Gold markets have had a strong week or so, but as we are just above the $1500 level, it’s likely that we are going to pull back a bit as the market tries to come to grips with the idea of being above that level. Typically, it’s as if market participants have to be acclimated to these fresh, new highs, and it looks as if that’s what’s been going on for a couple of days now. All things being equal, I believe that we will probably find a reason to continue going higher, but a short-term pullback just offers value.

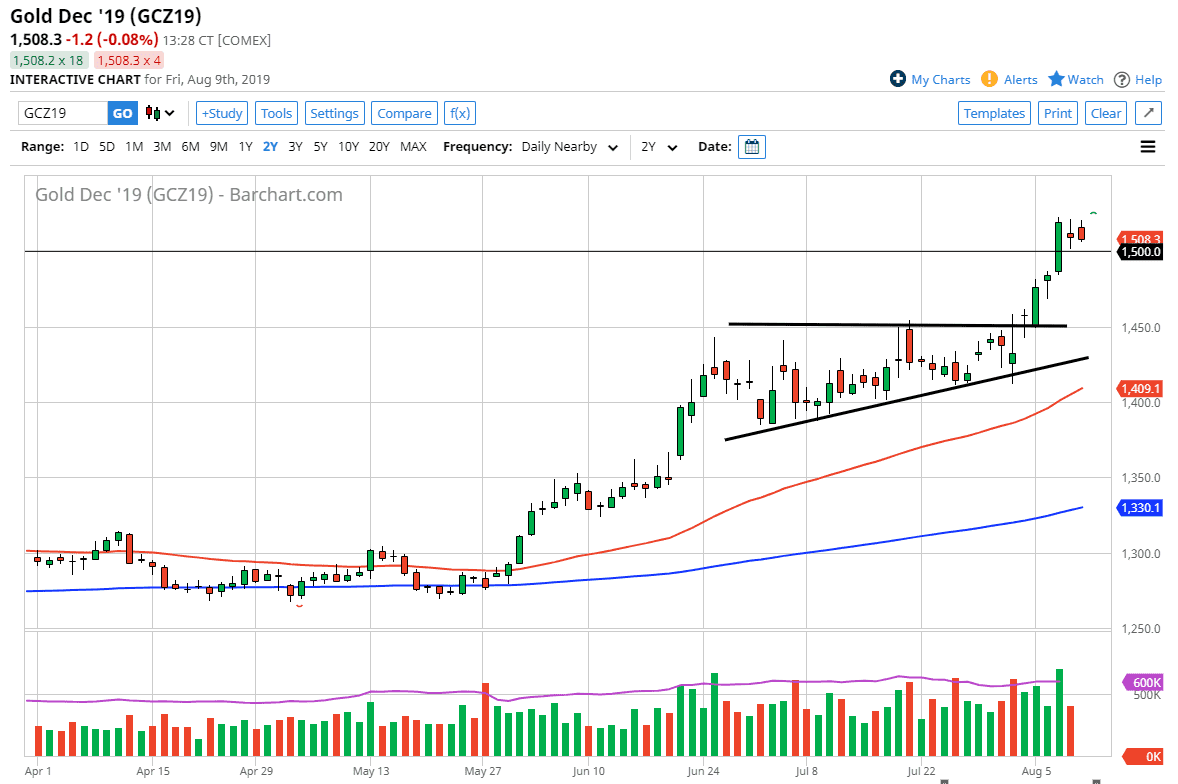

Looking at the chart, the most obvious support level underneath is 1450, as it was the top of an ascending triangle, and resistance. It should now be supported, so I think pullbacks to that area will continue to find plenty of interest, as those who had been shorting the market will be looking to bail and get out. The measured move of the triangle has been realized, so I think at this point it’s likely that we will pull back based upon that as well. I do believe it’s only a matter of time before we go to the upside, because there are more than enough reasons out there to continue to throw money at gold.

Central banks around the world continue to cut interest rates, and I think it’s likely that Gold will not only rallied against the US dollar, but most other currencies as well. That being said, the futures market certainly has liked gold, but we have been rather quiet. We basically have one of two options here: a pullback to the $1450 level or perhaps a break above the highs from the last three days. Either one of those are buying opportunities but obviously you would rather see a bit of value brought into the market at a lower level. The 50 day EMA is now starting to reach towards the ascending triangle as well, so I think it’s only a matter time before longer-term technical trading would dictate that we go higher as well. That being said, if we were to break down below the 50 day EMA, the market probably goes looking towards the $1400 level, possibly even lower than that. I’m looking for value at this point and will be very patient. I believe that eventually we will go looking towards the $1800 level, possibly even the $2000 level.