EUR/USD

The Euro has rallied most of the week but spent Friday forming a bit of a shooting star. Because of this I believe that the market is probably going to pull back a bit towards the 1.1250 level before finding buyers, and I think that buyers are all the way down to the 1.12 level so I think a short-term pullback will be followed by more bullish pressure as we try to fulfill the overall consolidation that extends from the 1.12 level up to the 1.15 level which is massive in its importance.

USD/CAD

The US dollar pulled back during the week, reaching down towards the 1.33 handle before finding support. We have recently broken above the top of the symmetrical triangle that I have marked on the chart, and we should now see support as it was previous resistance. Because of this I believe that the US dollar will probably rally against the Canadian dollar and reach towards the 1.35 level given enough time. Overall, the Canadian dollar continues to suffer due to poor economic domestic figures.

AUD/USD

The Australian dollar rallied a bit during the week, testing support yet again. The support extends all the way down to the 0.68 level also I think at this point we continue to find buyers on dips. These buyers will be extended and even more aggressive if the Chinese stimulus starts to work, or perhaps we get some type of situation where the US/China trade negotiations get better. If that looks like we are getting closer to a deal, the Australian dollar will ultimately take off to the upside.

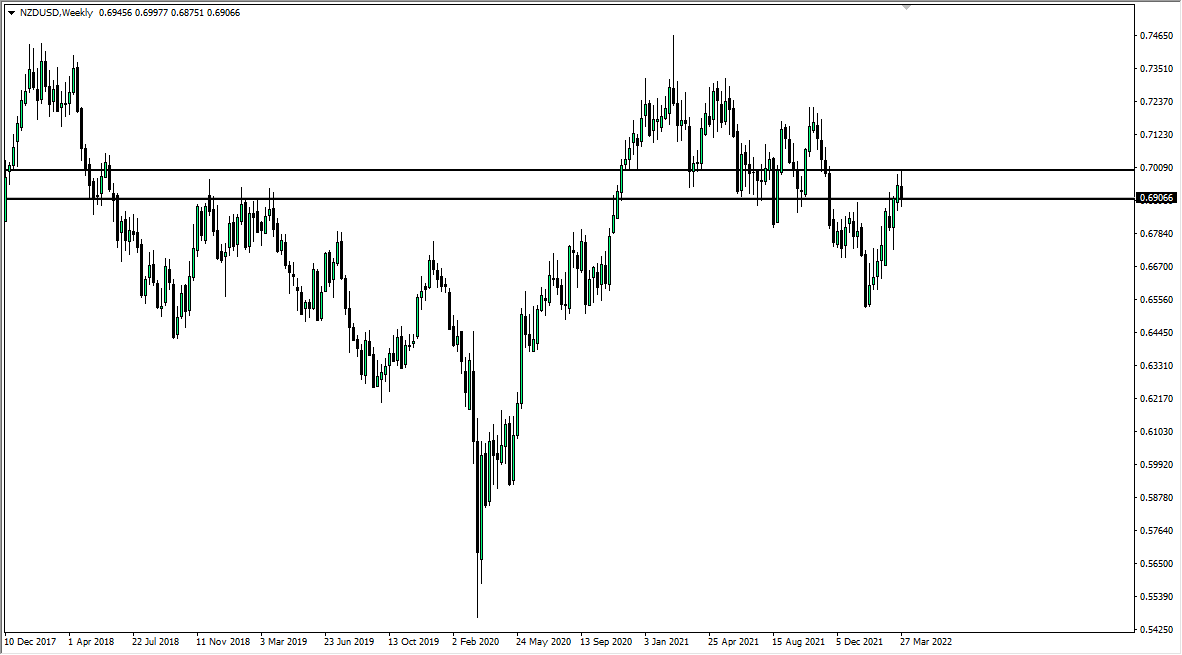

NZD/USD

The New Zealand dollar rallied during most of the week, showing signs of momentum to try to break out above the massive resistance level at the 0.68 handle. If we can clear that on a daily close, it’s very likely that we will then go to the 0.70 level. However, I think that it’s very likely we will continue to fade the 0.69 level above as it has been so stringent.