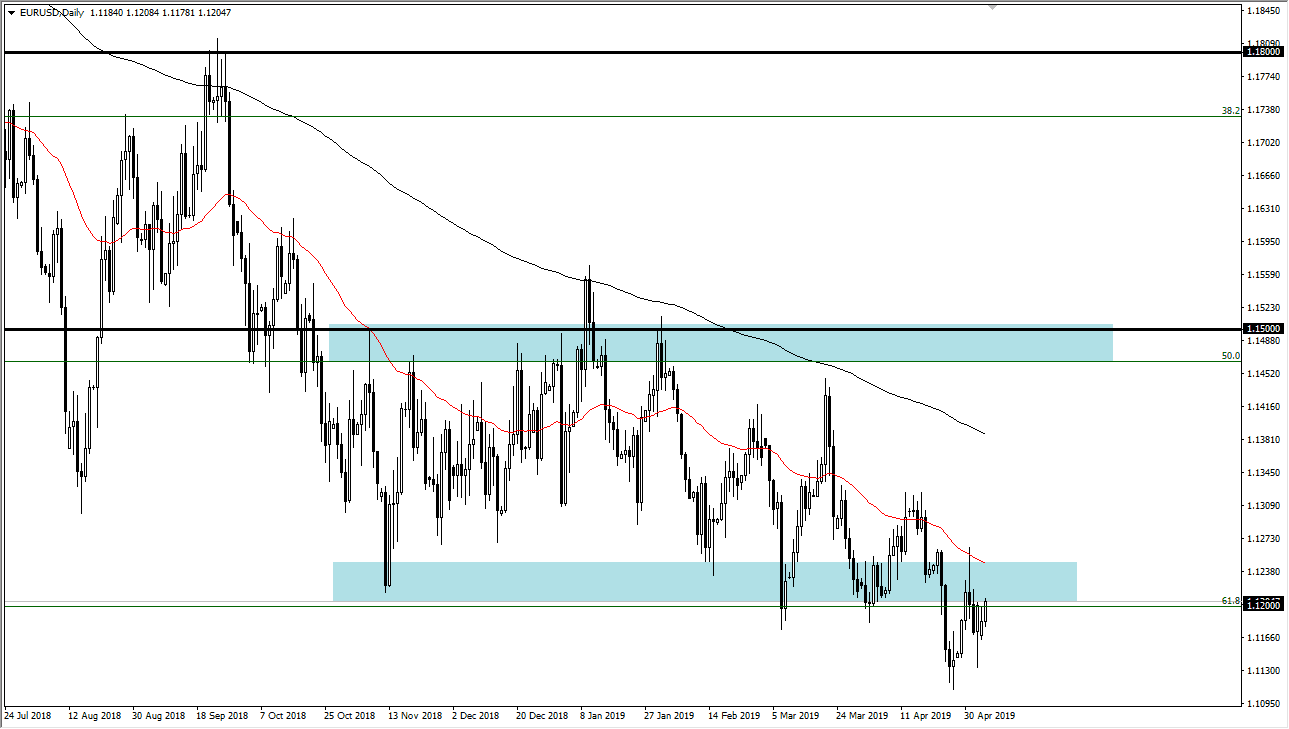

EUR/USD

The Euro initially rallied during the trading session after the tweeting of President Trump suggested that there was going to be further tariffs placed upon the Chinese. After that, the Chinese suggested that they were going to show up for the meeting to negotiate the trade deal with the Americans. This sent the markets throughout Asia and early European trading into a downward spiral, having the currency markets chop quite wildly. However, we ended up hanging about the 1.12 level, an area that is important from a psychological and a structural point of view. Although this was a reasonably bullish candle stick, the reality is that we still have a lot of resistance just above that could continue to cause issues. With that, it’s not until we clear above the 50 day EMA which is pictured in red that I’m a buyer. I suspect the first signs of exhaustion will be sold.

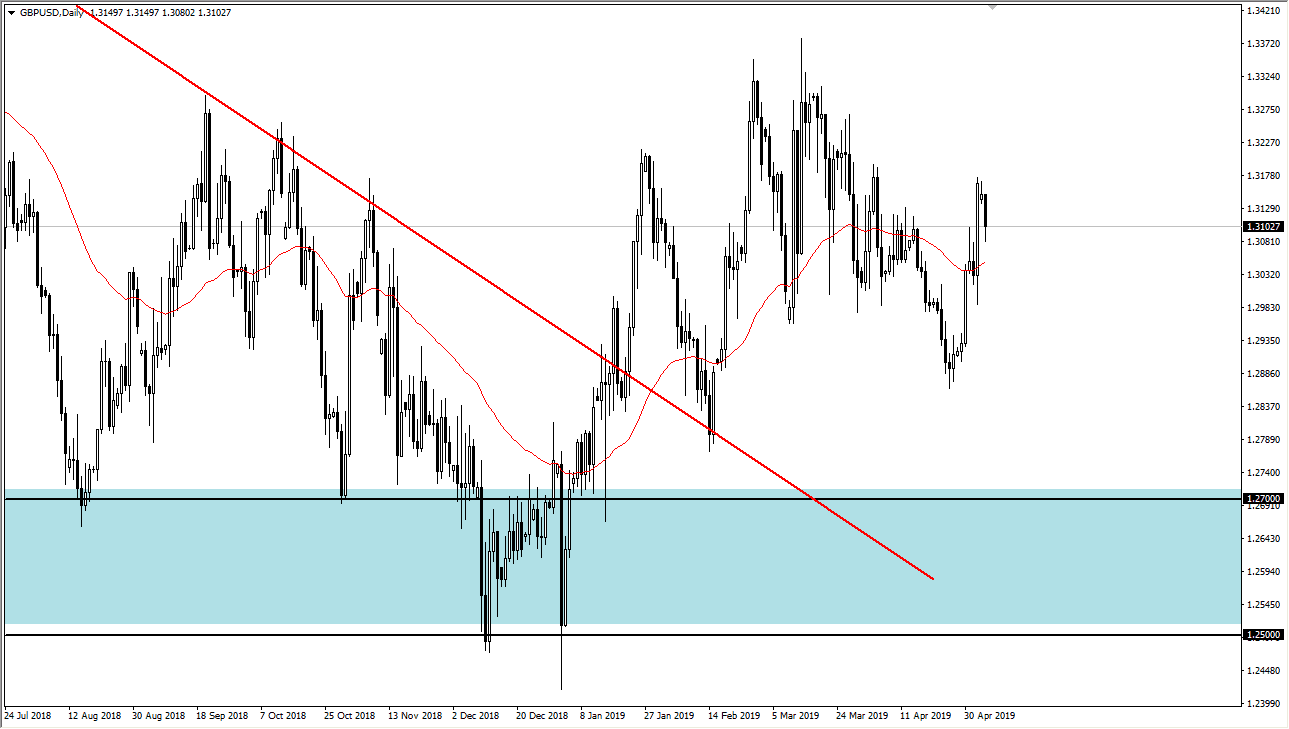

GBP/USD

The British pound fell during the trading session on Monday, as the same bad news came out to have the markets go about wild. The US dollar gain because of treasury buying, which of course had its effect over here. However, the 1.31 level has offered a bit of support, and it looks very likely that we are going to try to find buyers in this area. The 50 day EMA is just below though, and it’s likely that there will be buyers below trying to pick this market up. If we can break above the 1.32 level, we could then go to the 1.33 level. Either way, I think we are going to get a lot of choppiness and noise due to the Brexit and the occasional headline, so it’s difficult to put on longer-term trades. I suspect that after the recent action though, people will be buying dips in short bursts.