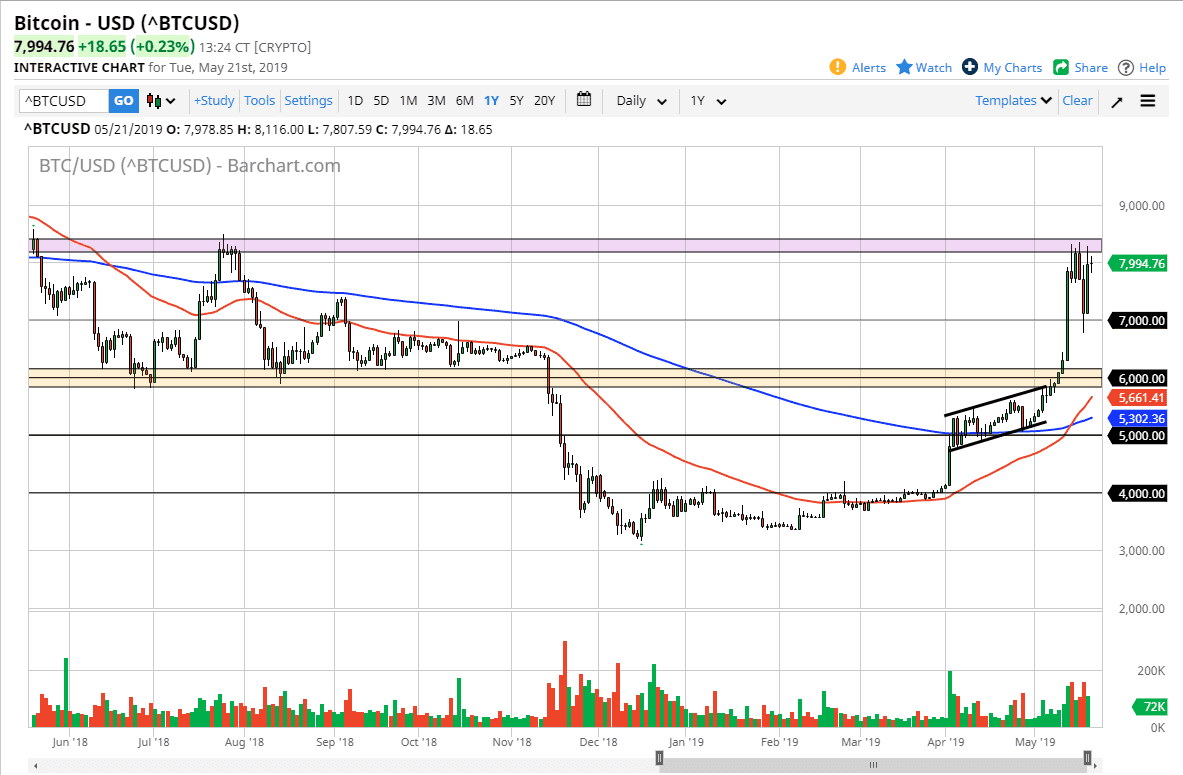

Bitcoin markets did very little during the day on Tuesday, and I think that’s a good thing. As you know, I myself am not necessarily a believer in Bitcoin long term, but what I do believe in his technical analysis. The chart has been signaling higher prices, and that’s good enough for me.

However, we had gotten a bit parabolic again, and I think this market is going to be even more sensitive to overbought conditions considering the recent history. The horrific selloff starting in the beginning of 2018 is something that is still fresh in the memory of traders. It’s hard to imagine a scenario where people look at the chart going straight up in think “to the moon!” That being said, given enough time I’m sure certain people will probably fall for it.

At this point though, we are looking at a lot of true believers and perhaps early adopters coming into the market and pushing the crypto currency higher. Those people are more long term oriented, so therefore they’re not necessarily “hot money.” Another thing that will hopefully slow the ascent of bitcoin is that a lot of people who have been underwater for almost 2 years now will be more than willing to get out of the market to breakeven.

Going forward I fully anticipate that we will consolidate between $8000 and $7000, possibly even as low as $6000. This is a good thing as we need to continue to attract more buyers in this market to continue to break out to the upside. We can’t expect this market to be a 20,000 next month. If it does that I will be trying to find various ways to short this market as it will be begging for return to the selloff we just had about 18 months ago.

I think a bit of consolidation and perhaps momentum building is going on, as the $8000 level is somewhat resistive. I would anticipate buying on the dips and thinking of them as value propositions.