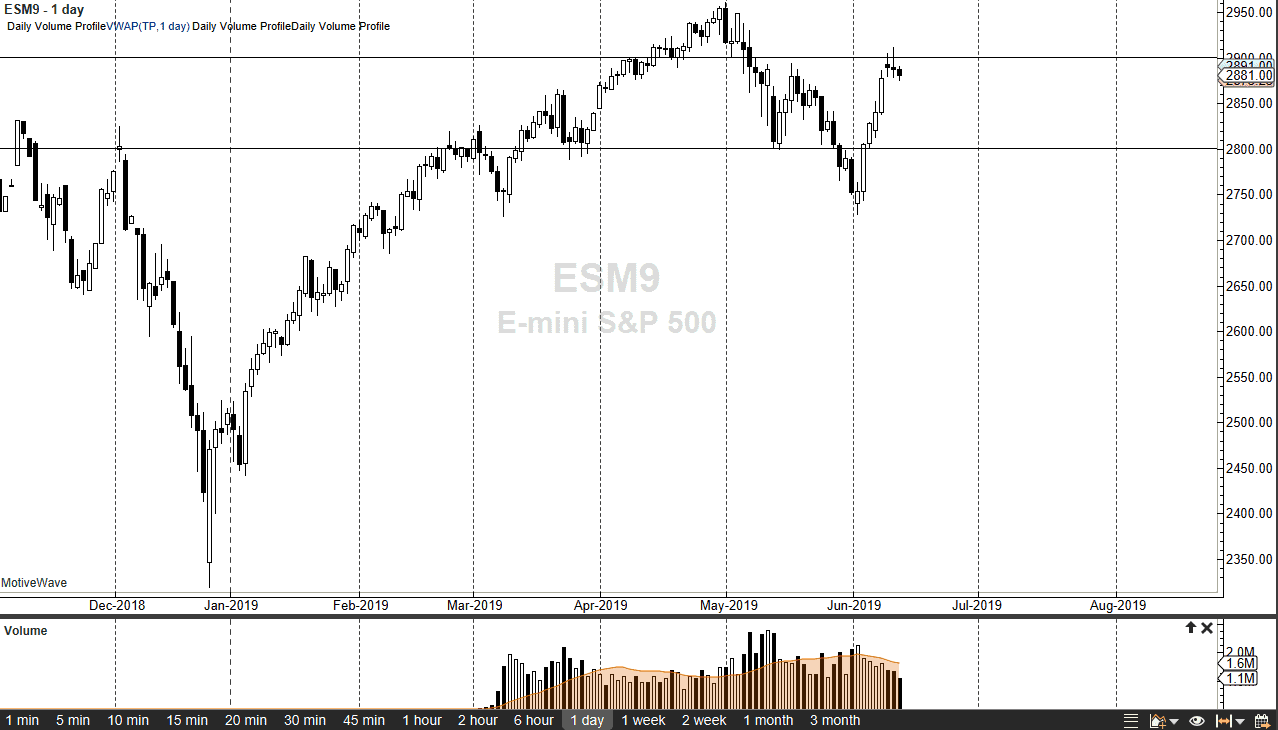

S&P 500

The S&P 500 continues to be an absolute mess, as we have formed a couple of shooting stars over the last handful of sessions, but Wednesday saw a little bit more aggression when it comes to selling. Now that the 2900 level has shown itself to be massive resistance, I think at this point we are starting to get a bit exhausted. For me, the trade is relatively simple: if we break down below the lows of the trading session on Wednesday, we probably continue to go much lower. In fact, I suspect it’s very likely as the market simply has far too much to concern itself with these days. However, it’s very likely that if we break above the shooting star from the session on Wednesday, that would be an extraordinarily bullish sign. To the downside, I suspect that we could go to 2850 rather quickly.

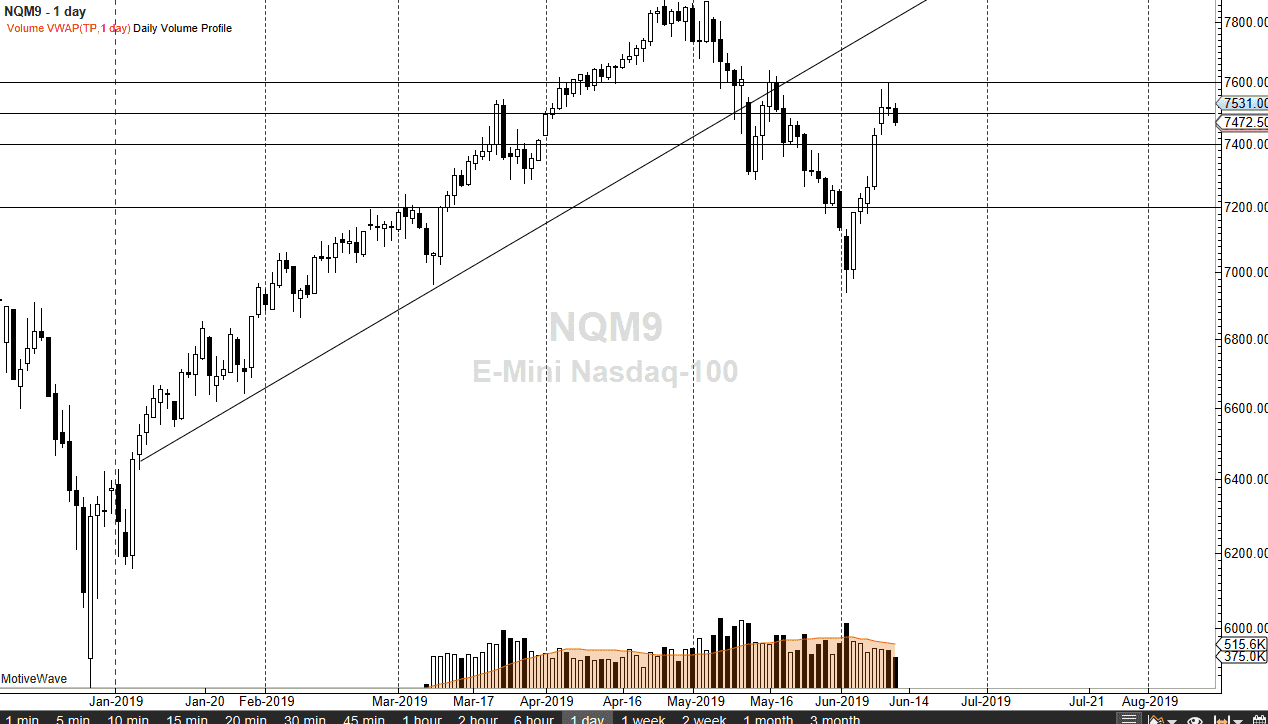

NASDAQ 100

The NASDAQ 100 also looks a bit overstretched and tired at this point, so I suspect that we are probably going to go looking towards the 7400 level. This makes a lot of sense, because the United States and China are in the trade war that doesn’t seem to be letting up, and therefore technology companies will probably get hammered. The candle stick from the session on Tuesday was a perfect shooting star at the perfect place, and I don’t believe in coincidences. 7400 will be targeted initially on a break down below the lows of the trading session on Wednesday, but we could go as low as 7200 after that as we simply grind back and forth and look for some type of clarity.It just doesn’t look like there is a lot of conviction.