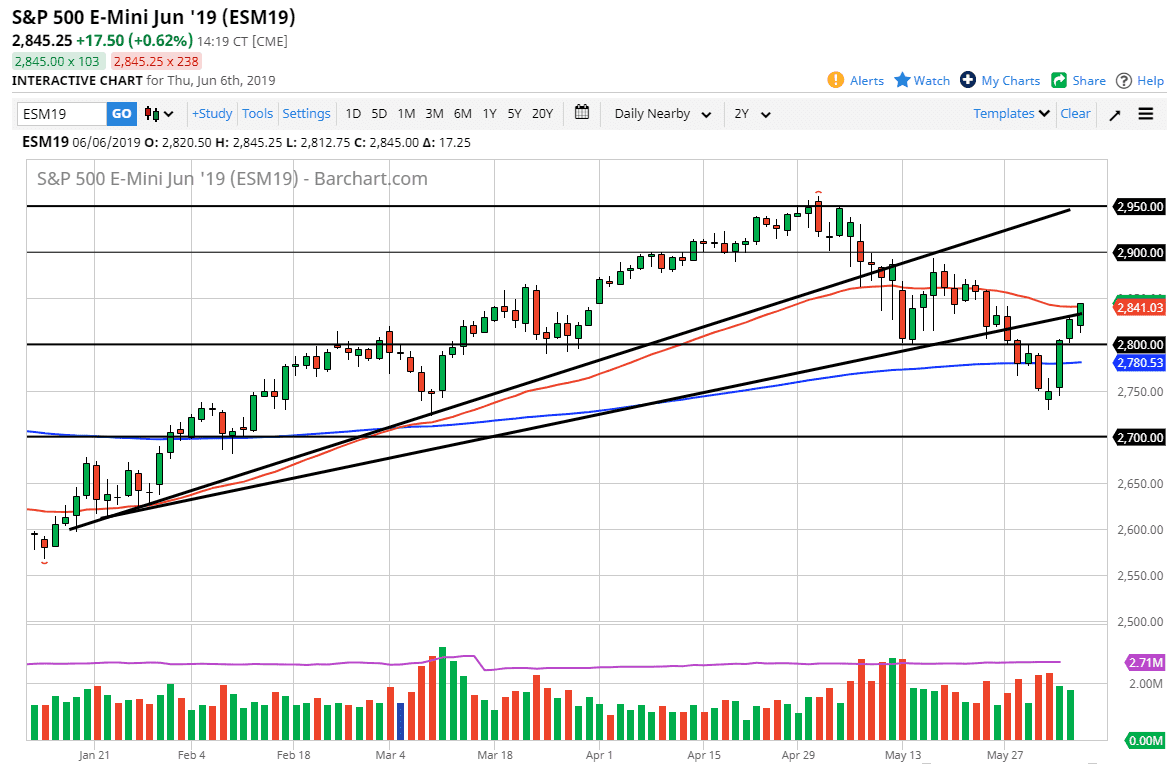

S&P 500

The S&P 500 initially pulled back just a bit during the trading session on Thursday, but then shot higher. We have broken through the 50 day EMA late during the day as the United States looks likely to push back the implementation of tariffs against Mexico. Beyond the 50 day moving average, we have also broken through the previous uptrend line, which is a very strong move. We are now approaching the 2850 handle, and those “midcentury levels” do attract a lot of attention. At this point though, it looks very strong. However, we have the jobs number coming out so anything is possible. It certainly looks as if the market is primed to go higher though, so look at pullbacks as potential buying opportunities as long as we can stay above the psychologically important 2800 level, something that shouldn’t be too hard to do over the next couple of trading sessions.

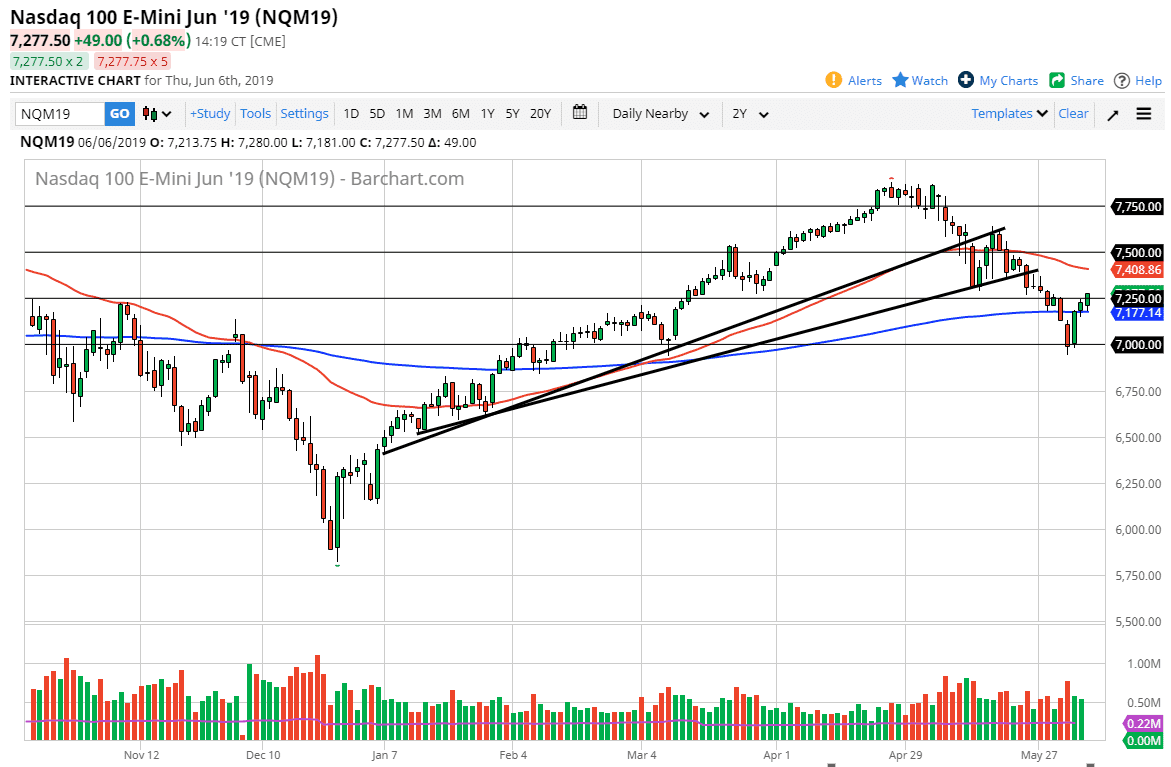

NASDAQ 100

The NASDAQ 100 initially pulled back during the trading session but then shot higher as the 200 day EMA has offered support. By breaking above the 7250 level it looks as if we are ready to continue going higher. Ultimately, the 50 day EMA above will be a bit of trouble, but as the sentiment in the stock markets changed rapidly later in the day, it looks very likely that this market will continue to go higher right along with the S&P 500

As long as we can stay above the 7000 handle, and I think we can, we may have already seen the worst of the selling pressure, and now that the large, round, psychologically significant figure has held, we may be seeing a reversal of this significant pullback again. Expect volatile conditions to continue.