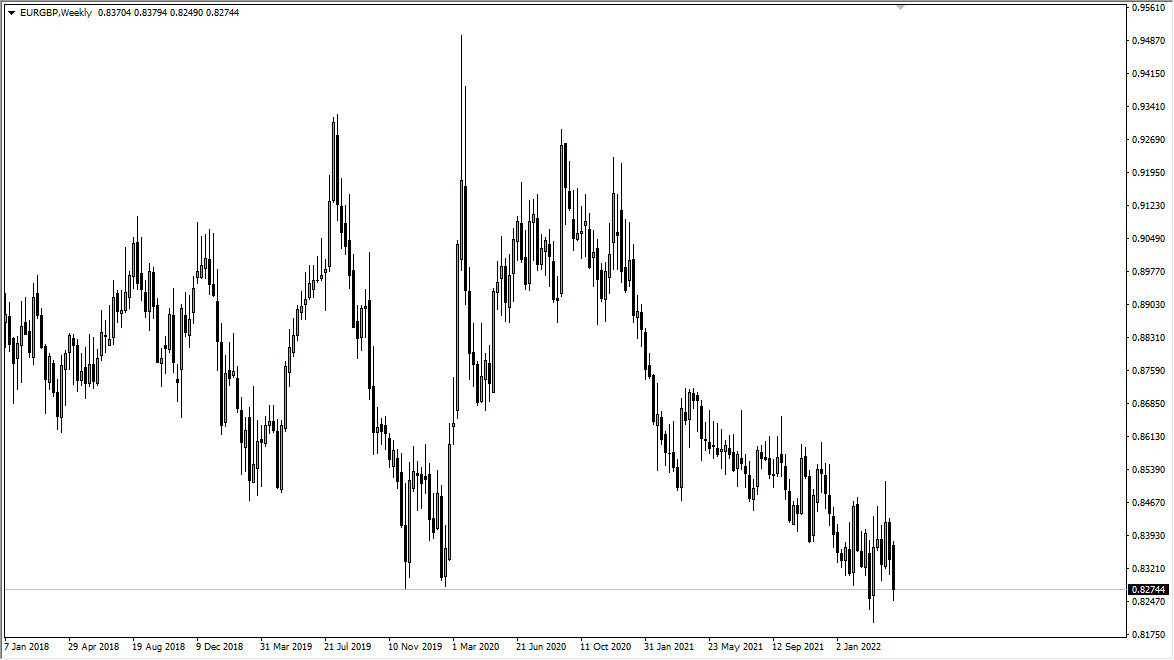

EUR/GBP

The Euro has rallied a bit during the past week, but as you can see we have been consolidating in general. With that being the case, I think the 0.8650 level continues offer resistance all the way to the 0.87 handle, and at this point it’s likely that we will continue to churn in this lower level, so it’s not until we break above the 0.87 level that I would be interested in buying. I suspect we will continue to simply grind back and forth in choppy sideways action, offering an opportunity to trade short-term range bound strategies.

EUR/USD

The Euro rallied during the week, showing a bit of a save. The 1.12 level underneath is massive support, just as the 1.15 level above is massive resistance. With this past week’s action, I suspect that short-term rallies will continue to be bought, for short-term gains. Expect choppy and messy action, but I do think that we are in the process of trying to put a bottom into the marketplace.

USD/CAD

The US dollar initially fell against the Canadian dollar during the week but we continue to see a lot of support underneath the 1.33 handle, as buyer stepped back into the market. With that being the case it’s very likely that we are going to turn around and rally on these dips, so I do like buying short-term pullbacks. I don’t expect a major meltdown or anything like that but I do believe that we are going to continue to be supported underneath.

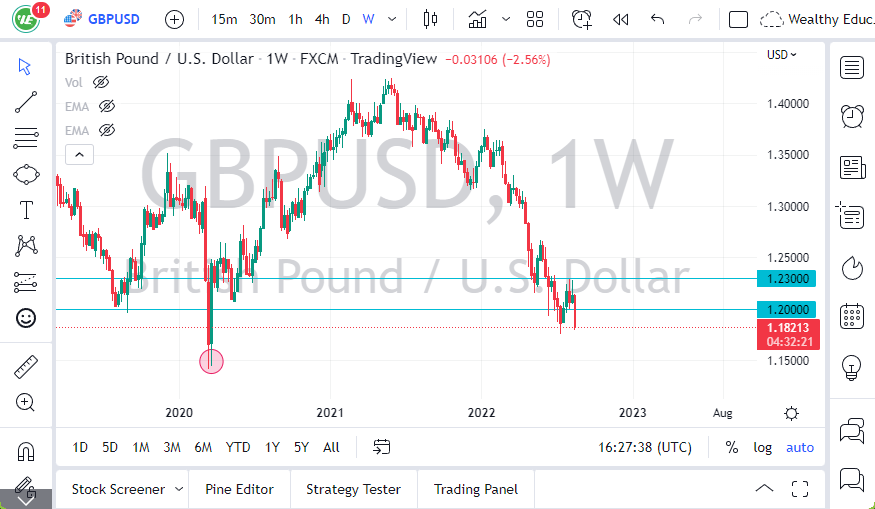

GBP/USD

The British pound rallied during the week but gave back about half of the gains. While this is a little bit of a stronger look than the previous week, at this point it’s likely that we continue to simply bounce from the 1.30 level underneath. If we do break down below that level, then we may need to go down to the 1.28 level. In general, this is a market that is simply floundering in both directions.