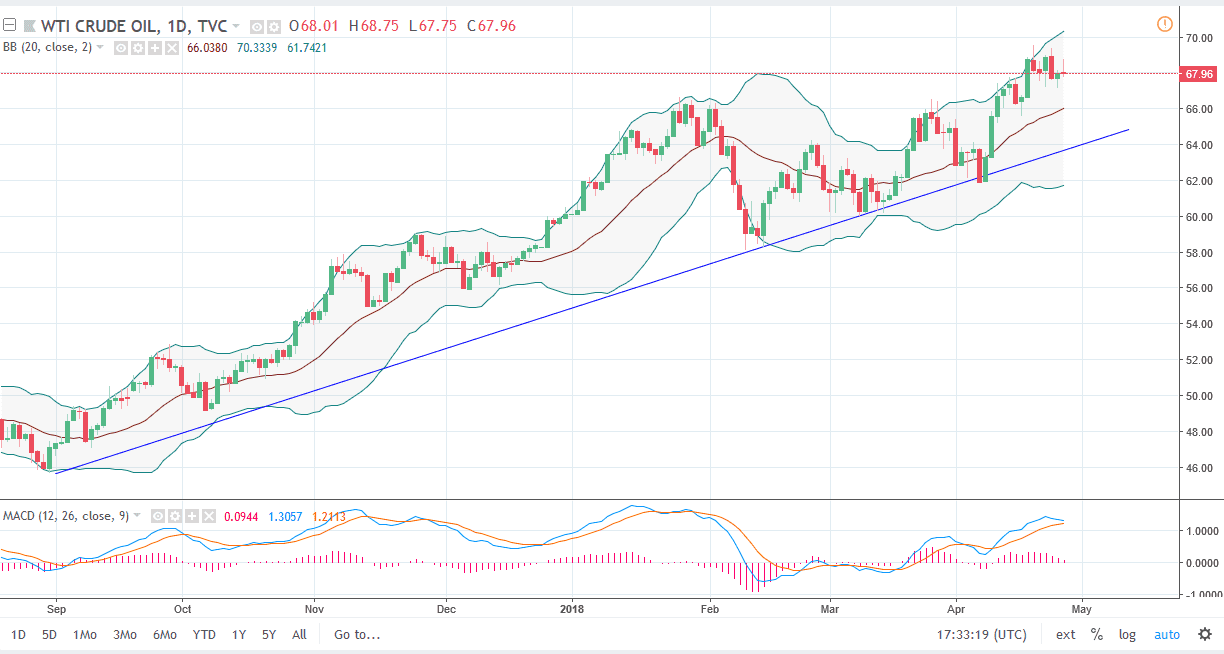

WTI Crude Oil

The WTI Crude Oil market tried to rally during the day on Thursday but gave back most of the gains. We are hanging about the $60 level, and I think what we are trying to do is build up enough momentum to finally break above the $70 handle. I think short-term pullbacks will continue to be buying opportunities, as there is a strong uptrend line underneath, and of course horizontal support at not only the $68 level, but perhaps the $66 level. If we finally do break above the $60 level, the market should continue to go much higher, perhaps reaching towards the $75 level over the longer term. I think if we did finally break down below the uptrend line underneath, then it would be time to start selling, but currently it looks as if the buyers are willing to come in and pick up value as geopolitical concerns continue to drive the price of oil up higher.

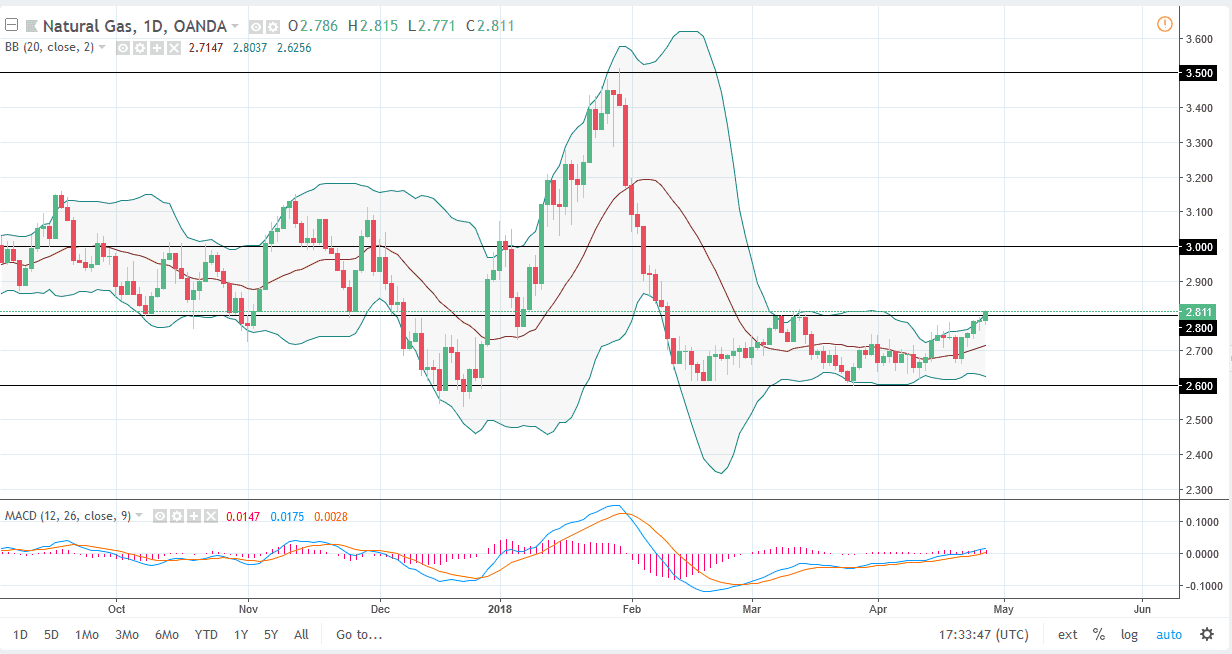

Natural Gas

Natural gas markets rose during the trading session on Thursday, breaking above the $2.80 level. Now that we have done that, it’s possible that we could go higher, but I would need to see a break above the highs of the trading session. If we do get that, then I think in the short term we could see buyers jumping in and taking advantage of a bit of momentum. I believe that the $3.00 level above is the “ceiling” in the market, so I would be especially interested in shorting this market on signs of exhaustion. If we break down below the bottom of the range for the day on Thursday, that is also a selling opportunity. I think at best; any short-term rally will be an opportunity for scalpers only.