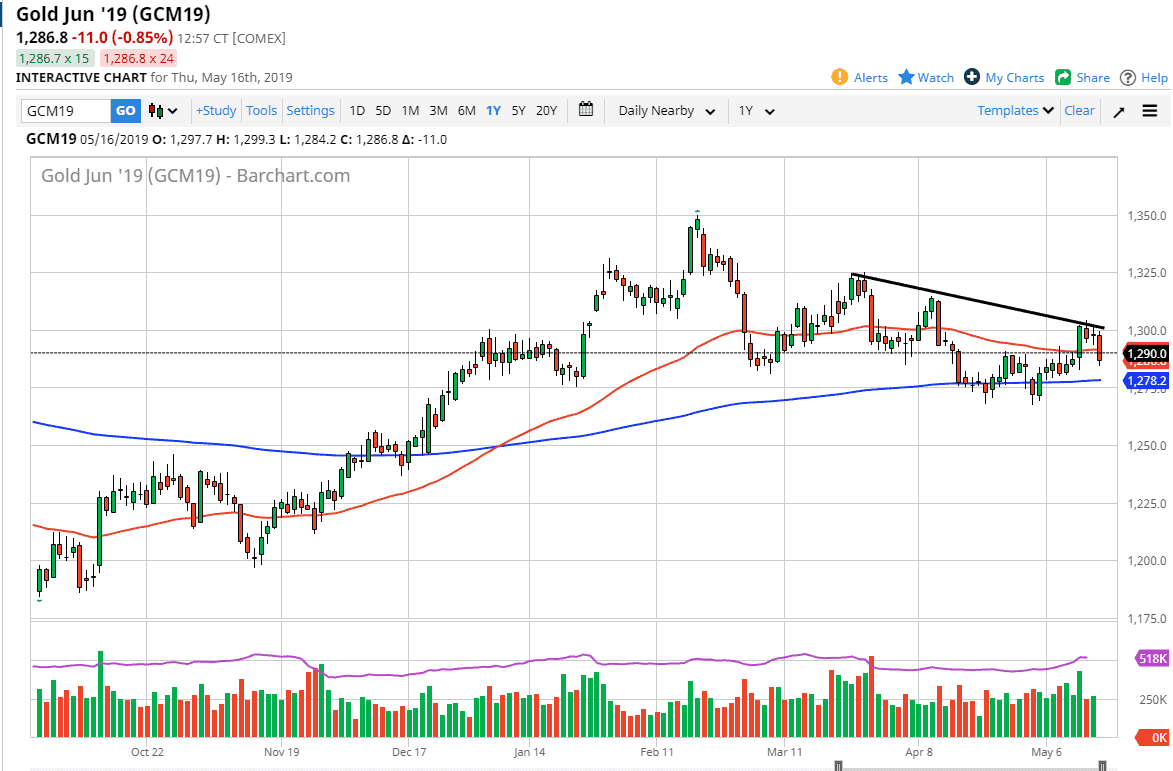

Gold markets fell during the trading session on Thursday, as we continue to see a lot of overall volatility in this market. Looking at the gold market, you can see that we have a downtrend line above that continues to be a bit of a distraction, driving prices lower in a very gradual manner. This doesn’t mean that we won’t have the occasional rally between now and our final destination, but what it does suggest is that perhaps we are going to continue to see conflicting forces taken advantage of this market on an almost daily time frame.

Looking at the candle stick for the trading session on Thursday, you can see that the downtrend line has been respected, but beyond that you can also see that the $1300 level has been respected as well. That makes quite a bit of sense, because quite frankly these large numbers attract a lot of order flow. We have sliced through the 50 day EMA which is also a pretty negative sign in and of itself, but there are other things to pay attention to.

We are starting to dig into an area that should be significant support, extending all the way down to the 200 day EMA. With that in mind, I believe that what we are looking at is a bit of arrange trying to form with a slightly negative bias. Because of this, I am a seller of short-term rallies that offer signs of exhaustion. Although we could simply roll over from here and continue to go lower, I believe that it makes quite a bit of sense that we look for “value” in the US dollar part of the equation. In other words, that we wait until prices rise and fail.

The other side of the equation of course is that we break above the downtrend line, which could completely rewrite where we go next. Under that scenario, I believe the first target would be $1315.