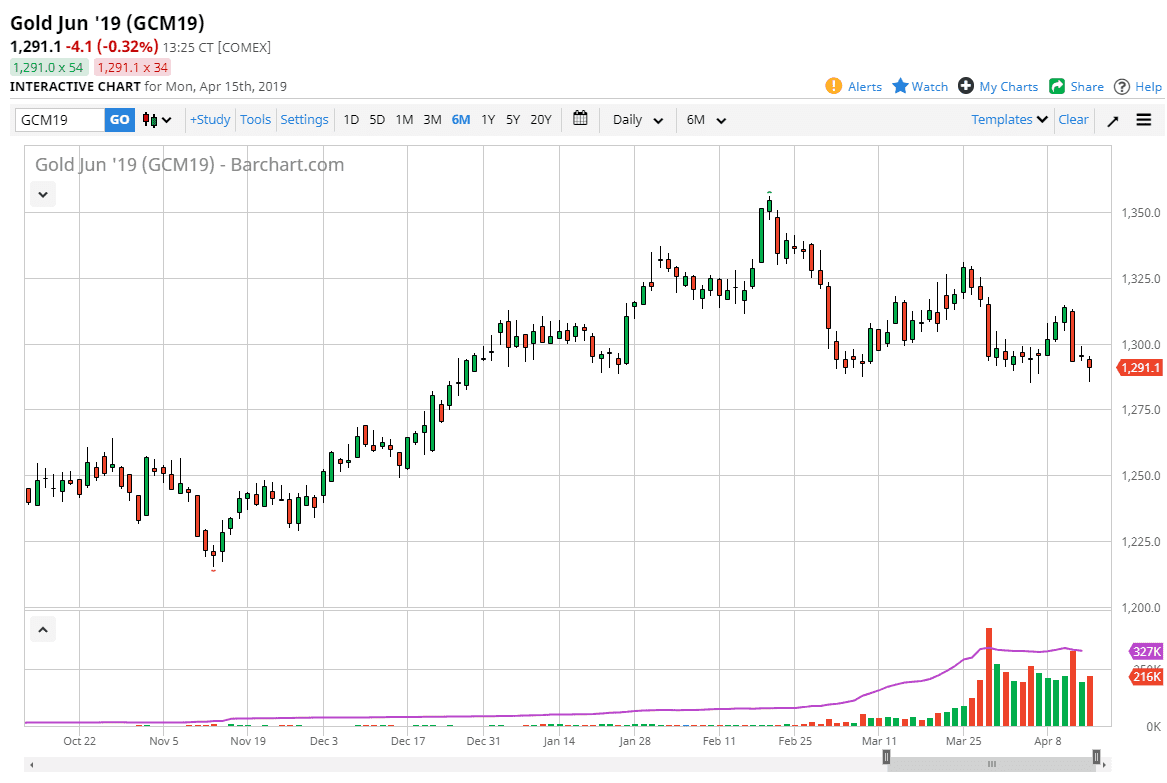

Gold markets fell immediately during trading on Monday, reaching down to the vital $1285 level. At this point, we have bounced and formed a bit of a hammer which of course is a somewhat positive sign of things in the market, but the biggest problem that I can see is that we keep making “lower highs.”

While this hammer shaped candle stick for Monday is very positive, the reality is that it’s not until we break the high above at the $1315 level that you can take any type of bounce seriously. In fact, it’s very possible that we see a bounce towards the $1300 level where sellers will be waiting. Remember, a lot of large funds will be looking at the large come around, psychologically significant number like they typically do. This could be a place where we see a lot of selling pressure and in fact already did during Friday’s choppy trading.

If we break down below the bottom of the candle stick for the Friday session, that should open the door for at least a $10 drop. After that, I’d be looking towards $1250 below, and quite frankly I think $1275 could only be a temporary stop on the way to lower pricing. If you squint, you can essentially make out a descending triangle being formed, which could measure for a move of about $60. That opens up the possibility of a move down to roughly $1225, which does structurally makes sense because the market tends to move in $25 increments, and of course that was an area where traders had been involved in more than once. This is essentially a “binary trade” in the sense that if we can get above $1315, we can start buying. Otherwise, selling breakdowns or even short-term resistive candles might continue to be the way forward.