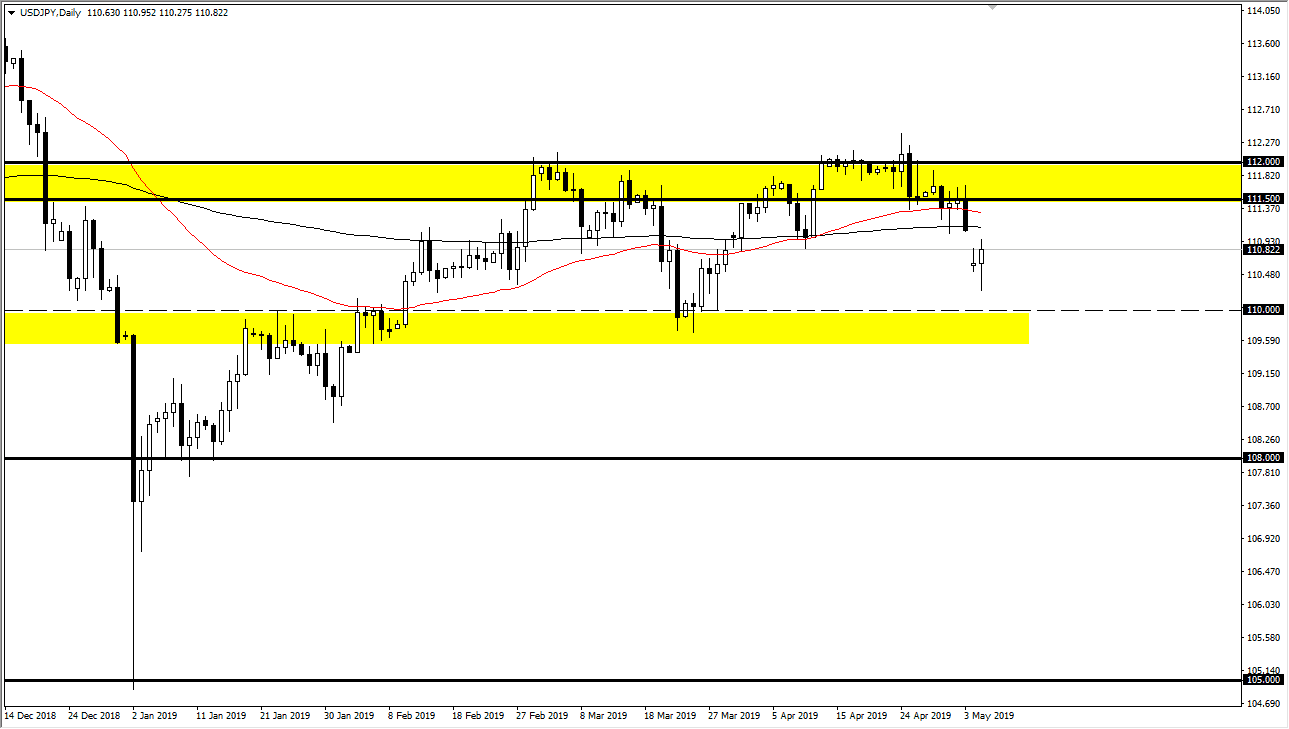

USD/JPY

The US dollar gapped lower against the Japanese yen as we got a bit of a reaction during Asian trading to tweets from President Donald Trump suggesting further tariffs increases out of China, and of course the Chinese looking less likely to meet up with the Americans in reaction. This had the Japanese yen is strengthening as a bit of a safety trade, as is typical. We fell rather hard, but as you can see have turned around of form a bit of a hammer. With that being the case, it looks as if we are simply stuck in the same consolidation area, between the ¥110 level on the bottom and the ¥112 level on the top. With that, it looks like we continue to go back and forth between these two levels. If you are looking to make profit from this pair, you will need to buy or sell based upon those levels.

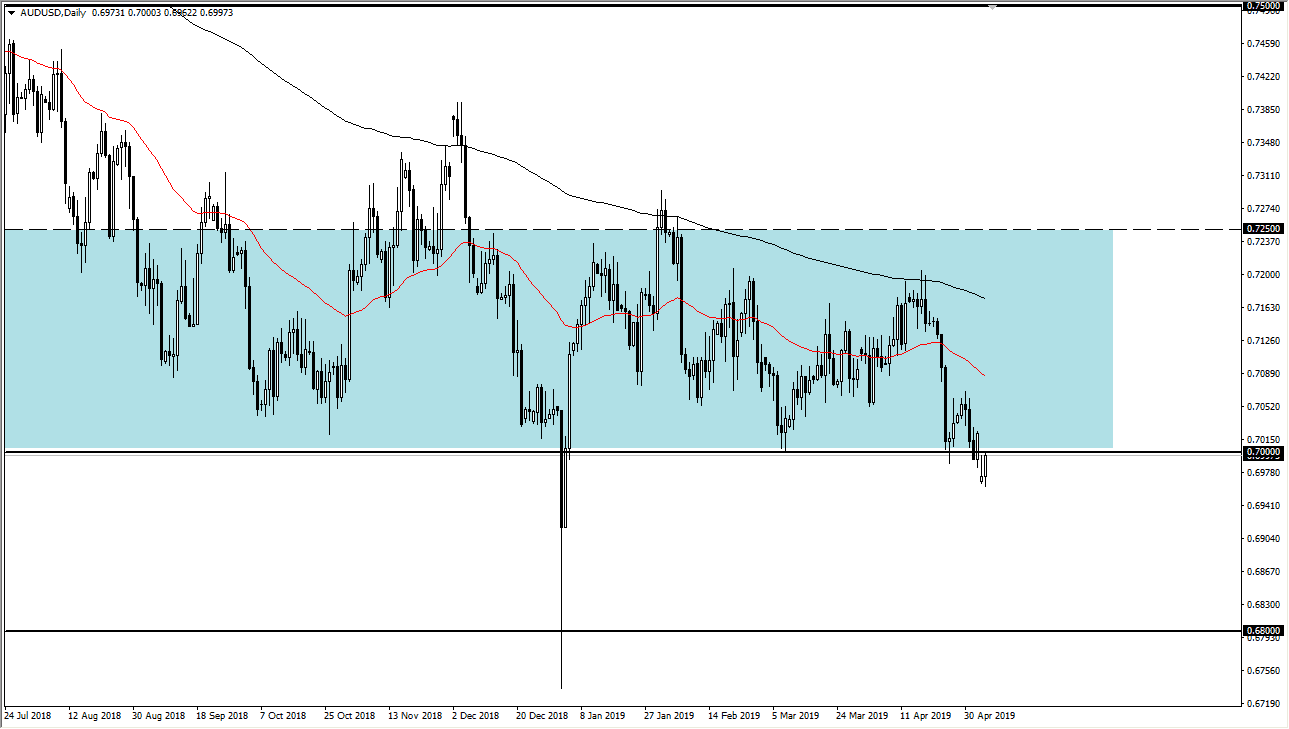

AUD/USD

The Australian dollar initially gapped lower for the same reason, and therefore turned around eventually as we got a bit of relief in the marketplace. Obviously, the Australian dollar is highly levered to the Chinese economy, so it makes sense that we had a major issue. The 0.70 level is a large, round, psychologically significant figure, and therefore it makes sense that we see a lot of noise here. There is massive support extending down to the 0.68 level, so the idea of shorting this market is all but dead to me, because I think that quite frankly there will be easier ways to buy the US dollar against another currency. However, if the US dollar sells off I think that the Aussie could rally quite nicely. We are starting to see the first vestiges of that here in the AUD/USD pair. The 0.7050 level will be resistance, and then the 0.71 level will be.