively resistive. Once we get above there, this market then becomes more or less a “buy-and-hold” type of situation, and I believe the pullbacks could be thought of as potential buying opportunities that show signs of support. I think that the 2150 level is essentially the support level that we are working with right now, and obviously that the area above needs a lot of momentum to be broken through.

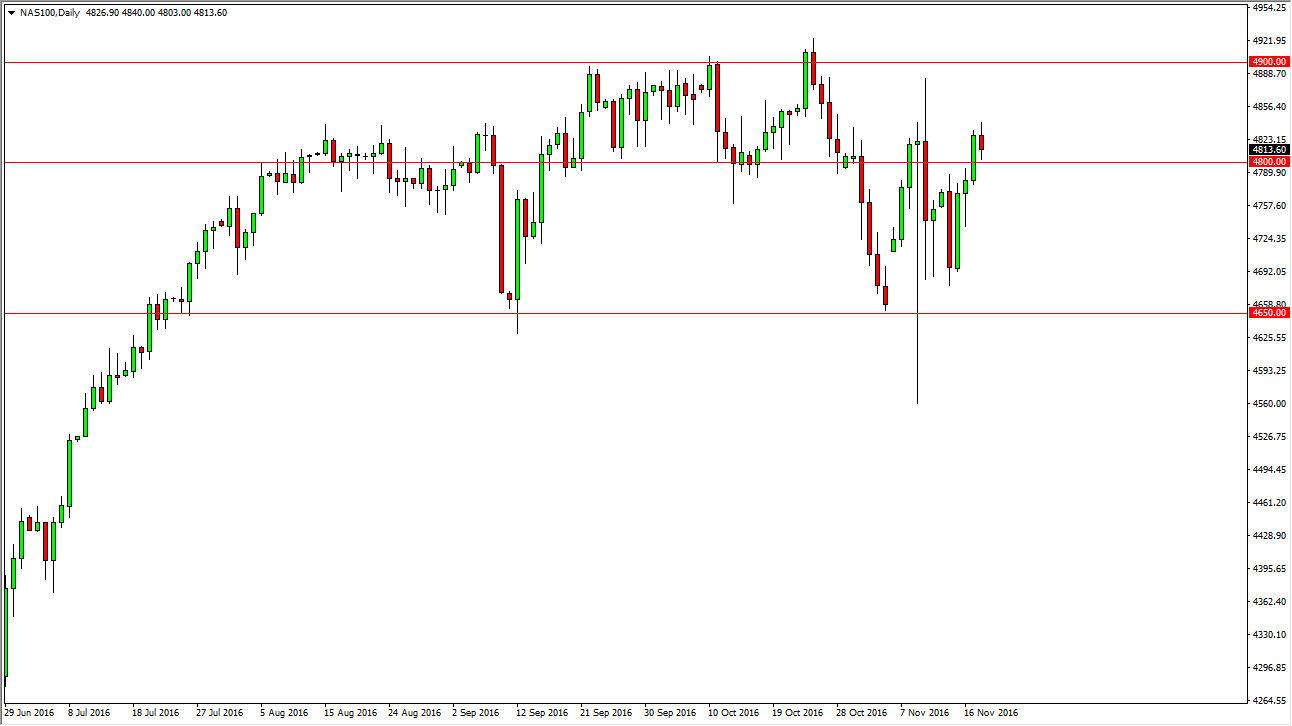

NASDAQ 100

The NASDAQ 100 fell slightly on Friday, testing the 4800 level for support. It did in fact find it there so I think it’s only a matter of time before the buyers jump back into this market. A supportive candle could be the ticket to go long, just as a break above the top of the range for the session on Friday would be. At that point, I believe that the market then goes to the 4900 level, and then eventually the 5000 level which is my longer-term target and has been for some time. Clearly the US indices are going better than most of the other ones around the world, and after the extreme volatility in the last couple of weeks, they have come out fairly strong. Ultimately, I believe that we do break out although I’m the first to admit that the NASDAQ 100 might be a bit of a laggard when it comes to the US indices overall.

I believe that the absolute “bottom” of the market right now and the uptrend is the 4650 handle. It’s not until we break down below there that I would consider selling, and that's not going to happen anytime soon.