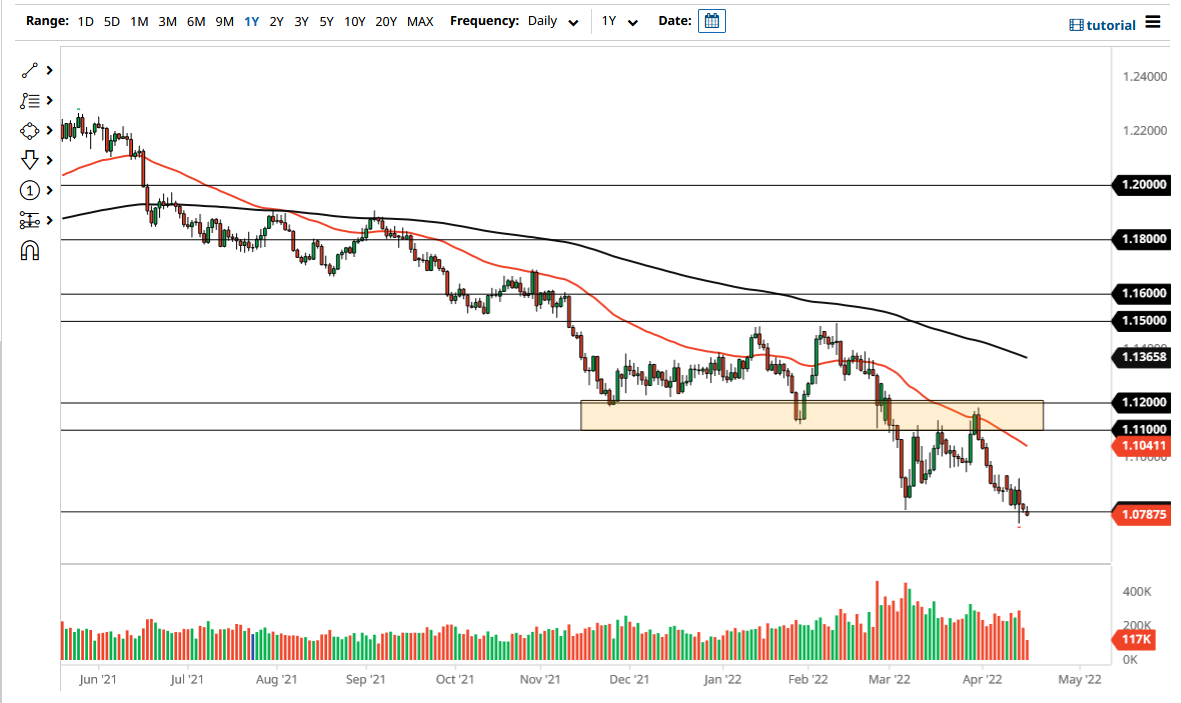

EUR/USD

Although the Euro had a couple of bad days on Thursday and Friday, and even formed a shooting star, I suspect that there is very little in the way of momentum to the downside for the longer-term. With this being the case, I anticipate that we will continue to bounce between 1.12 and 1.15. As we are drifting lower I will be looking for an opportunity to start buying closer to the 1.1250 level for a small bounce. I don’t see anything that is going to break us out of this range in the near term, so I remain a short term back and forth type of trader in the EUR/USD pair.

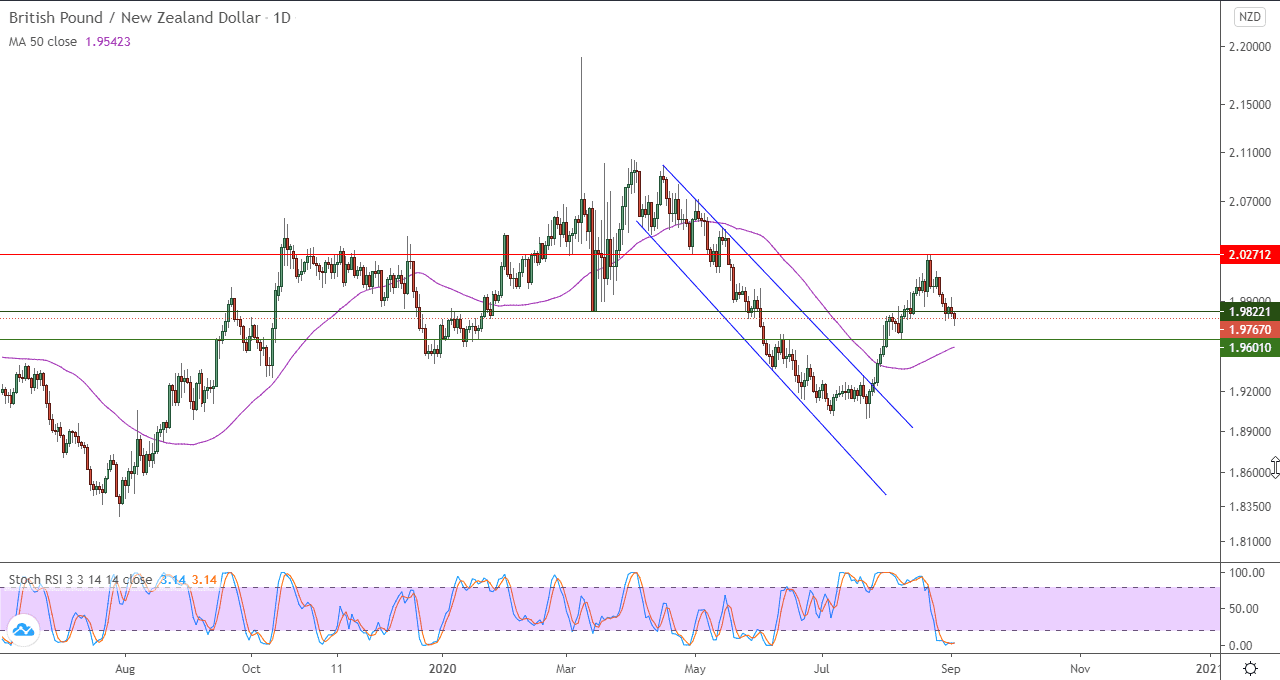

GBP/NZD

The British pound has rallied on Friday to break the top of the hammer from Thursday. That being the case, it looks very much like a market that’s ready to continue consolidating, and perhaps reach towards the 1.95 handle. That should be resistance but it looks to me as if we will continue to see plenty of opportunities on short-term pullbacks, as the 1.90 level continues to be a major support level in this market. Consolidation continues, we might as well take advantage of it.

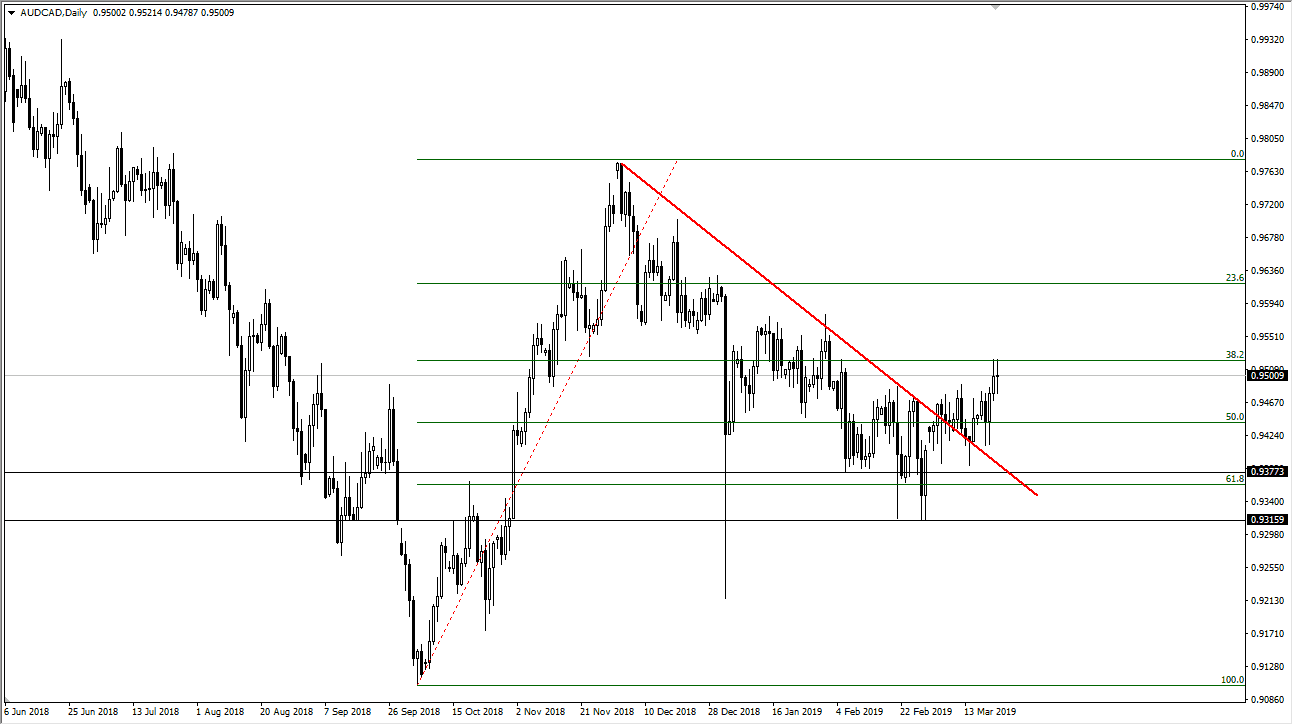

AUD/CAD

The Australian dollar went back and forth on Friday against the Canadian dollar but has enjoyed strength all week. As we are closing out at the 0.95 handle, it’s very likely that we could get a short-term pullback, but there seems to be a lot of demand below the 0.9450 level. That should lead to more buying this week, especially once the AUD/USD pair finds its footing near the 0.70 handle. That of course will have a “knock on effect” over here as the Canadian dollar is rather soft.

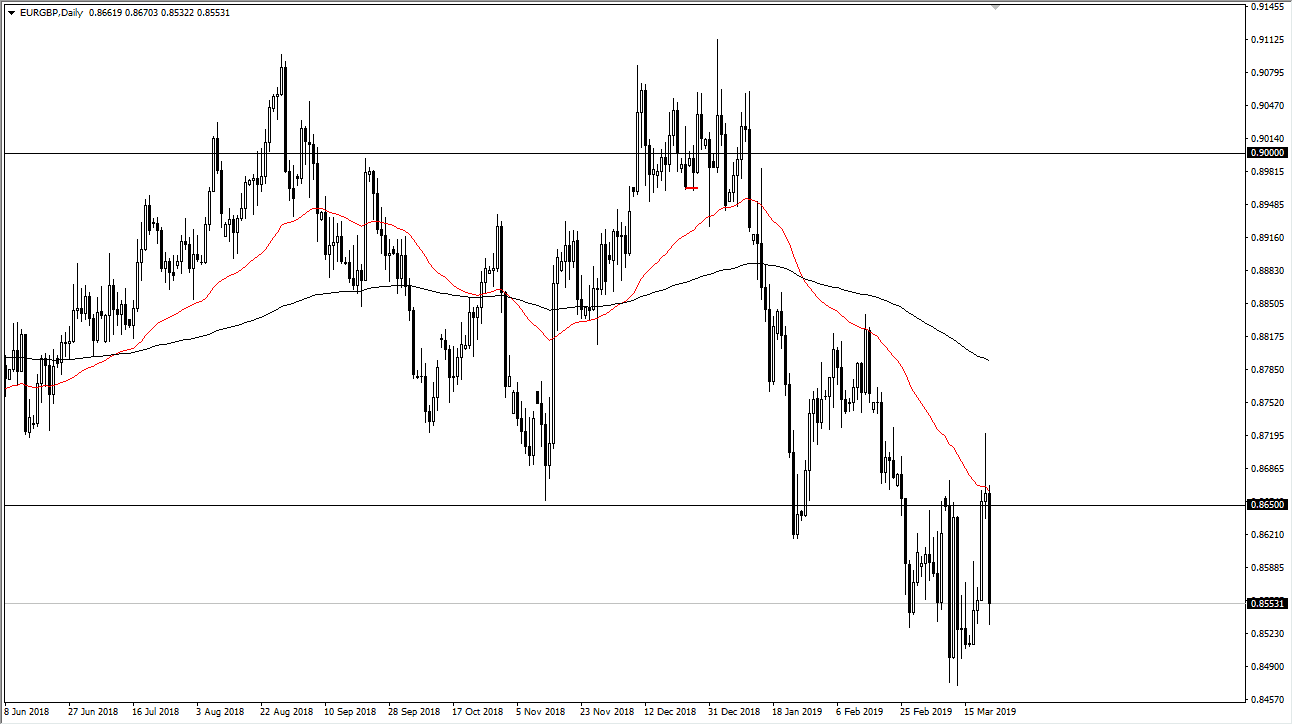

EUR/GBP

The Euro had a pretty wild week against Sterling, rallying significantly to break above the 0.8650 level. However, we turned around on Thursday and then continue to drop on Friday. The weekly candle stick is a shooting star shaped candle, so it looks very likely to continue to press to the downside so I suspect that selling rallies will continue to work.