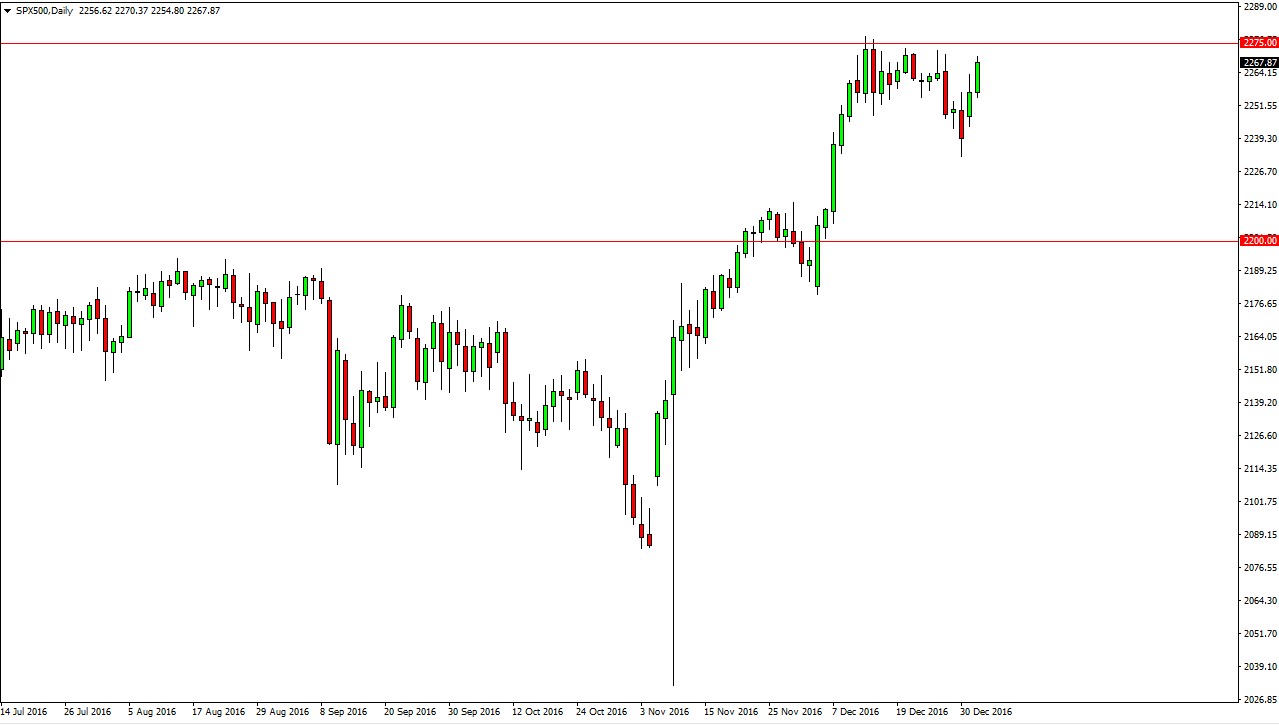

S&P 500

The US stock indices continue to look very healthy, as the S&P 500 rallied on Wednesday. I do see a significant amount of resistance above about the 2275 handle, but I think we will break above it. We have the jobs number coming, and that of course could be the catalyst to send this market above that resistance barrier. I don’t think that the pullbacks will lead to anything major, and I believe that every time the market falls there will be value found by the bullish.

Once we break above the 2275 handle, I feel that the market then can reach towards the 2300 level and then eventually beyond that to the 2500 level. The market has been overbought for some time, so this consolidation makes quite a bit of sense. Ultimately though, US indices are going to outperform most other indices around the world, so I still like the idea of going long. I believe there is a massive floor down at the 2200 level.

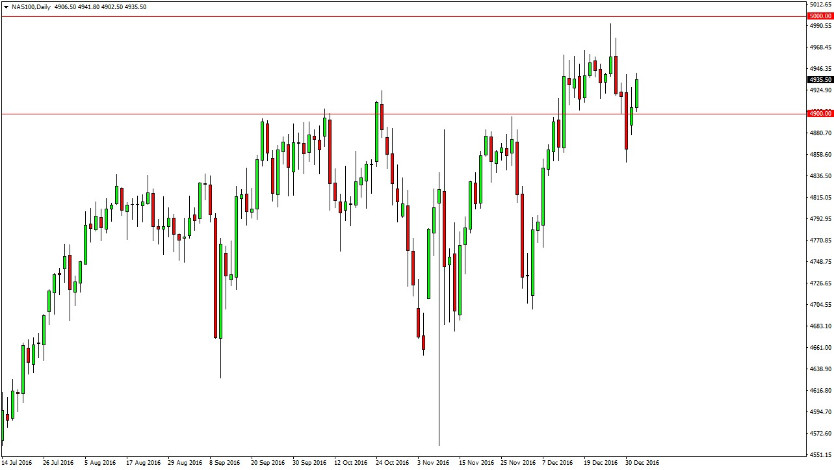

NASDAQ 100

The NASDAQ 100 continue to go higher on Wednesday, as we have cleared the 4900 level. It now looks as if the market will probably reach towards a 5000 level above, which will be significant resistance. We probably need a healthy jobs number in the United States to do that, so I think in the meantime we made bounce back and forth with more of an upward bias than anything else. Pullbacks should be supported quite healthily below, and thus I have no interest in selling this market as US indices overall seem to be going higher.

If we can finally break above the 5000 level, the NASDAQ 100 will go much higher, and I do believe that’s what’s going to happen. It’s going to take some work but will get there. I have no interest in selling.