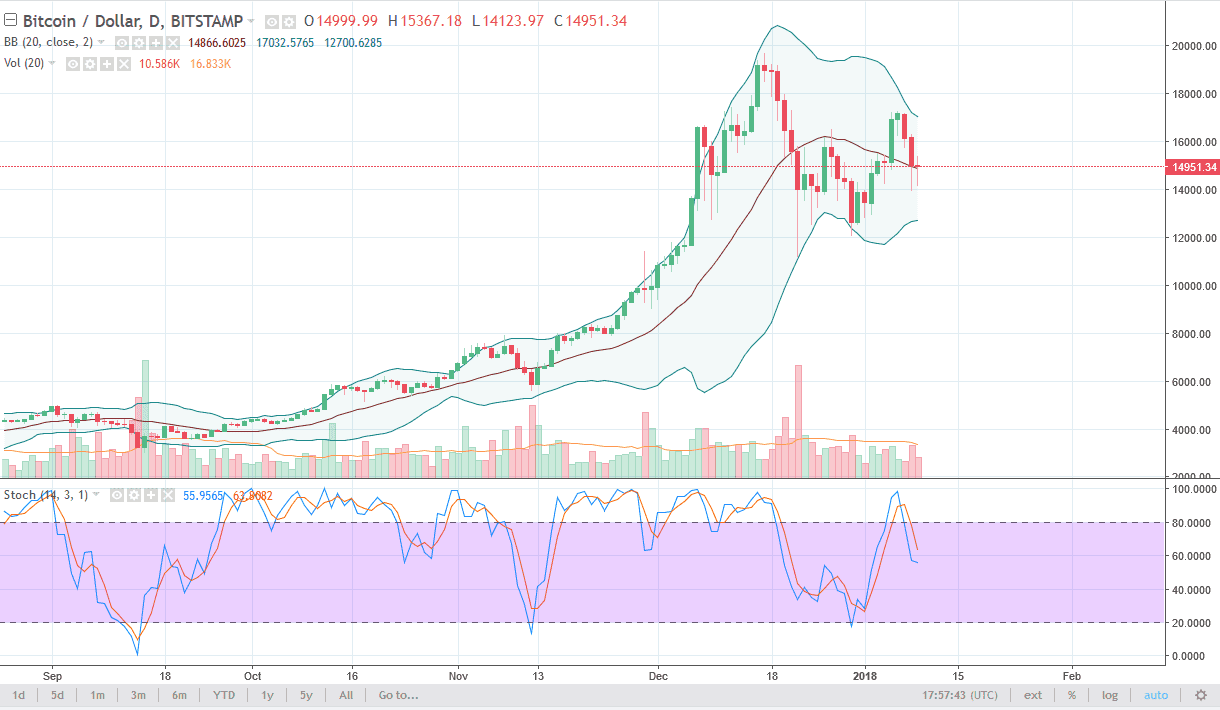

BTC/USD

Bitcoin fell during most of the trading session against the US dollar on Tuesday, but found the $14,000 level to be supportive enough to make the market turn around and bounce towards $15,000 above. The resulting candle is a hammer, and it looks likely that we could see buyers jump into the market if we can break above the candle. If so, I think the market then goes looking towards the $17,000 level, and ultimately perhaps even higher. I believe that we will continue to see a lot of volatility, but quite frankly it’s a market that continues to bang around overall. The Bitcoin markets have not behaved the same after the futures markets entered the fray, and this being the case it’s likely that the markets have already made most of the “easy money” that so many retail traders are looking to get involved in. If we do break down below the $14,000 level, I think the market will probably go to the $12,000 level.

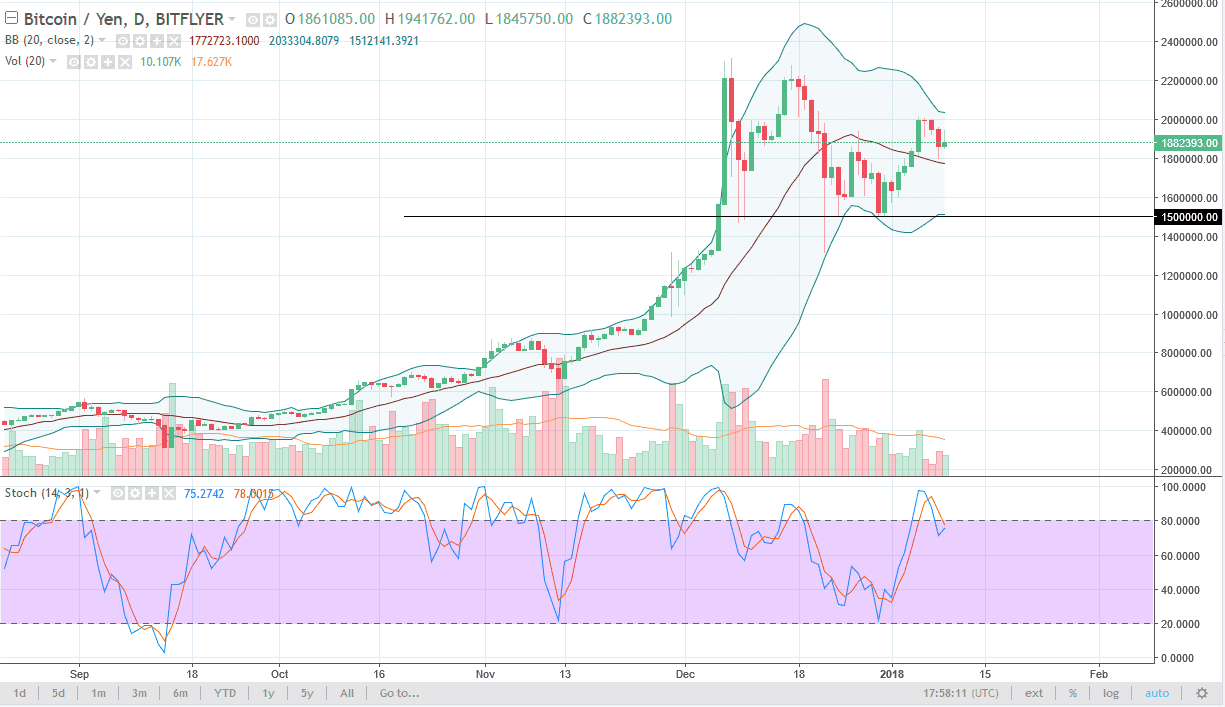

BTC/JPY

Bitcoin rallied against the Japanese yen, but struggled near the ¥1.9 million level, extending to the ¥2.0 million level. If we can break above that level, the market should then go to the ¥2.25 million level, which was the most recent high. It would make sense that the Bitcoin markets rallied more against the Japanese yen than the US dollar, because quite frankly 40% of the world’s volume comes out of Japan itself. The ¥1.5 million level underneath continues to be massive support, so I think it’s not until we break down below there that sellers can short this market with any sense of confidence. Buying on the dips could be a way going forward, but I would do so here, I would anticipate lower pricing before that happen. Alternately, I would also be willing to buy on a move above the previously mentioned ¥2 million level.