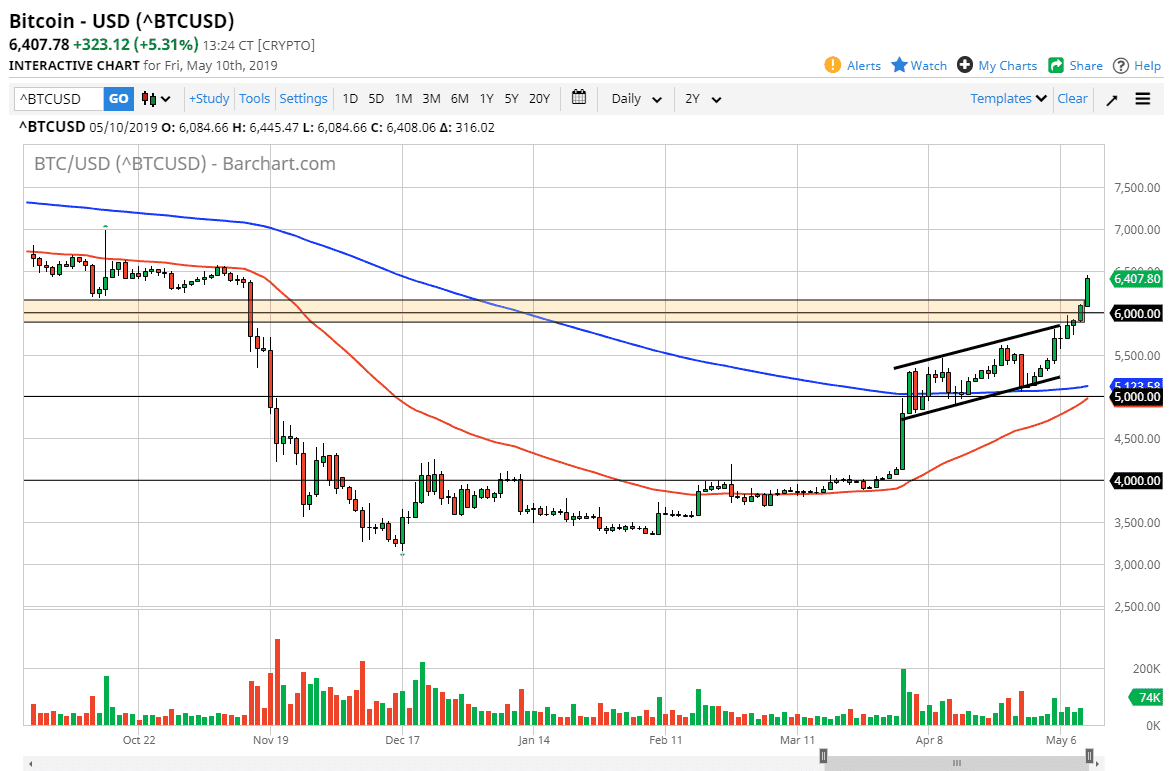

Bitcoin markets rallied significantly during the trading session again on Friday, as we have completely cleared the $6000 barrier. This is a best case scenario for Bitcoin, because I thought it would take several attempts to break out. We have now started to see “fear of missing out” yet again. That doesn’t mean that we are going to see the same type of activity that we used too, just that more and more people are starting to jump into this situation.

The $6500 level is the top of this resistance barrier, so we get above there, it’s very likely that we should go much higher. A breakout above the $6500 level should continue to see more money flying into this market. Pullbacks from here should find buyers just below the $6000 level, and quite frankly at this point it’s all but impossible to short Bitcoin unless something drastic happens. Don’t get me wrong, as you know I’m not a believer of the future viability of Bitcoin, but I don’t have to be. I’m a technical analyst, and I recognize that the market tells us we are going higher.

In fact, it unless we break down below the 200 day EMA, which is pictured in blue on the chart, I can’t imagine a scenario where I would be comfortable shorting this rally. Bitcoin obviously has seen a stunning turnaround, and it looks likely that the dips will continue to attract a lot of attention as they represent value. That value should continue to show itself occasionally, but in the end this has been a brutal reversal of fortunes, and it’s very likely that we are in the beginning of a bullish run. If we turn around and break below the $5000 level that would change everything, but right now that looks very unlikely.