USD/CAD

The US dollar has rallied against the Canadian dollar, breaking significant resistance in the form of the 1.34 level during the past week. However, we have struggled at the 1.35 level so it looks as if it’s going to take a significant amount of effort to finally break above there. I think that short-term pullbacks will probably continue to offer buying opportunities as Canada is economically weak at the moment, and oil markets have suddenly rolled over. If we break above the top of the weekly candle stick, then I believe at this point the market will probably go looking towards 1.37 level.

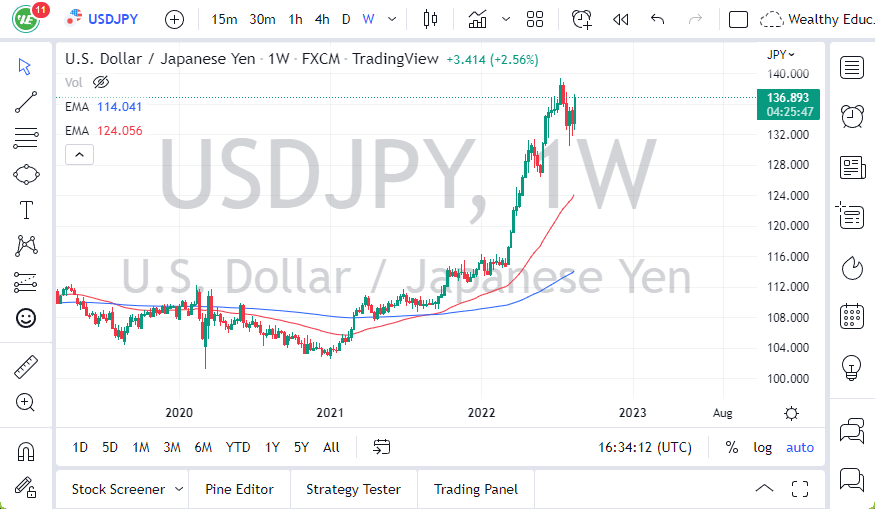

USD/JPY

The US dollar initially rallied against the Japanese yen but gave back the gains in order to reach towards the bottom of the range between ¥111.50 on the bottom, and the ¥112 level on the top. We tried to break out, but we failed. This is something to pay attention to, but I do recognize that there is a lot of support underneath, especially near the ¥111 level. I think this market continues to bang around in 50 pips increments and short-term charts going forward. It is a bit of a proxy for the S&P 500 which can’t quite break out either.

AUD/USD

The Australian dollar fell pretty hard during the week, slamming into the 0.70 level. At this point, there is a massive support level just below that should continue to keep this market somewhat afloat so I don’t have any interest in shorting. It looks very likely that we will bounce, especially after the Thursday and Friday session. The 0.72 level above will continue to be resistance though.

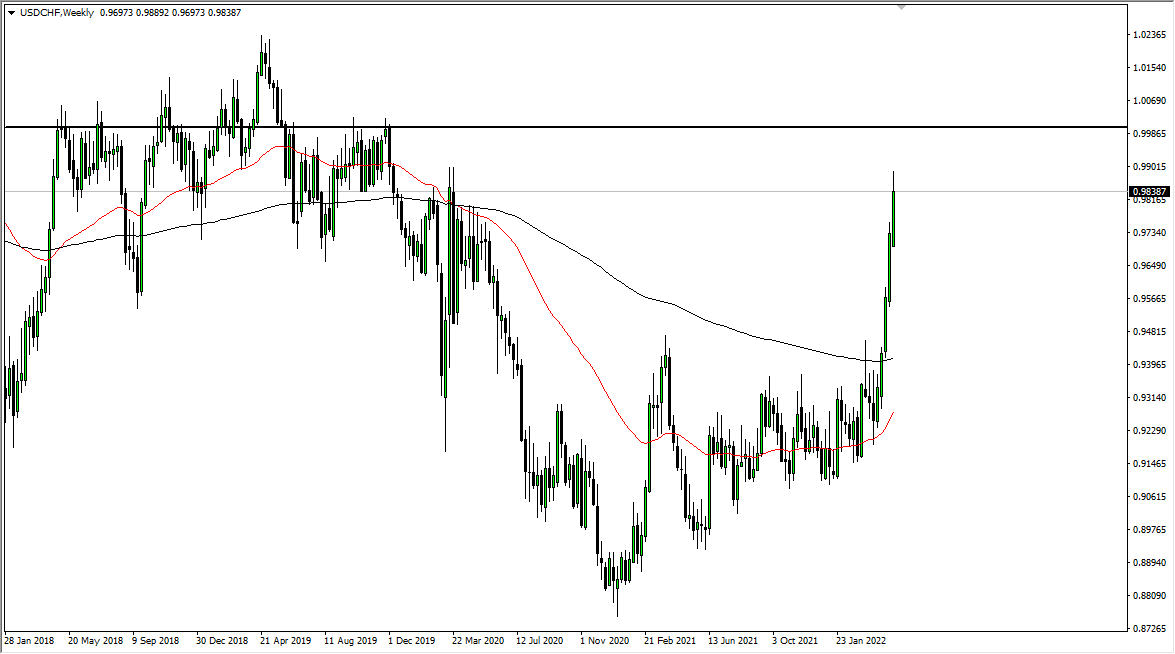

USD/CHF

The US dollar rallied during, reaching towards the 1.0250 level, which has been a high in the past. The MACD is diverging a bit, so I think that a pullback is very likely. I don’t necessarily think it’s a break down waiting to happen, just a pullback in what has been a very strong uptrend. Otherwise, if we can break above the 1.050 level on a daily close, then I think we go much higher.