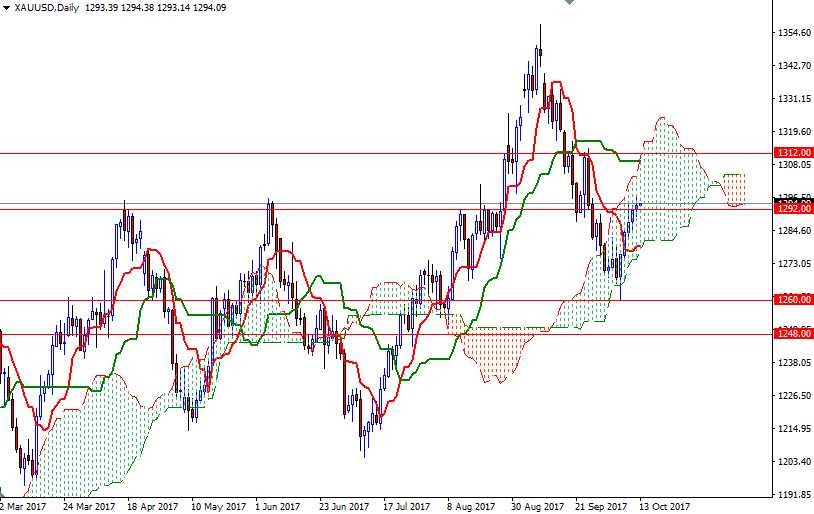

Gold prices ended Thursday slightly higher after a quiet session. XAU/USD reached the $1298-$1296 area as expected but was unable to break through. Consequently, prices retreated to Ichimoku cloud on the 4-hour chart before finding support. It seems that the market intend to retest the resistance in the $1298-$1296 zone again today.

XAU/USD is trading above the Ichimoku cloud on the 4-hour chart, and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. The short-term charts suggest that a test of 1302 is likely if XAU/USD is able to climb and hold above the 1298/6 area. A weekly close beyond 1302 implies that the market is on its way to 1312-1309.

To the downside, the initial support stands at 1289 followed by 1285/4. The bears will need to clear the support in the 1285/4 area in order to take the reins and test 1281/79. A break down below 1279, the daily Tenkan-sen, indicates that the market will be targeting the 1272 level.