The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 28th May 2017

Last week, I predicted that the best trade for this week was likely to be long the British Pound and Euro, and short of the U.S. Dollar. This did not work out very well, with the Euro failing to rise above 1.1250 before falling, while the British Pound was hit by new opinion polling showing that the General Election seems to be narrowing. This combination trade was not profitable, with EUR/USD falling by 0.25%, and the GBP/USD currency pair also falling, by 1.75%. This produced an average loss of 1.00%.

The Forex market is in a less settled mood, with trends against the U.S. Dollar and in favor of the Euro, British Pound, and Swiss Franc, although there has been a pull-back against the trend this week. Gold has also performed quite well. With major market news concerning the U.S. Dollar due later this week, the major movement of the week in the Forex market may not be determined until Friday. Additionally, the British Pound looks vulnerable to any further tightening of British political opinion polling, and the latest polls have wide variations in results. I therefore suggest that the best trades of the coming week will be long the Euro and Gold, and short of the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major elements affecting market sentiment at present are increasingly positive economic data within the Eurozone concerning growth and unemployment, and a marginally improved growth outlook for the U.S. economy, tempered by ongoing political uncertainty concerning the relationship of the Trump administration to the FBI. These positions are unlikely to change before Friday, when U.S. Non-Farm Payrolls data will be released.

Technical Analysis

USDX

The U.S. Dollar printed a bullish candle this week. It is a candle of normal size closing near its high, however, the rhythm of the pattern is bearish and the candle does nothing to seriously call that into question. The bullish trend line is broken and has been rejected bearishly from the broken side, with a new resistance level forming at 12289. The price has broken convincingly below the formerly supportive level at 12203. The price is now below its historic levels from 3 months and 6 months, so has a long-term bearish trend. The signs remain bearish.

EUR/USD

The weekly chart below shows that this currency pair just broke bullishly above a bearish trend line which has formed and held over 1 year, as well as a big psychological number at 1.1000. The candle that formed this week is a small bearish pin candle, but in the context of the recent movement, it does not look very convincingly bearish. This pair was again the center of the Forex market this week. The price is well above its levels of both 3 months and 6 months, so is now technically in a long-term bullish trend. There is a very high probability that there will be some more bullish momentum left in this move, which should see the price continue to rise over the short-term at least. However, if the price does break up above 1.1250, it begins to approach an area which has been strongly resistant for more than 2 years.

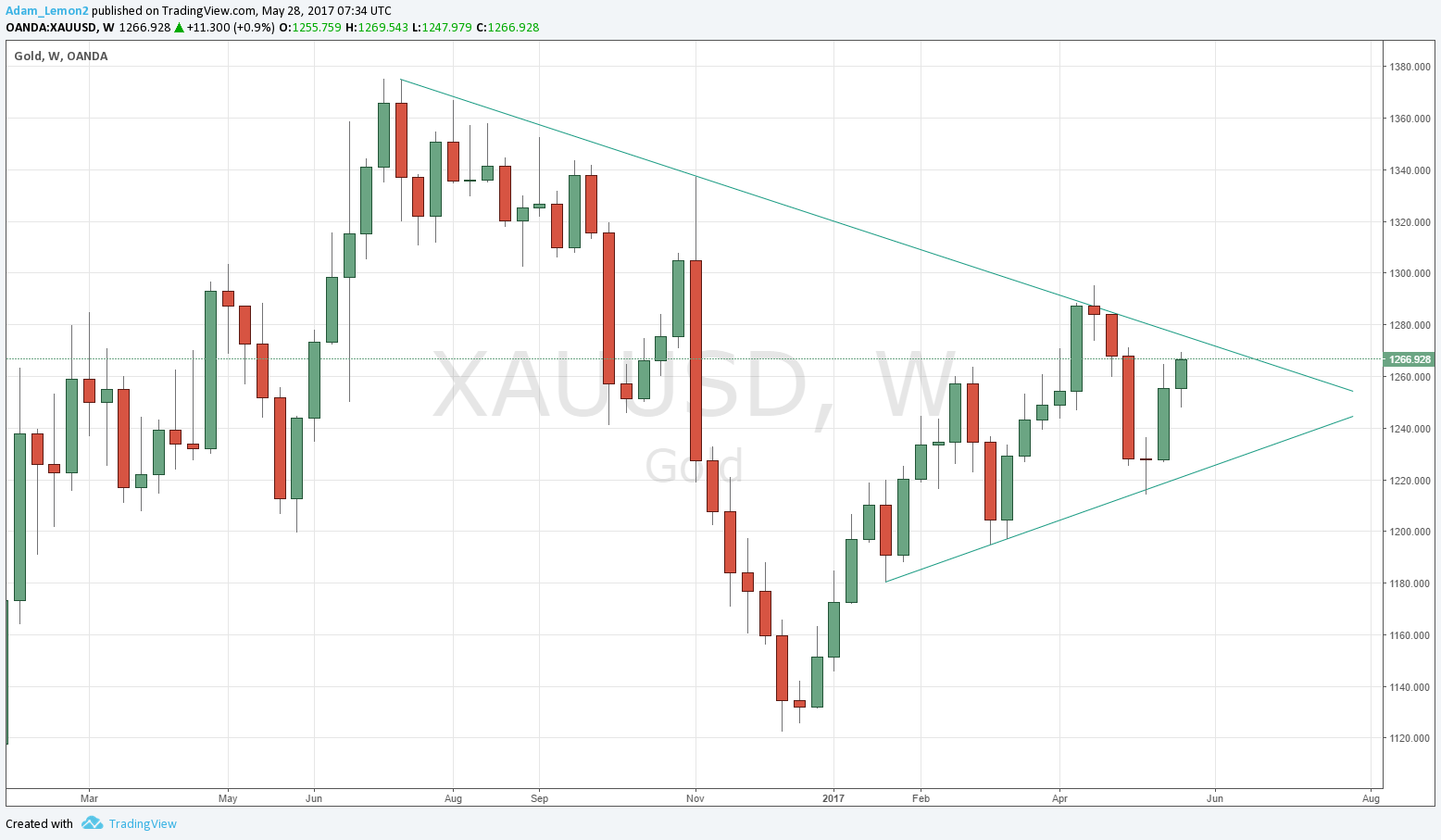

GOLD

The weekly chart below shows that this pair had a bullish week. The candle that formed this week is a normal sized bullish candle, closing near its high. The price is above its levels of both 3 months and 6 months, so is now technically in a long-term bullish trend. The rhythm of the past few months has been solidly if quietly bullish, with a clear series of higher lows supported by the bullish trend line shown in the chart below. There is a reason for bulls to be cautious: there is a long-term bearish trend line not far above which may continue to hold, and the bullish momentum is not very strong. However, if the price can break up above that trend line, it would be more likely to increase its bullish momentum.

Conclusion

Bullish on the Euro and Gold; bearish on the U.S. Dollar.