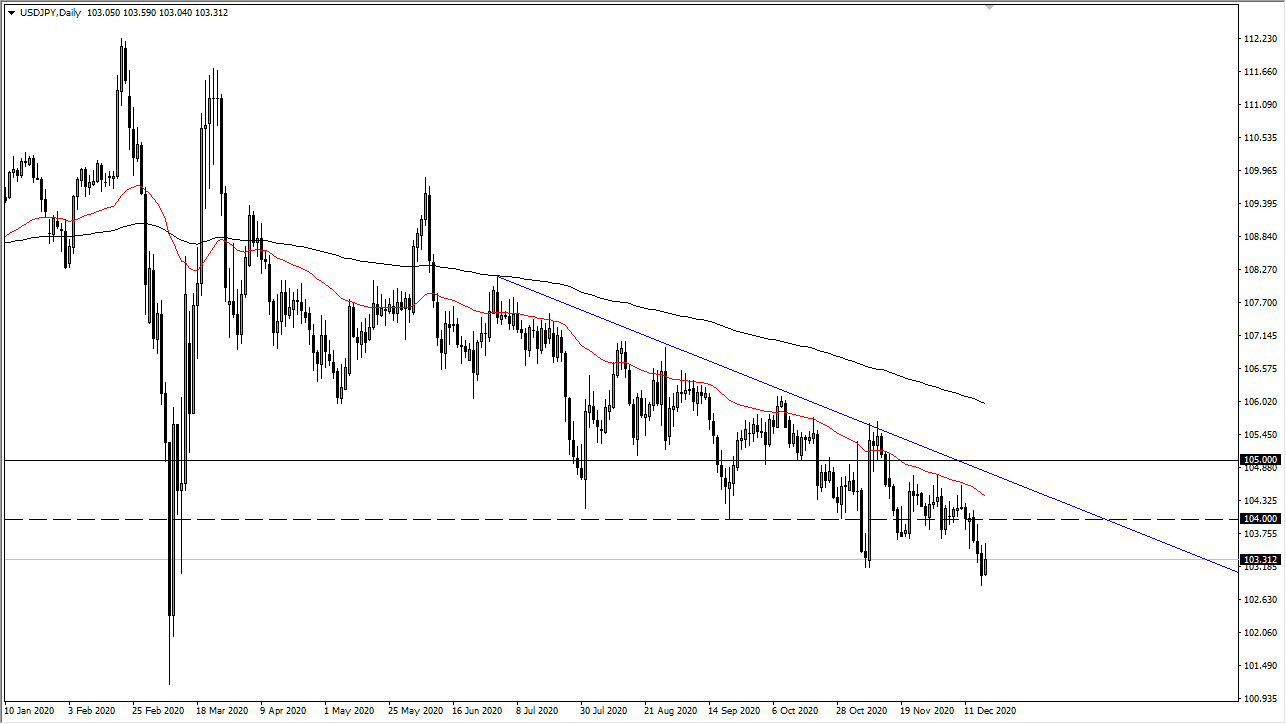

USD/JPY

The US dollar fell during most of the trading session on Tuesday but did find support at a couple of crucial places. The first place that I would point out is the black 200 day EMA. That of course quite often will be thought of as a trend defining EMA, but we also have the 50 day EMA pictured in red just above there. At this point, the market looks as if it is going to struggle to break out to the upside, but clearly selling isn’t exactly taking over either.

Keep in mind that this pair does tend to mimic the S&P 500, so if we can get a major break out above there, it’s likely that this pair will follow suit. If we break out over the highs of last week, I suspect we are going to go looking towards the ¥113.50 level. To the downside, if we were to break below the 200 day EMA, we will more than likely go looking towards the ¥110 level.

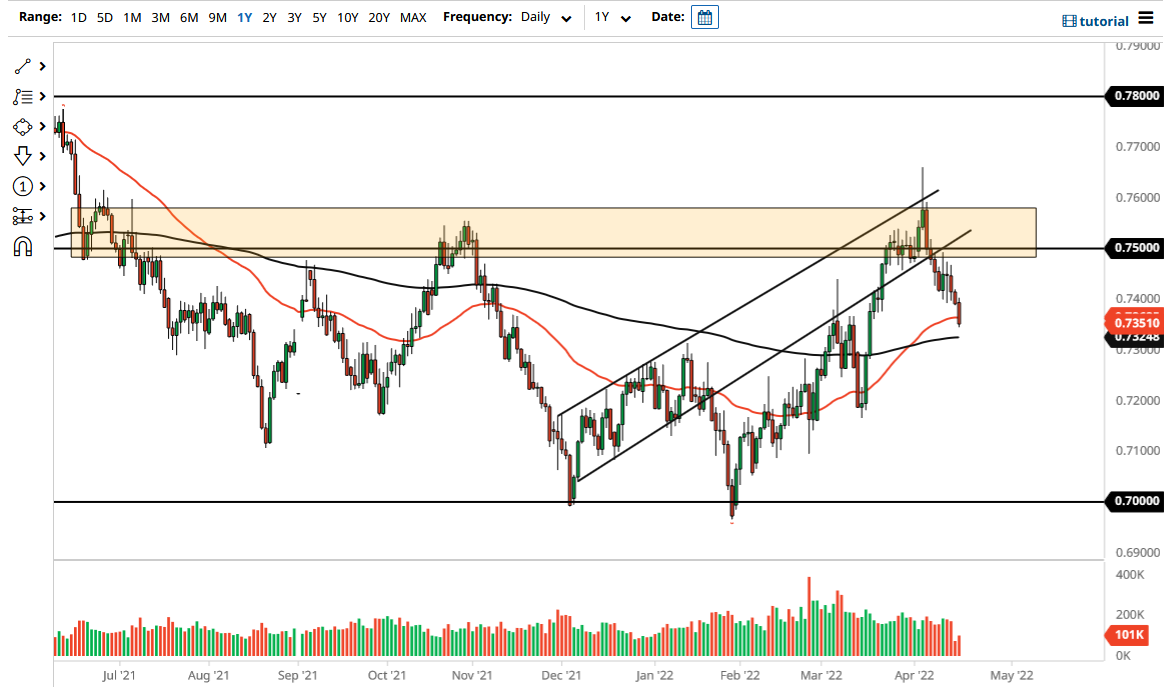

AUD/USD

The Australian dollar went back and forth during the trading session on Tuesday, as we continue to see a lot of volatility. However, the most important thing on this chart for me is going to be the 0.70 level. I think that level continues to be a major support barrier that extends down to about 200 points, so keep that in mind. In fact, it’s not until we break down below the 0.68 level that I’m willing to start selling. It’s a simple set up for me, as this will come down to what’s going on with the US dollar. If the US dollar loses a bit of strength, then I think the Australian dollar will rise. However, the US dollar starts to strengthen against most other currencies, I will simply ignore this pair.