The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 24th March 2018

In my previous piece last week, I was bullish on the GBP/USD currency pair and the S&P 500 Index provided their respective highs from the previous weak was breached. There were no such price breakouts in the GBP/USD currency pair, but the S&P 500 Index did break its high, although it ended the week down from that high by 1.06%.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative values of the Canadian Dollar and the British Pound.

Last week’s market has changed again – markets have reverted to a more “risk-off” mode as a dovish Federal Reserve cut its forecasts for U.S. economic growth, fueling fears of a coming slowdown in global economic growth. Forex price movements were dominated by a moderate flight to safety, so the Japanese Yen and Swiss Franc gained while the commodity currencies weakened. Britain’s Brexit drama continues, with the E.U. agreeing a new departure date of 22nd May if the British Parliament passes the deal this week, or 12th April if it does not. It is still very unclear what will happen next or if the British Parliament will even vote again on the deal this week. The British Parliament must pass legislation amending the exit date before Friday or according to U.K. law, the U.K. will leave the E.U. on Friday on a “no deal” basis at 11pm local time.

In addition to the possible Brexit vote, this week will probably be dominated by GDP data releases from the U.S.A. and Canada.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar and on global stock markets following the Federal Reserve’s more dovish approach to monetary policy and growth. This can be expected to strengthen the Japanese Yen and Swiss Franc and weaken the commodity currencies, although price movements have not been significantly large. Overall, this market is choppy and quite difficult to trade in any direction with confidence.

If somehow the U.K. leaves the U.K. at the end of this week without a deal – which I think is very unlikely – the British Pound will fall sharply, probably by more than 10%.

Technical Analysis

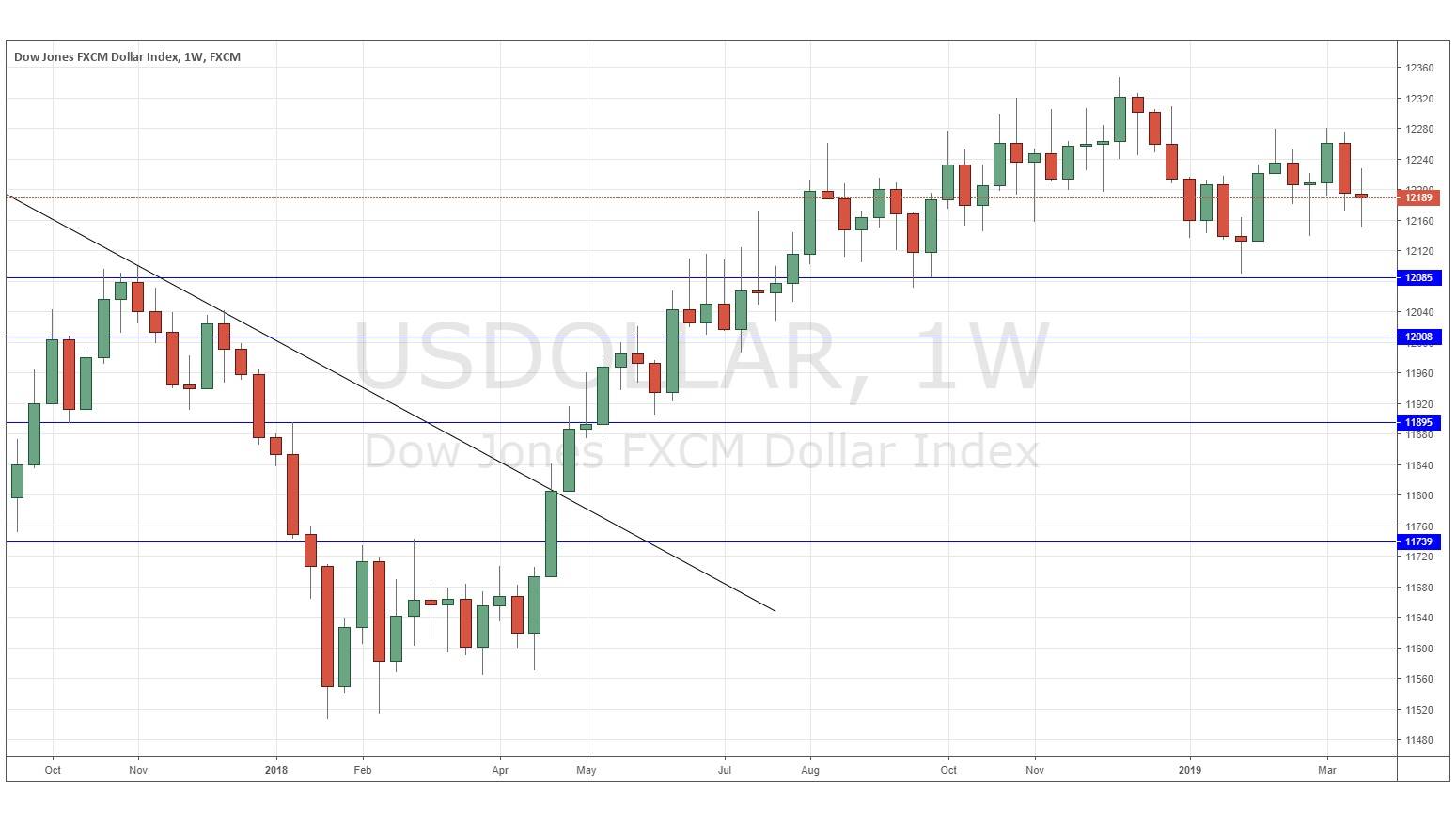

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index printed an indecisive doji candlestick right in the middle of a multi-month area of consolidation. The price is down over 3 months, but still slightly up over 6 months, so we have a mixed wider price action context picture on the Dollar. Overall, next week’s direction again looks very uncertain.

GBP/USD

The weekly chart below shows last week produced a relatively large and seemingly quite bullish candlestick. The price reached a 9-month high the week before last and there is technically a bullish trend. However, the technical are probably going to be of limited use: this week may see a Brexit deal agreed, which would certainly cause a strong bullish breakout; we may even see the U.K. leave at the end of the week with no deal, which would certainly make the price fall very sharply.

NZD/USD

This currency pair has had a few stabs in recent weeks at breaking the 9-month high price below 0.7000. It seems to have retreated again, but if the USD weakens strongly over coming days, there is a small chance that there could be an interesting bullish breakout here.

Conclusion

The market looks too choppy and uncertain right now to make any forecast.