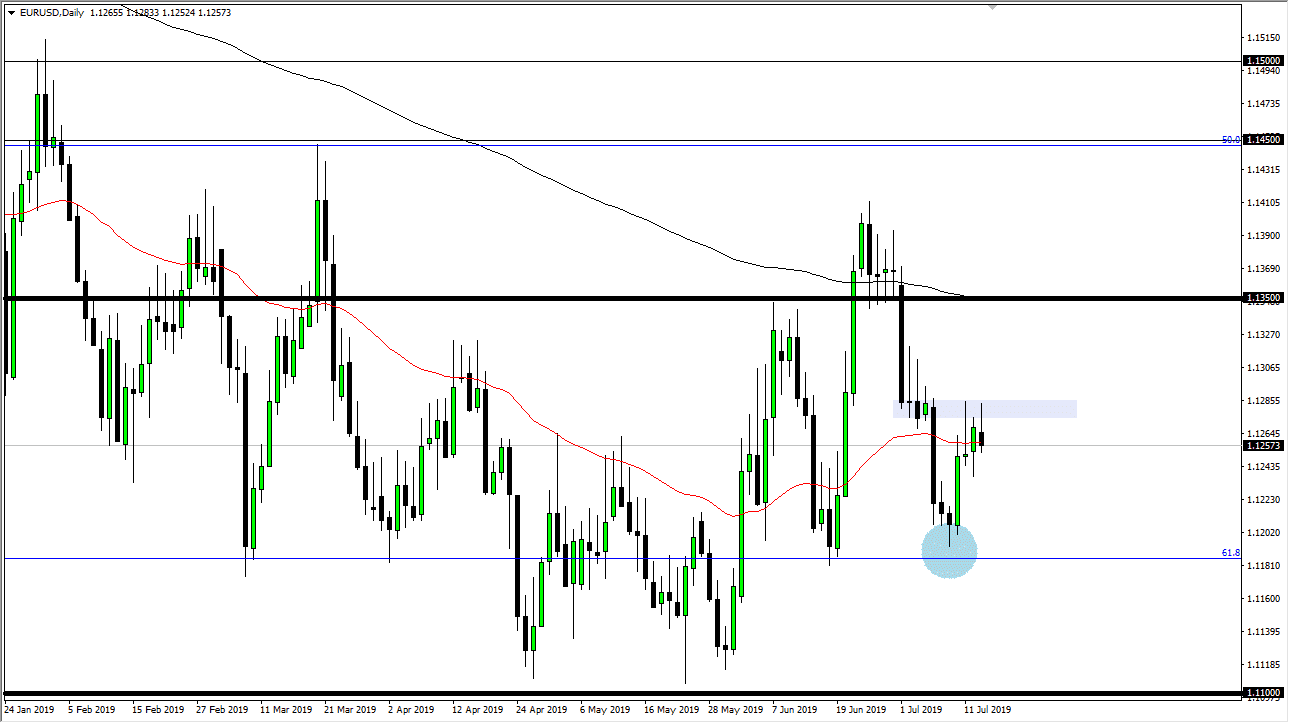

The Euro continues to find resistance, especially near the 1.13 level above. At this point, I believe that the 1.13 level is the beginning of significant resistance that extends a bit higher, based upon what we had seen during the last couple of weeks. Every time we try to break above the 1.13 level, the sellers come back in and as you can see we have several shooting star like candles in this general vicinity. To the downside, we have seen a lot of support near the 1.12 level, which is also near the 61.8% Fibonacci retracement level. In other words, this is a market that continues to struggle overall, and therefore I think that clarity is probably the one thing you won’t get.

The fact that we are forming yet another shooting star at this obvious level tells me we simply aren’t ready to go higher. Even if we do break above the top of the range for the trading session on Monday, there is plenty of resistance that extends even further to keep this market from taking off. To the downside, the 1.12 area should continue to offer support as well. We just don’t have anywhere to go right now as we are in the dead of summer, and further compounding things is the fact that the 50 day EMA currently sits in the middle of the candle stick and is flattening. There is no real decisiveness when it comes to this market, and that makes quite a bit of sense when you think about the central banks overall.

The Federal Reserve is expected to cut interest rates in July, so this has lifted the Euro in general. However, the ECB is also expected to ease its monetary policy, and therefore we have a lot of back and forth. Ultimately, this is a fight between a couple of lightweights, and it’s not until we get more clarity coming out of the Federal Reserve that we will get the impulsive candle to make the serious trade. I believe that the next day or two is probably going to be bouncing around in a 100 PIP range between the 1.13 level above and the 1.12 level below. Ultimately, we are floating around directional S, and I don’t see that changing in the short term. However, if we were to get some type of impulsive candle stick that breaks out of this range, then we can start to revisit.