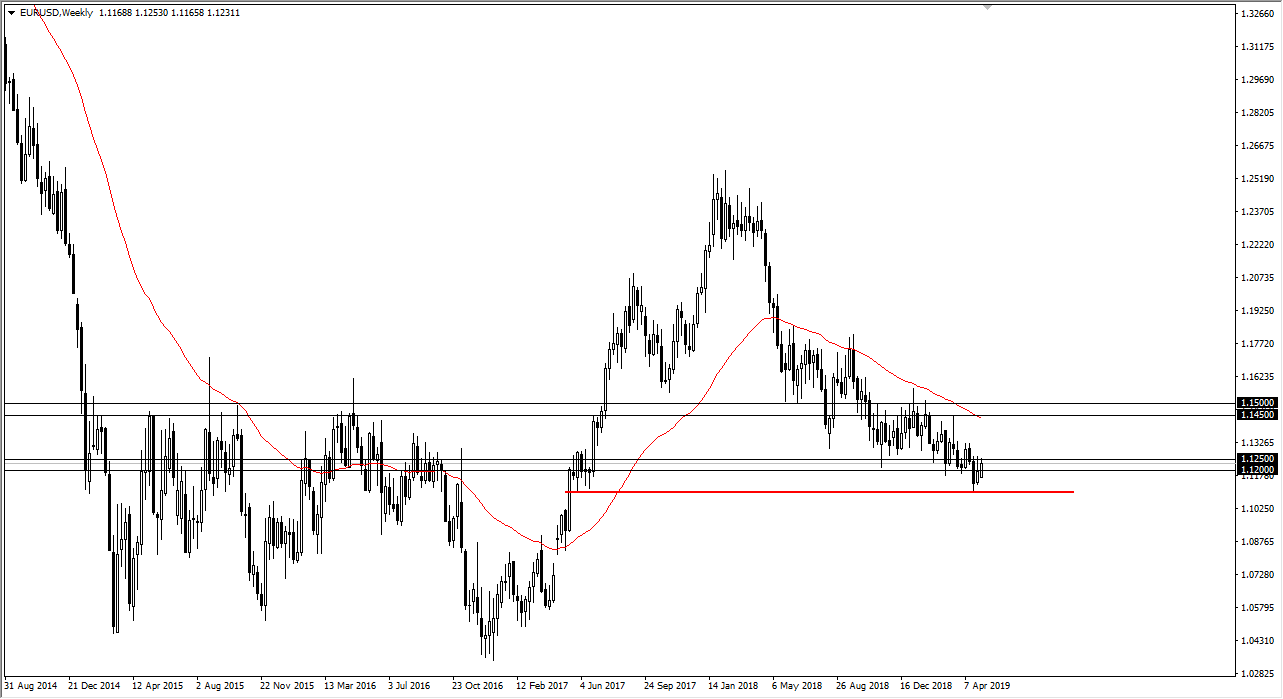

EUR/USD

The Euro rallied a bit during the week, reaching towards 1.1250 level, an area that was previous support. The fact that we pull back from there wasn’t much of a surprise, as we continue to see a lot of uncertainty when it comes to the global markets. That being said, if we can break above the 1.1275 handle, it’s likely that longer-term traders will come in and try to pick this market up a bit. Otherwise, I fully anticipate that we will reach down towards the 1.11 handle.

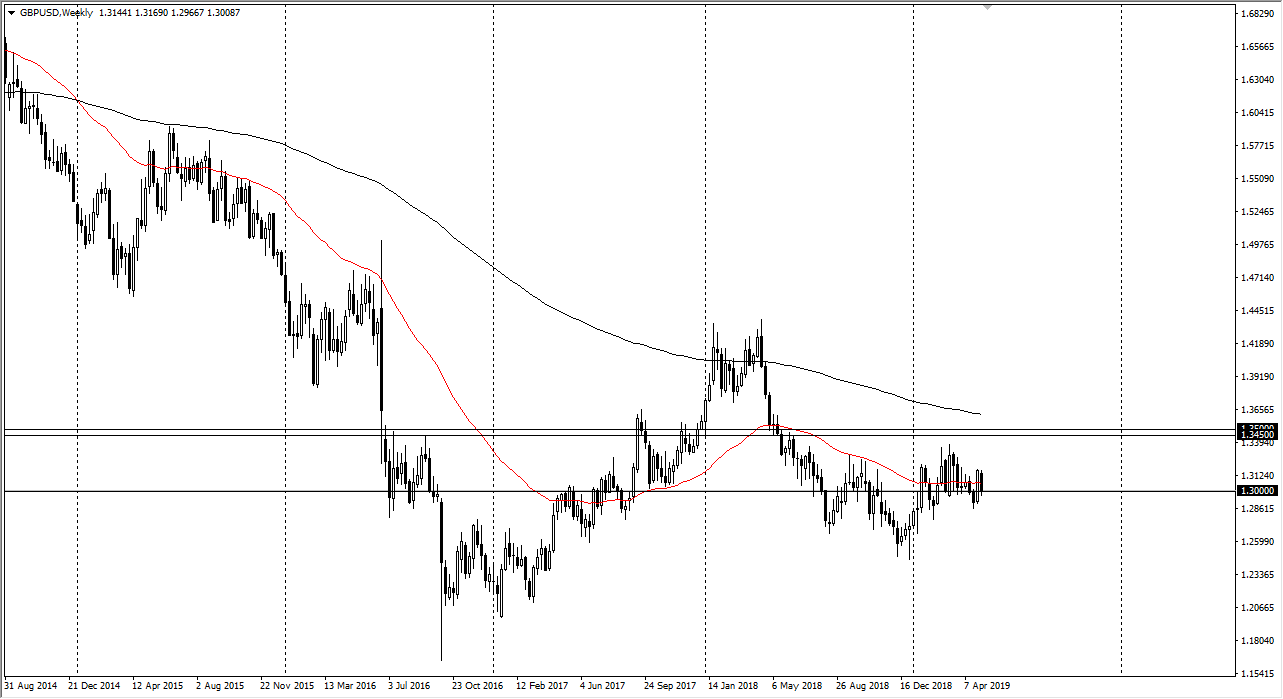

GBP/USD

The British pound fell during most of the week, testing the 1.30 level. That is an area we have seen interest in previously, very supportive action as you know. At this point, I believe that the market will eventually find enough value at lower levels to take advantage of it and start buying again. However, if we break down below the 1.28 handle, that could have this market unwinding to the 1.25 level.

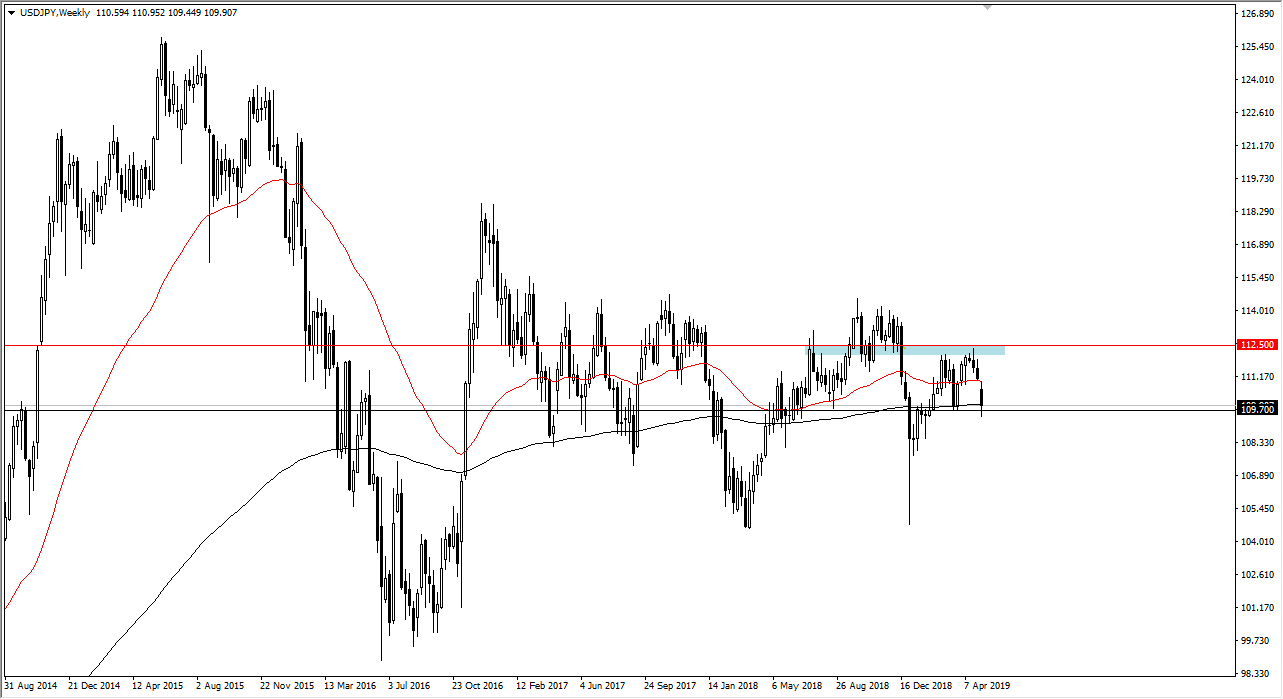

USD/JPY

The US dollar gapped lower at the open of the week, rallied a bit and then fell towards the ¥109.50 level. The market has recovered nicely from their late in the week though, so I think that this week may see some buying pressure, perhaps trying to fill that gap towards the ¥111 level. However, if we break down below the ¥109.50 level, then we likely go down to the ¥108 level underneath which is significant support.

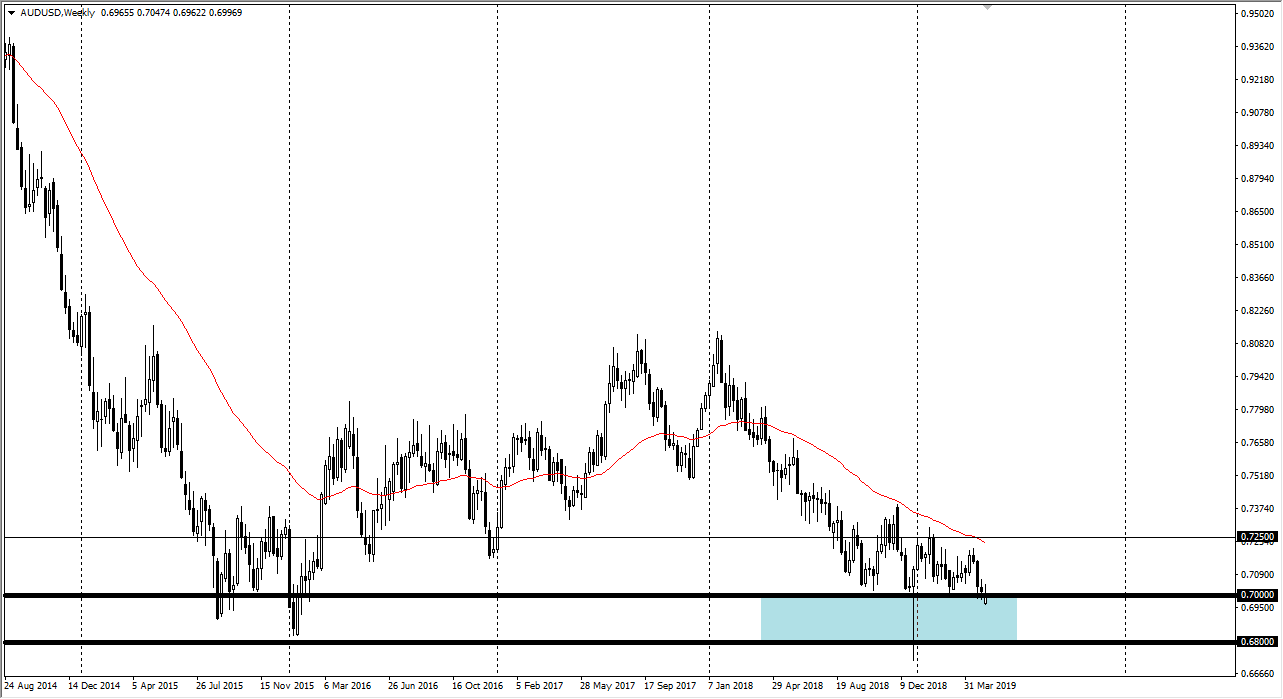

AUD/USD

The Australian dollar gapped lower during the open of the week, and then turned around to break above the 0.70 level. At this point in time, we have seen sellers come back into the market but buyers have returned later in the week as well. If we can break above the top of the weekly candle stick, then we could grind towards the 0.72 level. Otherwise, if we drop from here I would stand on the sidelines as there is a huge support barrier.