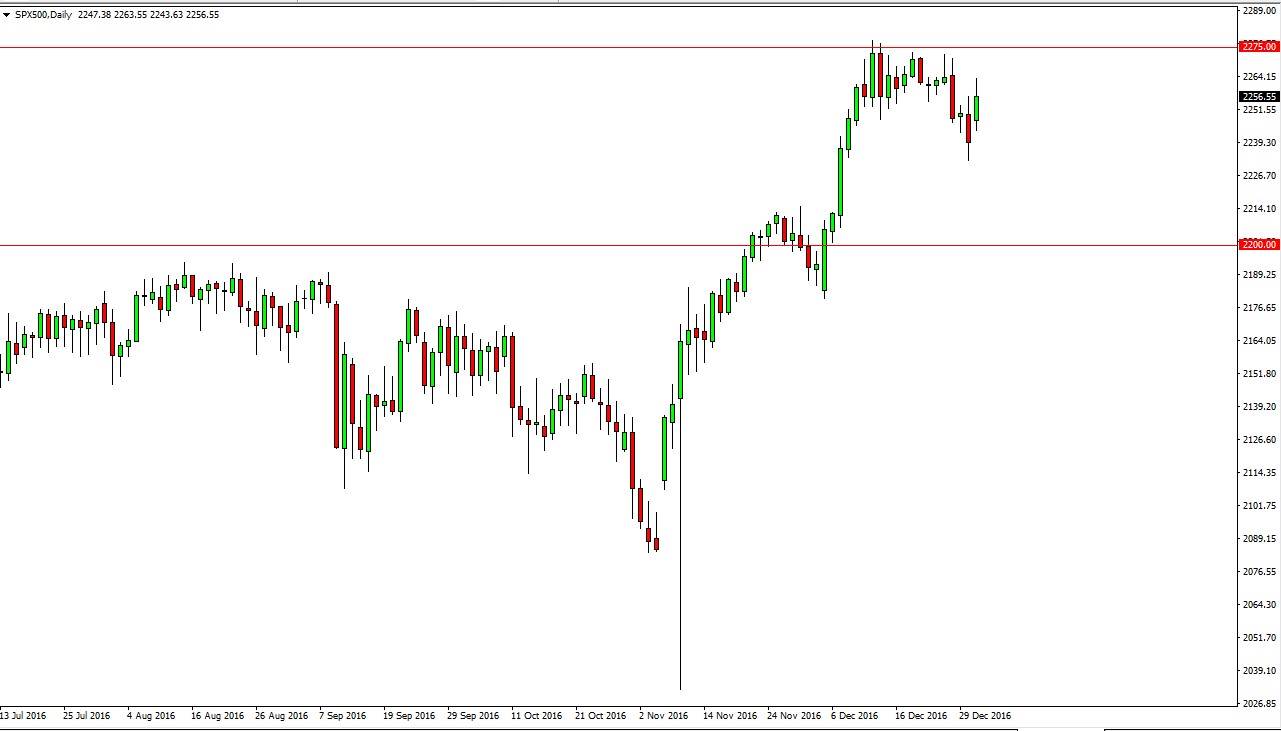

S&P 500

The S&P 500 rallied on Tuesday as liquidity picked up just a bit due to traders coming back from the holiday season. Ultimately, one of the biggest things that I am concerned about is the 2275 level above. This is an area that should be rather resistant, and quite frankly we may need to see the jobs number come out before the market decides to break above it. When it does, I think that we go much higher perhaps even reaching as high as 2300 and the short-term. I still believe that pullbacks are buying opportunities, and that there is a significant “floor” in this market near the 2200 level. Until we breakdown below that handle, I don’t really see a scenario in which I am comfortable selling.

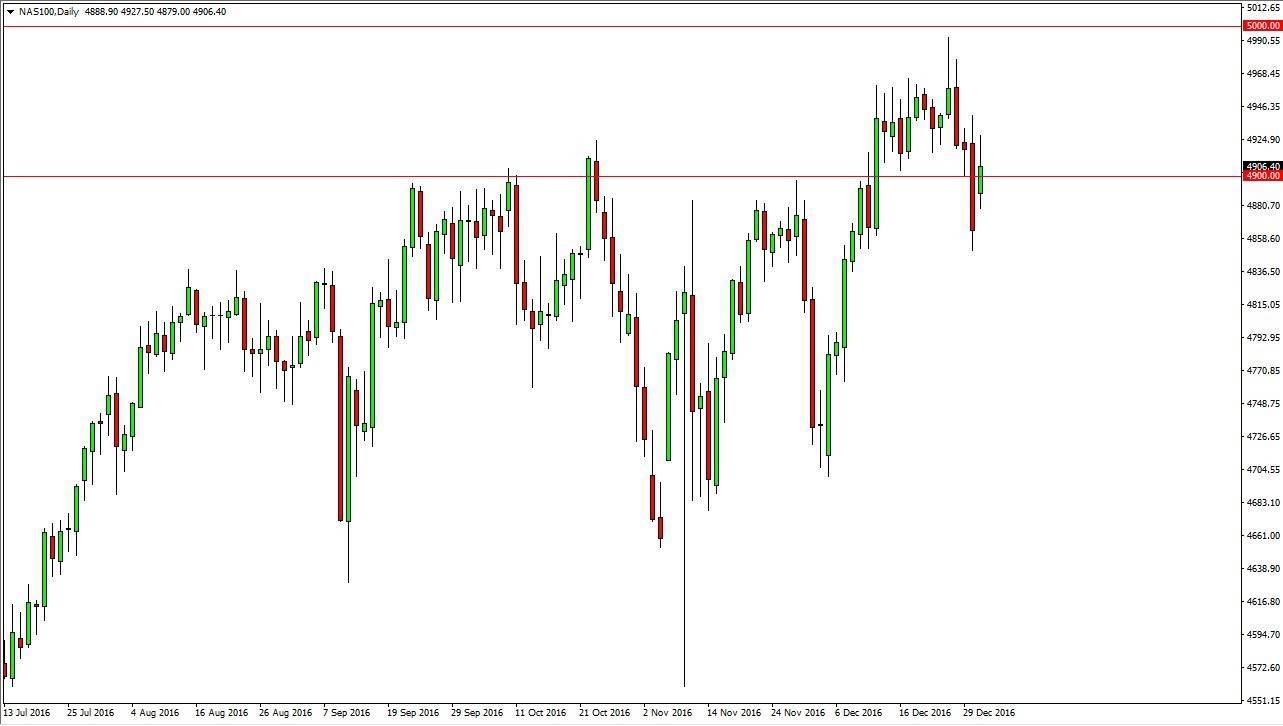

NASDAQ 100

The NASDAQ 100 gapped higher at the open on Tuesday, and then shot towards the 4925 region. In this area, I see quite a bit of noise, so it’s not a surprise that we gave back some of the gains. Ultimately, I think we go higher and continue to reach towards the 5000 level. The 5000 level will be resistive, and will take quite a bit of momentum to break above. Sooner or later we should though, and when we do I feel that the market will be free to go much higher. It will be the next leg higher in the longer-term uptrend if you will.

Even if we fall from here, I see quite a bit of support just below so I look at every pull back as “value” in a market that has lagged behind its brethren in the United States. All of the US indices tend to move in concert, and the NASDAQ 100 has been a bit slower than the others. Because of this, I think that there is some pent-up energy underneath.