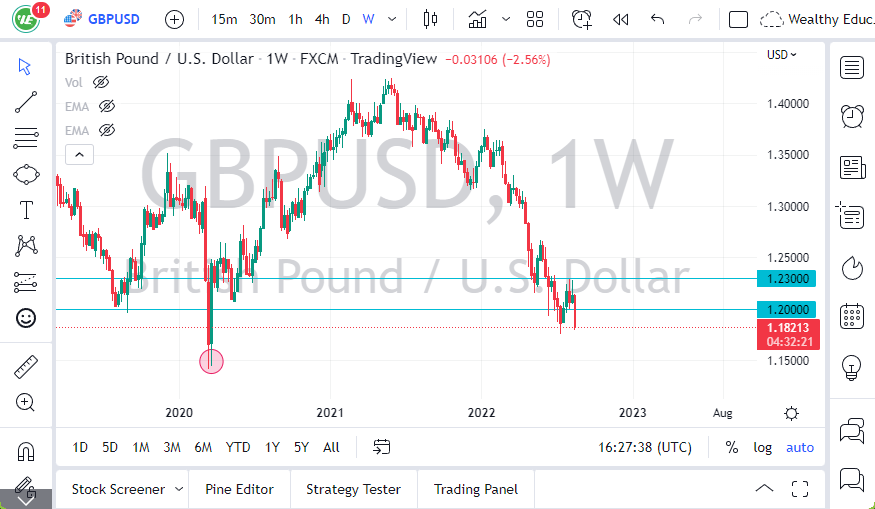

GBP/USD

The British pound try to rally during the week but then broke down towards the 1.30 level by the time we closed out for the weekend. At this point, the market is forming a descending triangle so it’s very likely that we will break down. I don’t think that we are going to collapse, but it is probably leading towards a short-term pullback towards the 1.27 area or so. If we do rally from here it’s not until we break above the 1.3150 level that I would consider buying. Even then, the upside is somewhat limited to the 1.3350 level.

AUD/USD

The Australian dollar initially tried to rally during the week but then gave back all of the gains to show signs of weakness again. Ultimately, this is a market that is trying to form a bit of a base at this point, so therefore I think that we are simply waiting for some type of good news to come out of China or the US/China trade negotiations. Currently, the 0.70 level underneath is massive support, so I don’t think that we break down through there. At this point, it’s a matter of picking up value as it presents itself.

USD/CAD

The US dollar initially fell against the Canadian dollar but then found support just above the 61.8% Fibonacci retracement level, and the 1.3250 level. We had recently broken above a symmetrical triangle, but at this point it’s likely that the market will continue to consolidate overall, with an upward tilt. I like the idea of buying short-term pullbacks, as they represent value in the greenback, especially as the Canadian economy continues to have a lot of overhang of gloom. This isn’t going to be an exciting trade, but it certainly looks as if it is a “buying on the dips” type of market.

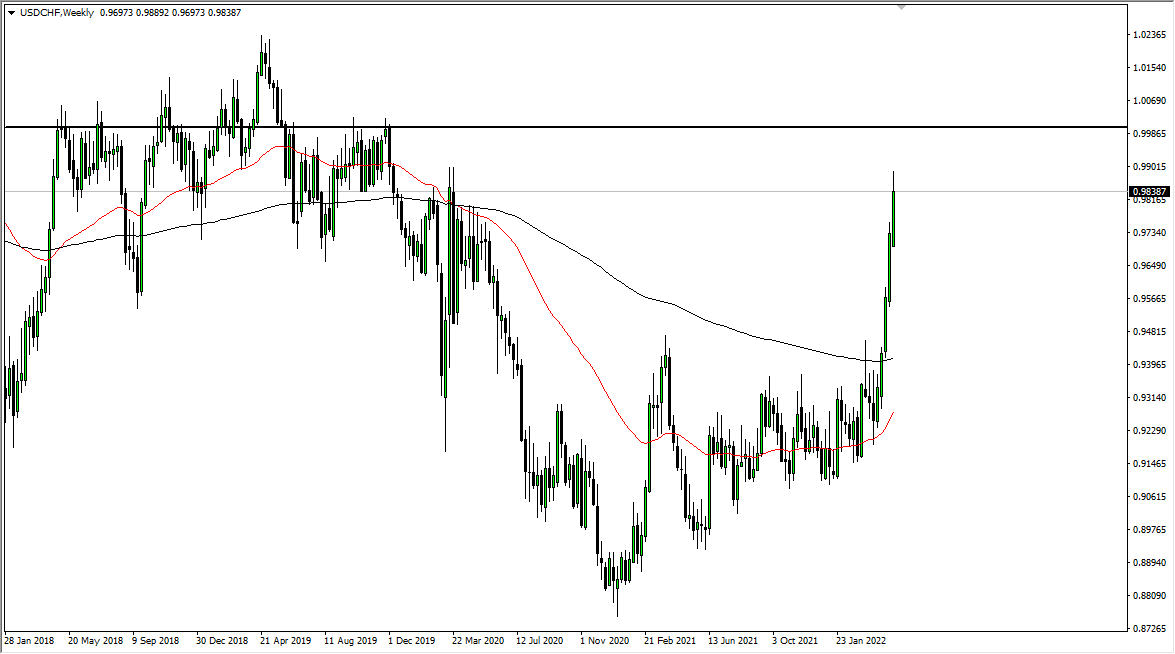

USD/CHF

The US dollar rallied significantly during the week, breaking above the 1.01 level. We are at the top of the rising wedge, so if we break out above here it would be an extraordinarily strong move just waiting to happen. Otherwise, we very well could roll over back towards the parity level. Pay attention to the 1.02 level. If it gives way, this market is going to take off to the upside.