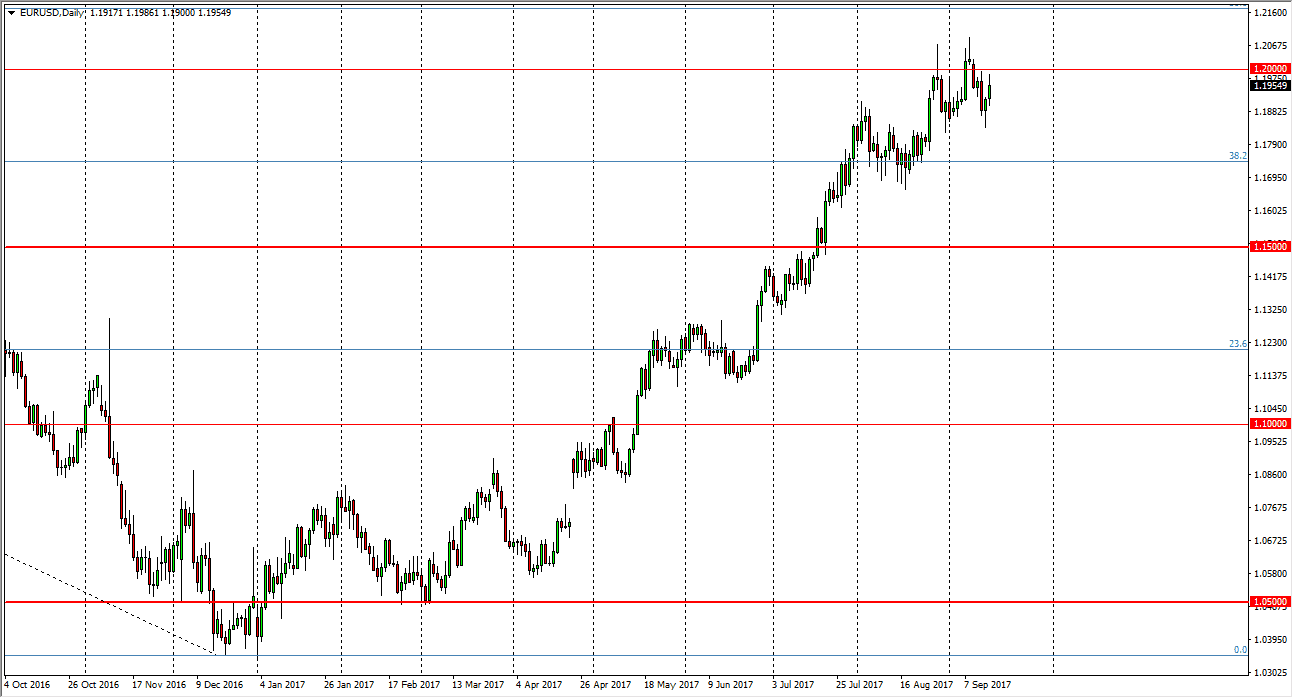

EUR/USD

The EUR/USD pair rallied on Friday, testing the 1.20 level. However, it’s obvious that we are going to struggle in this general vicinity, as there is a certain amount of resistance. I think pullbacks are buying opportunities, and I think that if we can break down below the 1.18 level, that changes everything. But in the meantime, it looks as if we are going to continue to try to go higher, and if we can clear above the 1.21 handle, I think the markets ready to go towards my longer-term target of 1.25. I believe in buying dips, I don’t have any interest in shorting this market, and if we break down below the 1.18 handle - I would only look for buying opportunities at lower levels.

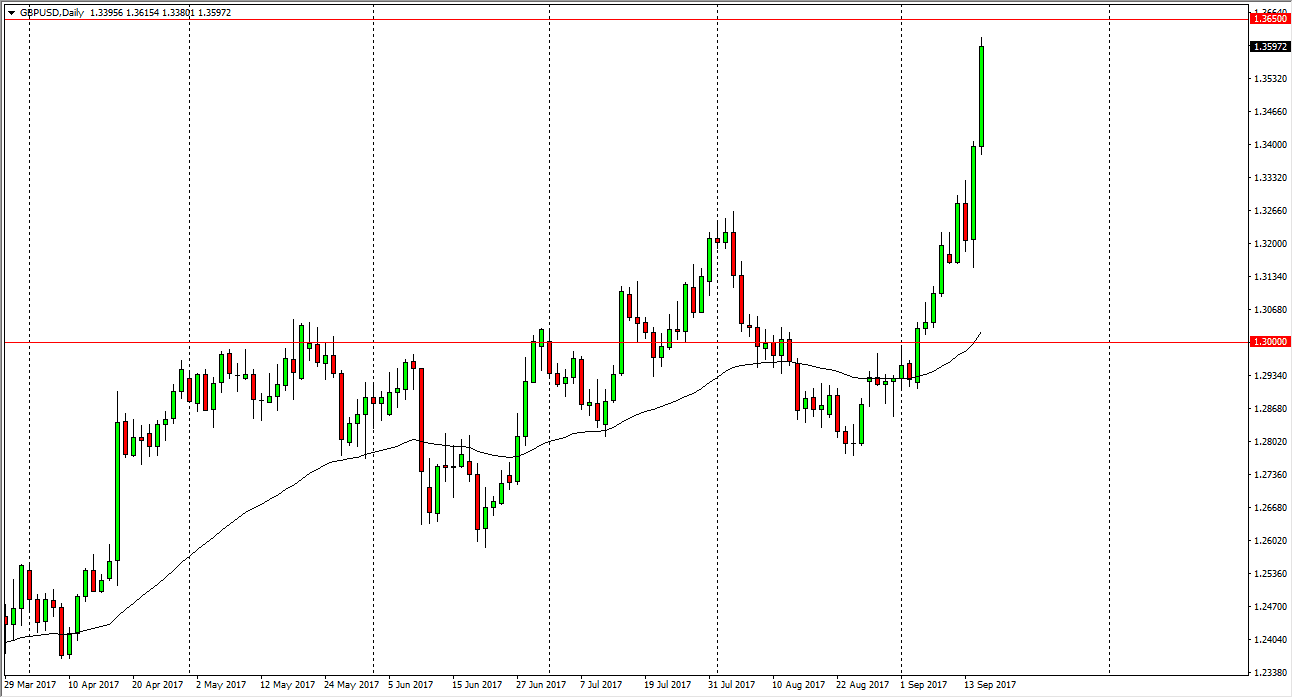

GBP/USD

The GBP/USD pair exploded to the upside on Friday, reaching towards the 1.3650 handle. There is a certain amount of bearish pressure in this area as it was the scene of the gap after the surprise exit vote coming out of the United Kingdom, but I think we will eventually break out above there. In the meantime, it’s likely that we will pull back to try to find some type of support underneath. Ultimately, the market looks very volatile, and a pullback from here is probably just going to be support waiting to happen. The British pound has been very cheap for a long time, and given enough time I think that we will find buyers on these pullbacks. I have no interest in shorting, as the Bank of England looks likely to raise interest rates in the near term. I think that the 1.30 level underneath is support, and should continue to be a “floor” in the market. With all this being said, I think looking for value as the way to go.