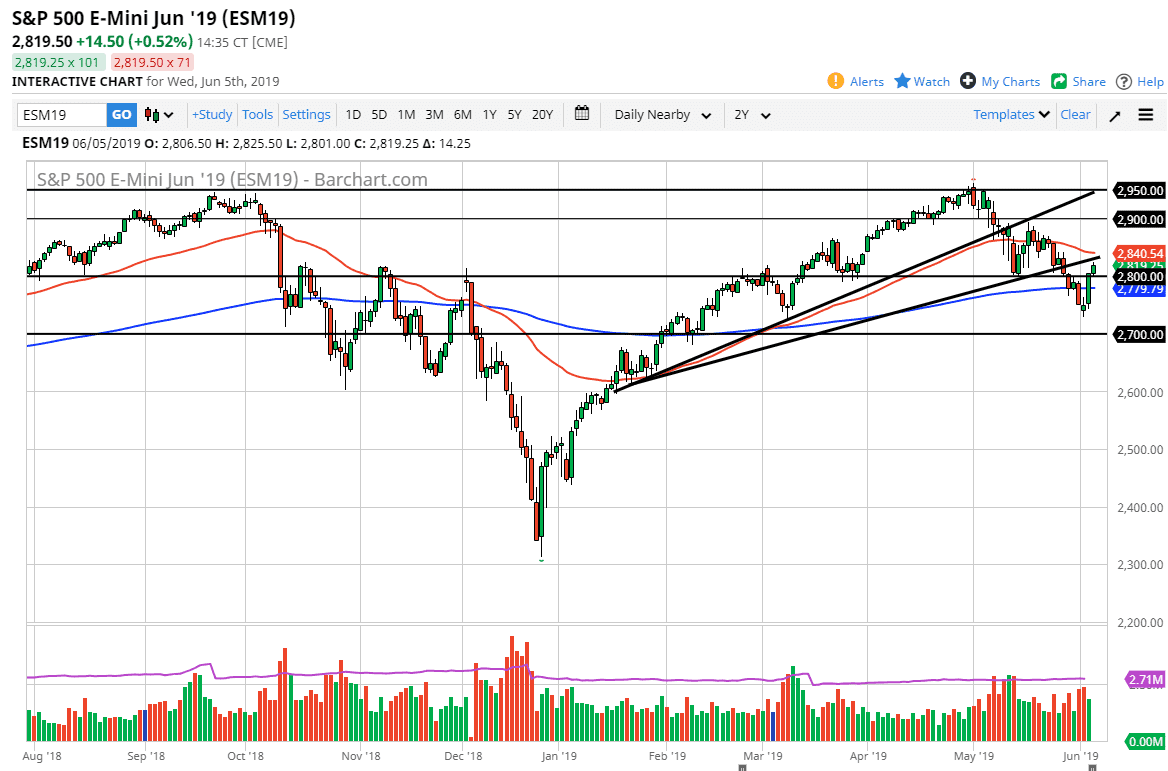

S&P 500

The S&P 500 rallied significantly during the trading session on Wednesday, as we are testing the bottom of an uptrend line that previously had been so important. The fact that we are close towards the 50 day EMA should bring in some selling pressure. At this point, there is a lot to work through but we also closed at the top of the range, which is bullish. At this point I think that Thursday has a lot of potential to be very choppy and back and forth, because beyond that we have the added specter of the jobs number coming out on Friday. This is probably not a market that you are going to be trading much during the day unless of course you can trade short-term range bound systems. A break above the 50 day EMA is very bullish and could send this market higher. However, if we break back below the 2800 level, the market could drop from there to continue the negative pressure.

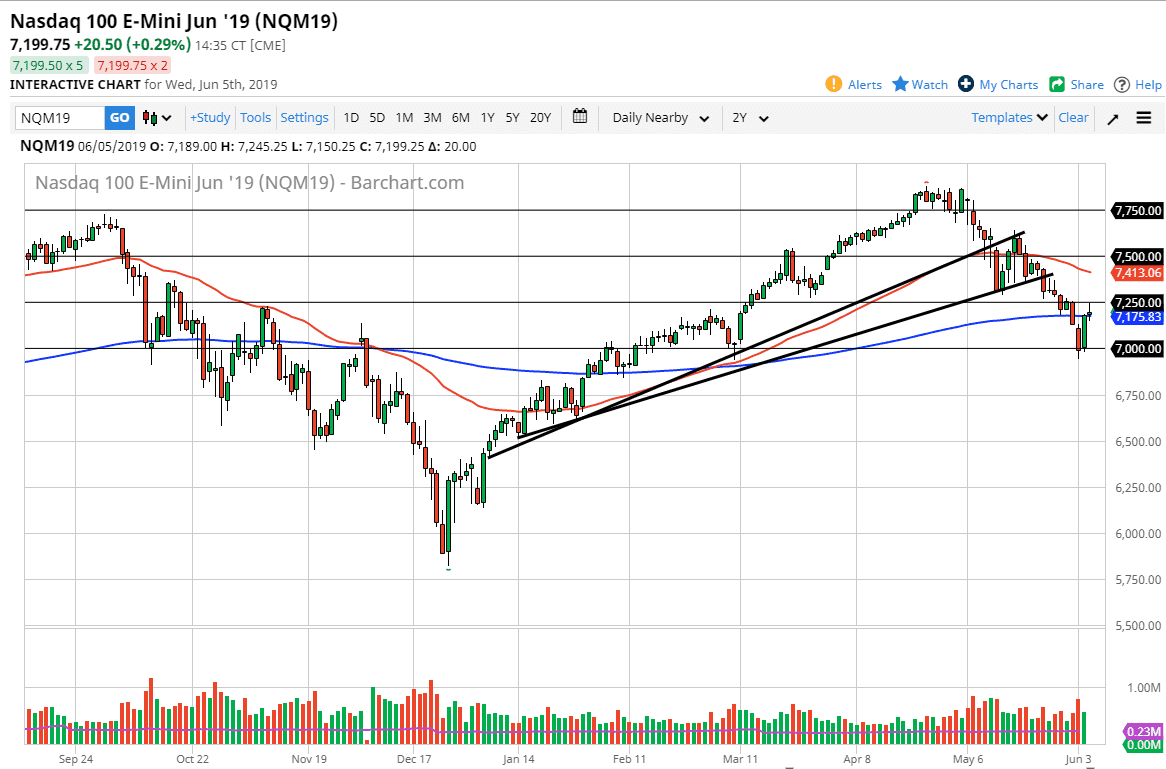

NASDAQ 100

The NASDAQ 100 rallied during most of the session on Wednesday but ran into resistance at the 7250 level. If we can break above there, then it’s very likely that we could continue to go higher. However, if we rollover and break back below the lows of the trading session for Wednesday, that could send this market looking towards the 7000 handle underneath. That would be massive support, and a break down below there could really send this market much lower. I expect a lot of noise in this area, but ultimately this is a marketplace that will continue to move based upon the US/China situation as it is so sensitive to trans-Pacific trade.