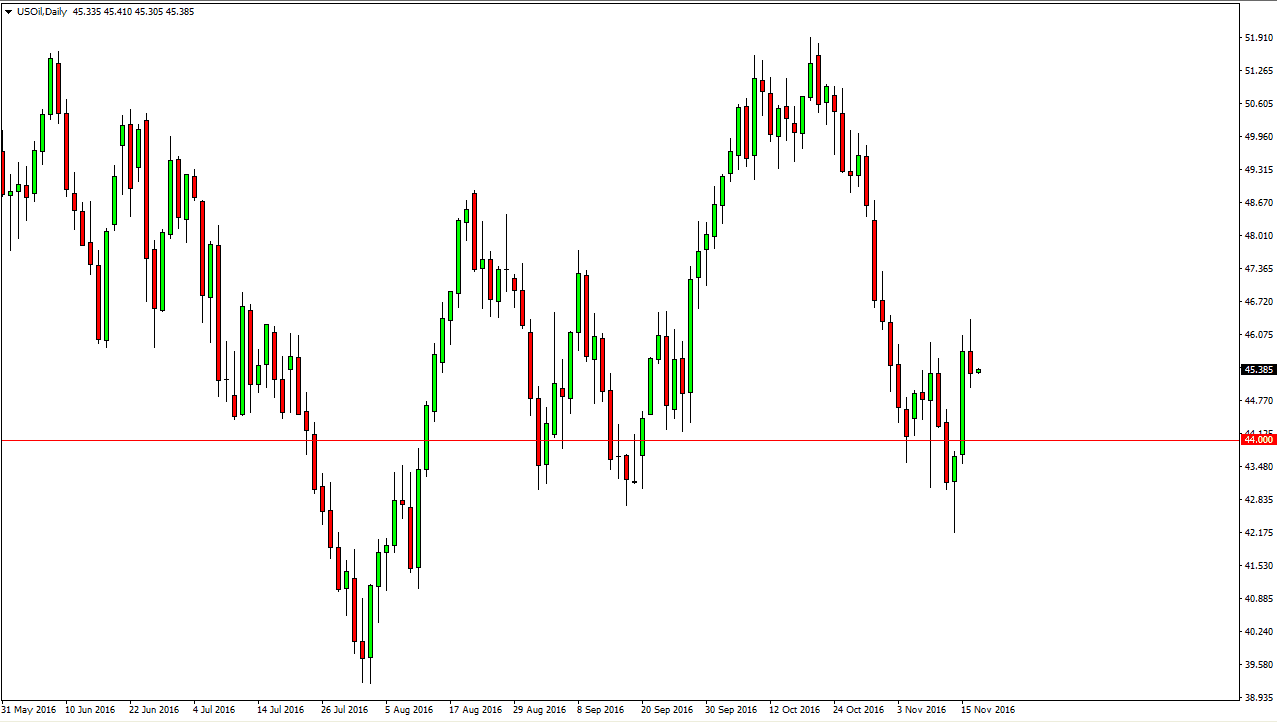

WTI Crude Oil

The WTI Crude Oil market initially rallied at the open on Wednesday, but turned around as the $46 level continued to offer resistance. The shooting star of course is an exhaustive candle, and I think if we can breakdown below the bottom of that shooting star we could then reach towards the $44 level, and then perhaps the $43 level below there. At this point, if we can break above the top of the shooting star, that would be a very bullish sign for the oil market, and could send it looking for the $48 level above. Nonetheless, there is a massive oversupply in the market, so at this point it seems very likely that we will have sellers enter this market again and again. Because of this, I am very sure the longer-term.

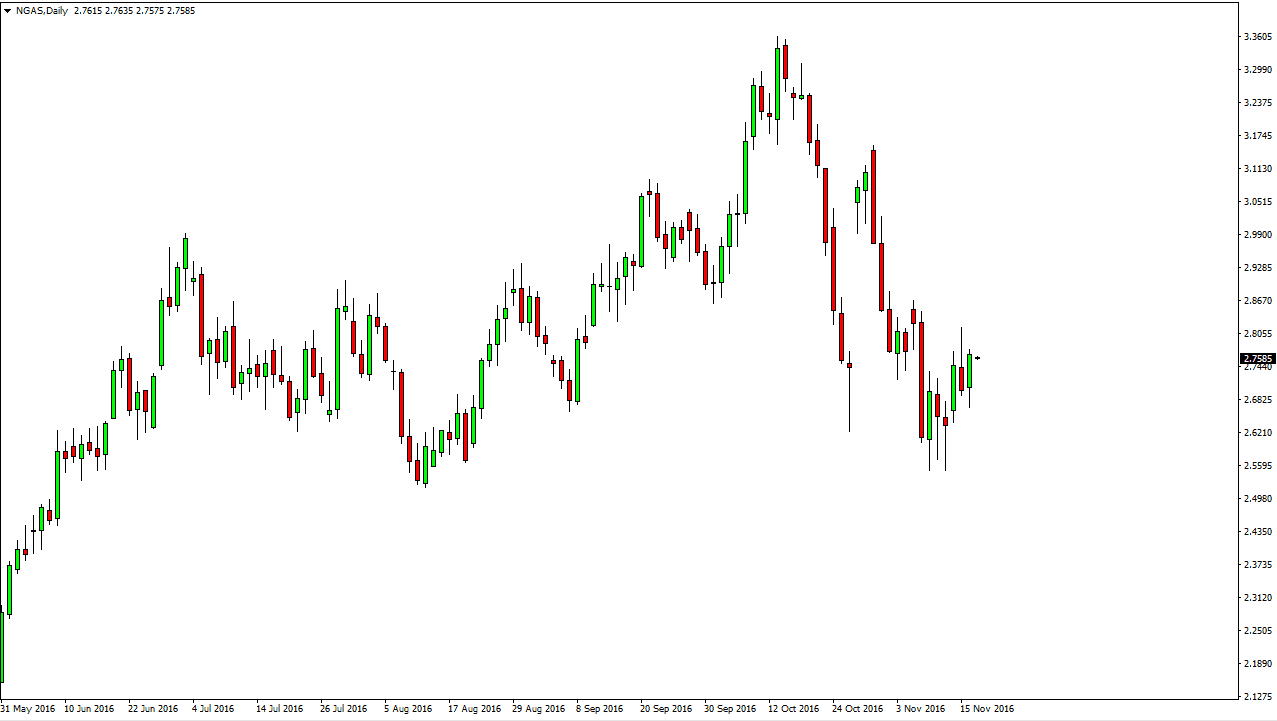

Natural Gas

The natural gas market initially fell during the day on Wednesday, but turned around to show signs of strength. Ultimately though, I believe that there is so much in the way of bearish pressure in this market that we should continue to go lower over the longer-term. With this, the market should and reach down to the $2.55 level below, which has been massively supportive. I have no interest whatsoever in buying this market as the oversupply has been so profound. With this, I think that it’s only a matter of time before the sellers return regardless. With this, I think that any sign of exhaustion should be an opportunity to short a market that quite frankly has no business being at these higher levels right now. I believe the market will eventually fall, and even though we are heading into the cold weather season in North America, there is more than enough supply out there to keep prices lower going forward and for the longer-term.