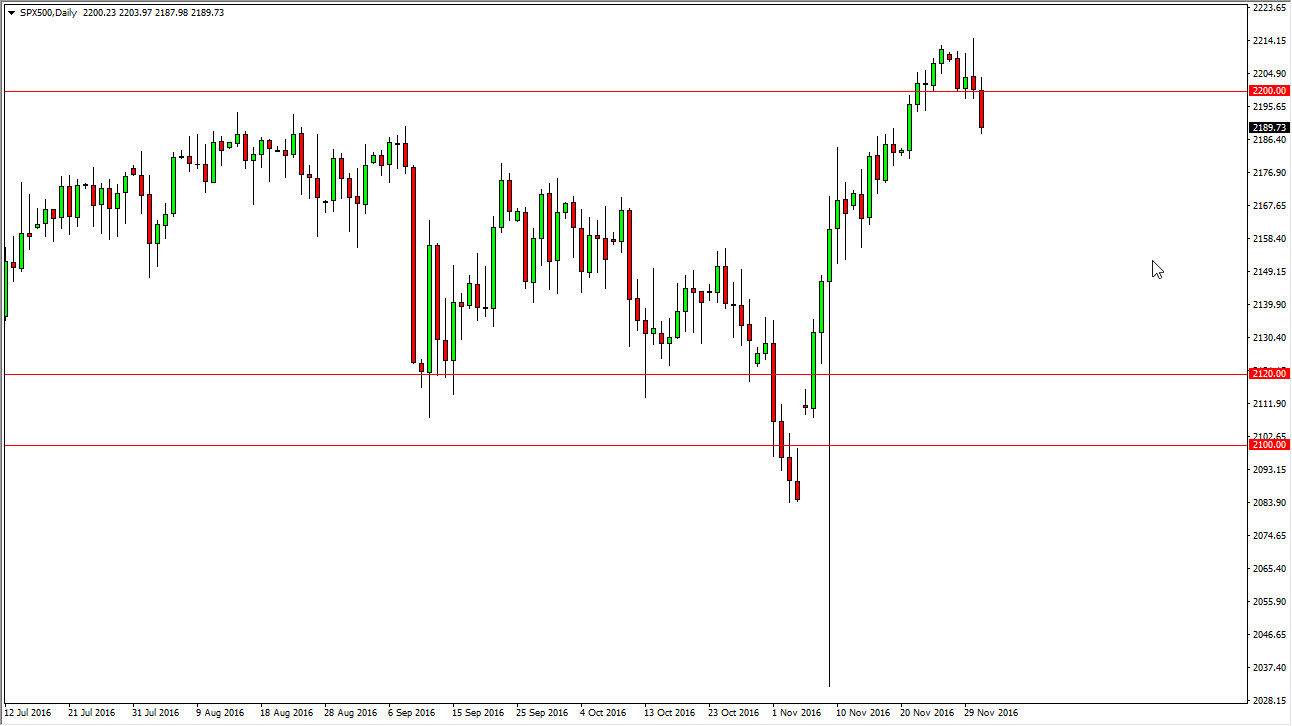

S&P 500

The S&P 500 initially rallied on Thursday but turned back to the very sign as we slammed into the 2190 handle. I think this might have been a bit of profit gathering ahead of the volatile jobs numbers coming out of America today, so I am looking at this as a potential buying opportunity. I see a significant amount of choppiness and support all the way down to at least 2150, and of course the most recent move has been explosive to the upside to say the least. At the first hint of support or a bounce, I am willing to go long of the S&P 500 yet again as I still believe we’re going to target the 2250 handle over the longer term. The jobs number is expected to be an addition of 175,000 jobs for the month of November, and of course a stronger than anticipated number will be bullish and should send the markets higher.

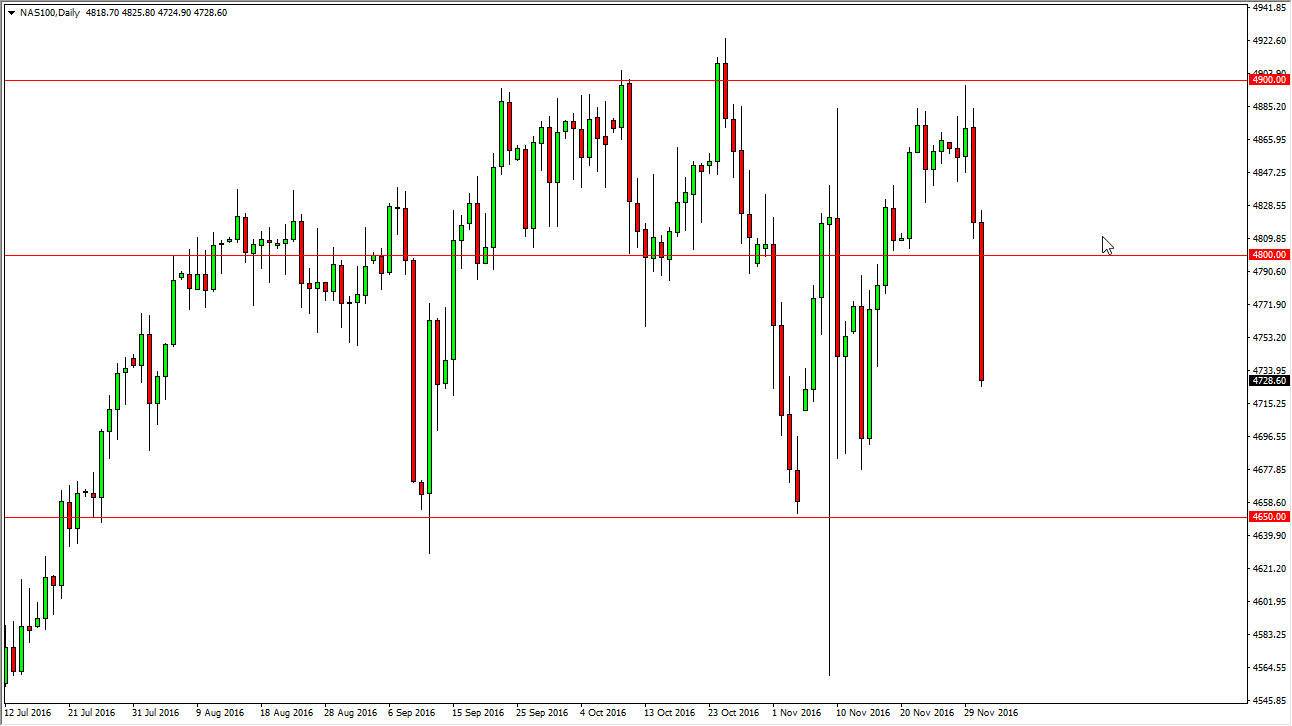

NASDAQ 100

The NASDAQ 100 has been a bit of a laggard for some time now, but quite frankly this was a very strange move. We sliced through the 4800 level like it wasn’t even there, and now we seem all but hell-bent on breaking down to at least the 4700 level. I still think that we can turn things around but a lot of the problems that you run into with the NASDAQ 100 is that people are concerned about foreign exports now. Ultimately, I believe that this market will find buyers underneath but given enough time a supportive candle should return. With this, the market should then reach towards the 4800 level and then the 4900 level.

The jobs number of course can have an influence on the NASDAQ 100 but if we’re concerned about European exports for example, this market will continue to be a bit of a laggard to the S&P 500 and the Dow Jones 30.