For five straight trading sessions, the EUR/USD pair is trading within a limited range between 1.1101 support, the lowest in 2 years, and 2.1187 resistance, and is stable around 1.1140 at the time of writing. This performance formed a new consolidating area on the daily chart signaling an upcoming strong move closer to continuing the move within its downward channel. US Dollar is still stronger against other major currencies despite expectations that the Federal Reserve will cut the US interest rate, the bank began its meeting today and tomorrow will announce its latest decisions, with expectations of a quarter-point cut to counter the consequences of the global trade war that led to a slowdown in the US economic growth.

Last week, the US GDP figures, which saw a 1.2% slowdown, were released against expectations of a stronger 1.8% slowdown from 1.3% growth in the previous quarter. The US economic slowdown was not strong, and therefore the dollar did not face a major shock. In general, the divergence of economic performance and monetary policy of both the Eurozone and the US will be in favor of the US dollar. The European Central Bank recently kept the interest rate unchanged at 0.00% but hinted in the monetary policy statement, according to Mario Draghi, that the bank is determined to provide more stimulus plans for the Eurozone economy, which is suffering from a slowdown due to the continuation of the global trade war.

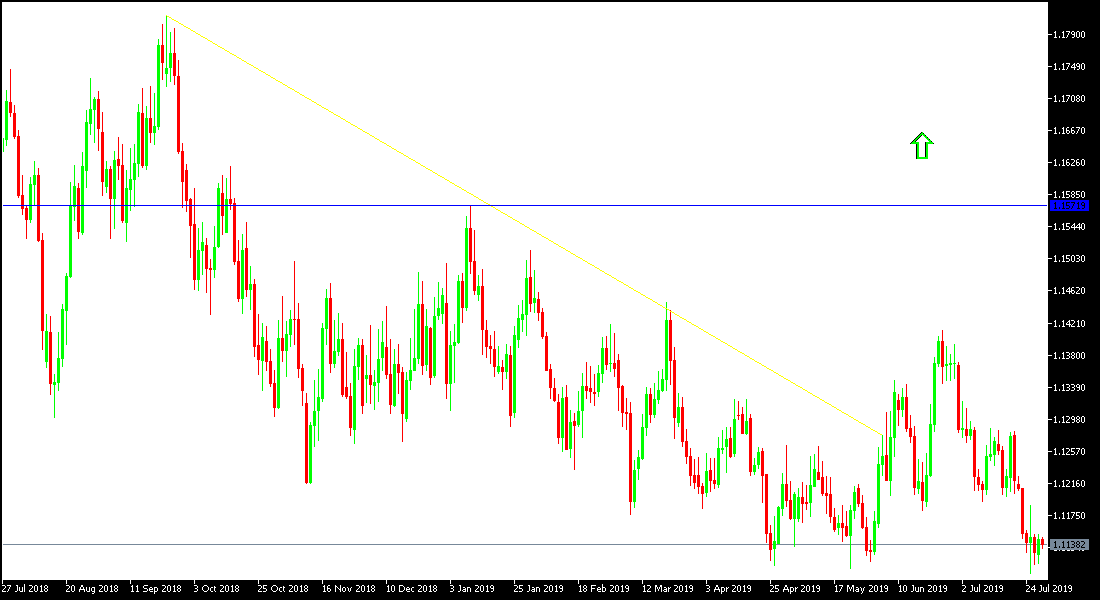

Technically: EUR / USD pair performance is still bearish and any move below 1.11 will support the strength of this trend and will test stronger support levels which may be closer to 1.1045, 1.0980 and 1.0900, respectively. On the upside, in the event of a bullish correction, the resistance levels will be 1.1200, 1.1285 and 1.1345, respectively, which are the closest to this trend. The pair is still bearish and still better sold from every ascending level.

On the economic data front: The economic calendar today will focus first on the German Consumer Price Index (CPI) and GFK Consumer Climate. From the US, there will be the Consumer Price Index (CPI), the Federal Reserve's favorite measure of inflation, and the average income and spending of the US citizen data, and then the US Consumer Confidence data.