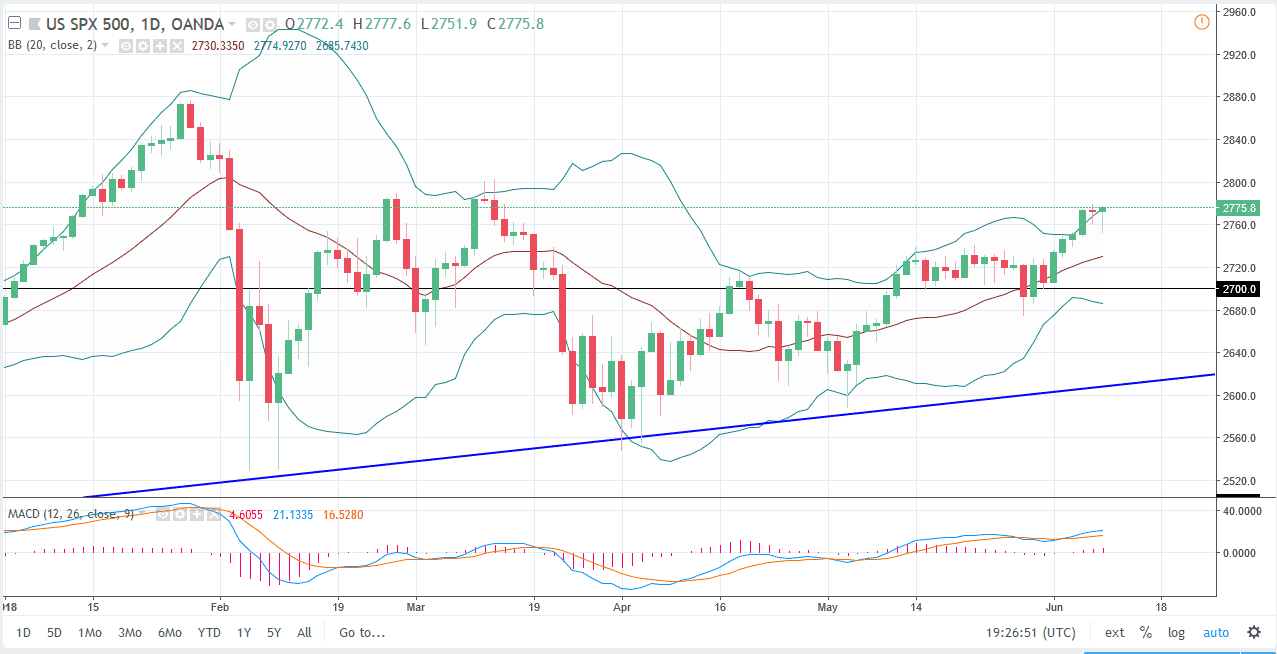

S&P 500

The S&P 500 initially fell during the trading session on Friday but turned around near the 2750 level to form a massive hammer. That’s a very good sign considering that we had been looking very soft to start the week. We turned around and gained it, wiping out the losses. There were a lot of people worried about the G7 meetings over the weekend, but quite frankly at the end of the day it looks as if value hunters came back in and pick up the stock market, looking to aim for the 2800 level next. If we can break above that level the market should continue to go much higher, at least 2800 if history is any predictor. Short-term pullbacks continue to be buying opportunities and I think that the 2700 level is going to offer massive support.

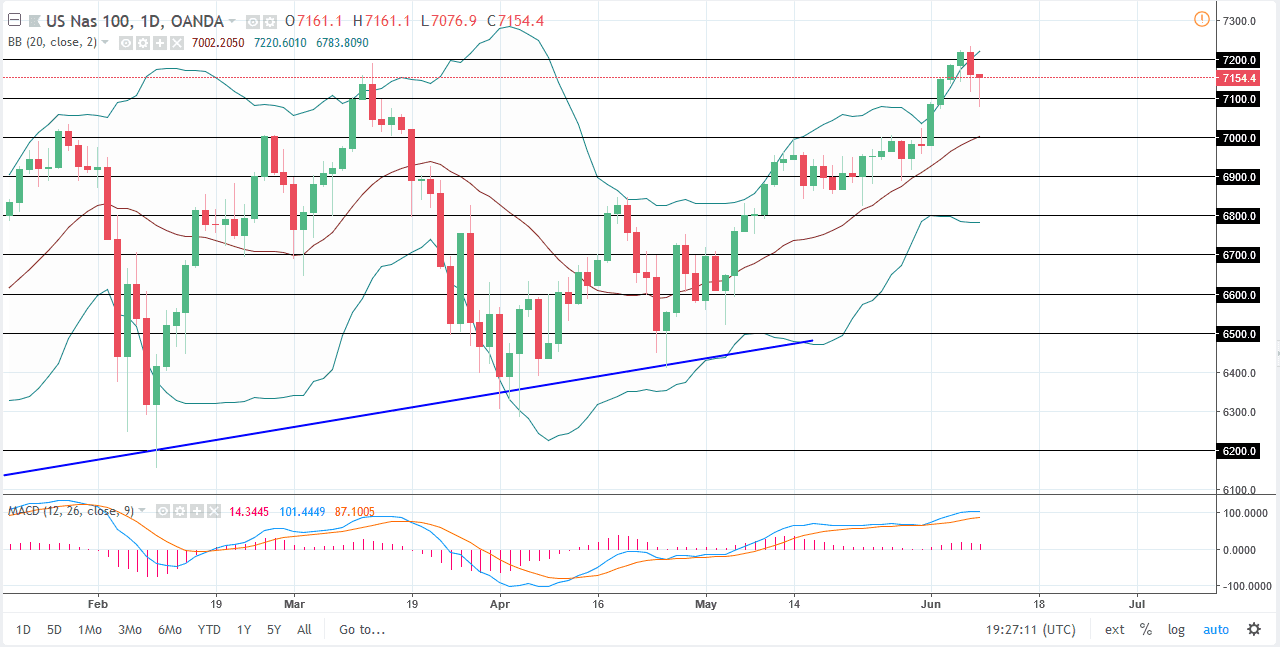

NASDAQ 100

The NASDAQ 100 has fallen during most of the trading session on Friday, breaking below the 7100 level. The market has turned around of form a hammer, and the hammer of course is a very bullish summit. The 7100 level looks like it is going to offer massive support now, and I think that it is only a matter of time before the value hunters push this market towards the highs again. While I am bullish in the NASDAQ 100, I am fully cognizant of the fact that it has lagged behind both the S&P 500 and the Dow Jones 30, two of the markets that I follow. The Russell 2000 level of course have positivity built in, so when I look at the NASDAQ 100, although I am a buyer, I realize that the other indices in the United States are going to outperform this market.