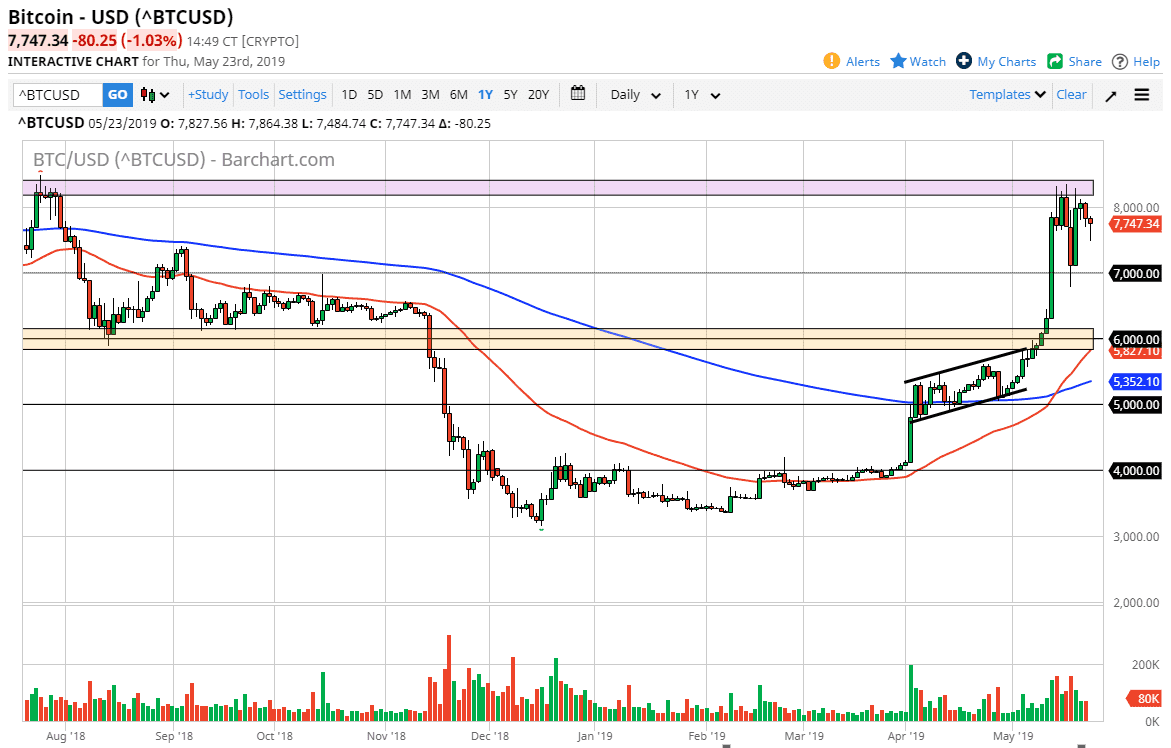

Bitcoin markets fell during most of the session on Thursday but did find buyers underneath to form a nice-looking hammer. This only solidifies the idea that I have in this market that there are plenty of buyers underneath looking to take advantage of value. Looking at this chart, it’s obvious that there is a lot of resistance at the $8250 level, but it also is obvious the buyers are willing to step in and pick up Bitcoin every time it drops.

This of course makes a lot of sense considering that the market did break a major resistance barrier in the form of $6000 previously, and then shot straight up. That means that a major resistance barrier has been taken over, and it’s likely that breaking through that area has brought more money into this market, and I think it’s only a matter of time before we continue to go even higher. In the short term though, it’s very likely that we need to find enough momentum to finally break out to the upside, and ultimately I think cooling off a little bit in this area makes sense. The fact that we form this candle stick tells me that there is much more buying interest than selling interest, so it’s a very good sign.

The $7000 level underneath is significant support, so if we break down below that level, then I think we probably unwind towards the $6000 level which quite frankly is even more attractive. As long as we stay above the $6000 level, I believe that we are still in a positive market. If we can break above the $8250 level, then it’s very likely that we go looking towards the $10,000 level. That of course will be an area of extreme interest.