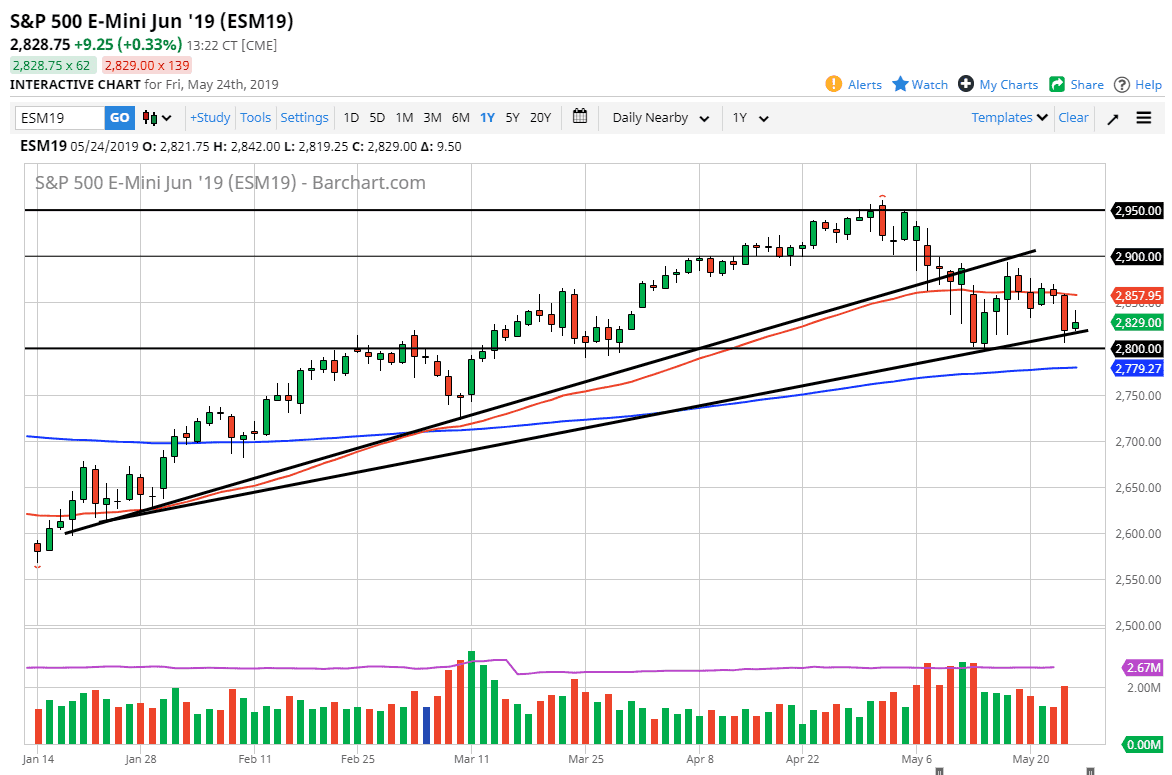

S&P 500

The S&P 500 rallied a bit during the trading session on Friday but gave back all of the gains. This is in a huge surprise though considering what we had seen on Thursday and the fact that the volume would have been a major issue going into the Memorial Day weekend. With that being the case, I would read too much into the Friday candlestick, except for the fact that people are not willing to hold on a lot of risk going into the weekend. We have three days of potential headlines that could cause issues in this marketplace, so it makes sense to stay away. Beyond that, the stock market will be closed on Monday. However, there will be futures markets trading occasionally on the Globex, so it’s possible that you can play the market if you choose to, and at this point I suspect it’s probably selling the rallies that will be the most beneficial trade.

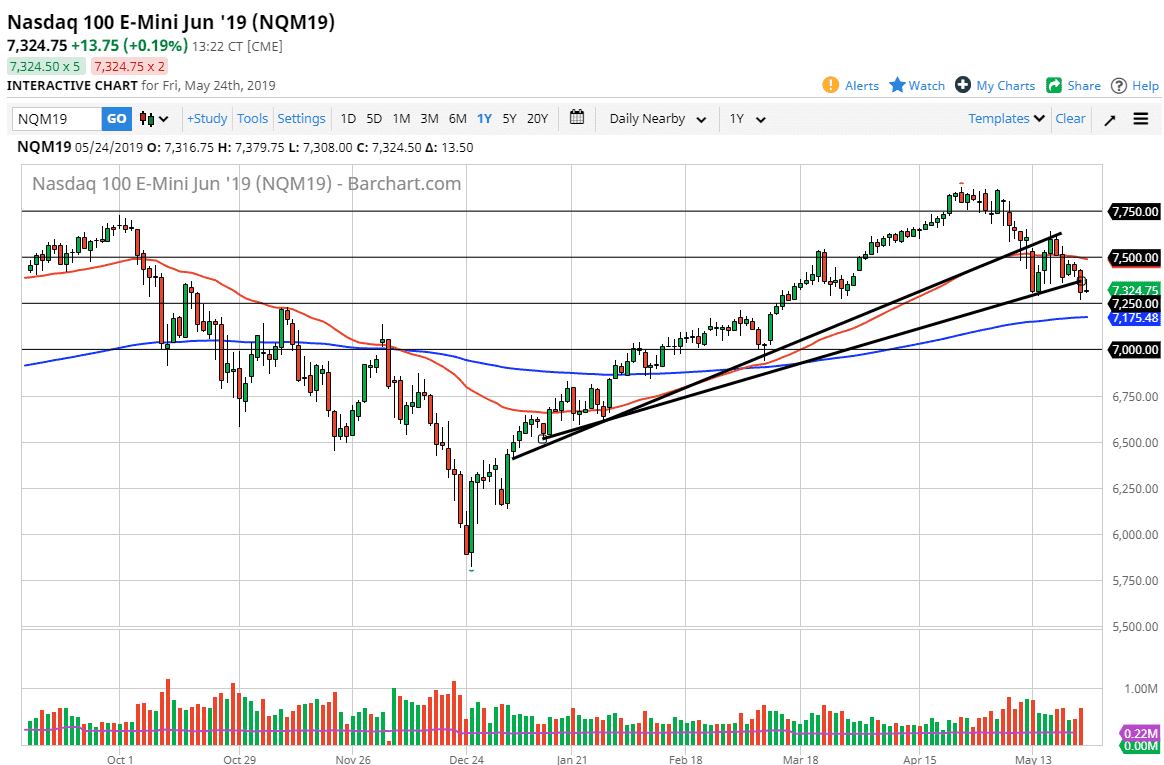

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session on Friday but gave back the gains to form a bit of an inverted hammer. That inverted hammer suggests that we are going to go lower but I also recognize that the 7250 level will be supported. A breakdown below that level could send this market much lower. At this point in time, we are likely to go test the 200 day EMA as we have broken through a couple of trendlines.

Don’t forget that the NASDAQ 100 is “Ground Zero” when it comes to the US/China trade situation due to all of the technology companies involved in that scenario. With this being the case, I suspect that the NASDAQ 100 will continue to be soft.