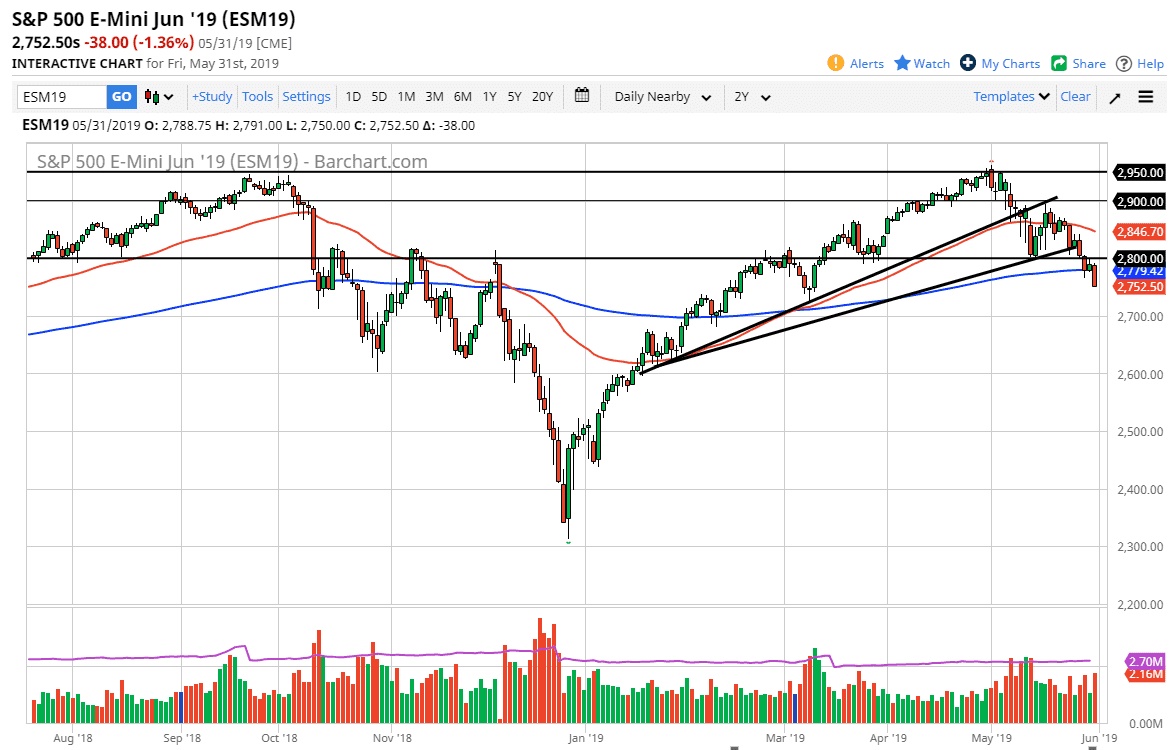

S&P 500

The S&P 500 broke down during the trading session on Friday, slicing through the 200 day EMA. The fact that we closed at the very bottom of the candle stick suggests that we are going to see follow-through, and it’s obvious that the market has become more bearish over the last couple of weeks. Geopolitical tensions and of course the trade war continue to cause issues, and at this point I think that we are starting to see Wall Street kind of come back to the fold of reality. Short-term rally should be selling opportunities, especially near the 200 day EMA and of course the 2800 level. This is a market that very likely will continue to drop from here, perhaps reaching down to the 2700 level, an area that is massive support. A break below there opens the floodgates.

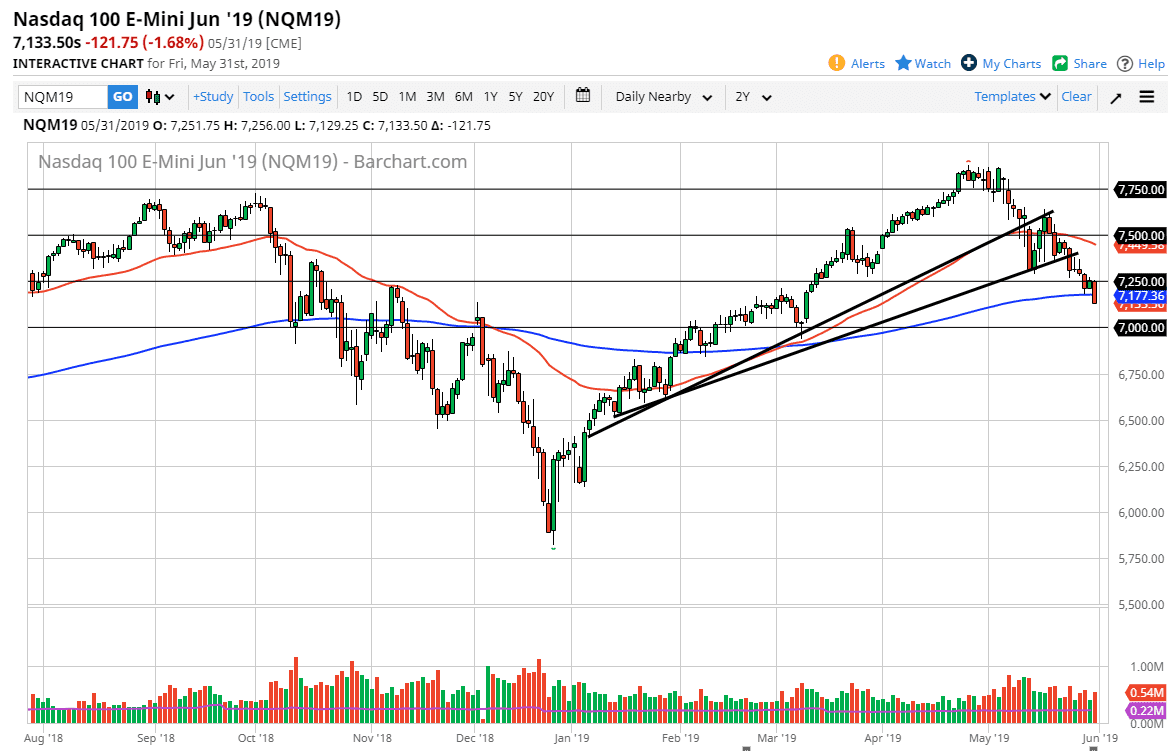

NASDAQ 100

The NASDAQ 100 of course also broke down during the day, and also closed at the bottom of the range. The market breaking below the 200 day EMA of course is a very bearish sign, and the fact that we closed at the bottom of the range of the day also suggests that there should be more selling pressure. The 7000 level will more than likely be targeted, an area that is a large, round, psychologically significant figure. I would be a seller of rallies all the way to the 7250 level. If we break above there, then we could reach towards the 7400 level.

If we did break down below the 7000 level, the market could go down to the 6750 handle. Either way, there are enough moving pieces out there that are working against growth that buying the NASDAQ 100 is going to be very difficult.