Bitcoin had a wild week which started with its 4th best daily performance and a price surge of over 42%; this was followed by sharp retreat as traders came to realize that comments made by Chinese President Xi in regards to blockchain technology did not mean that China is endorsing Bitcoin. On the contrary, China is pushing blockchain minus Bitcoin and is likely to roll out it national digital currency as early as 2020; the passing of a new cryptography law may have laid the groundwork for it. Cryptography should not be confused with cryptocurrency and BTC/USD has reversed sharply after reaching its resistance zone and once clarity set in. You can read more about a resistance zone here.

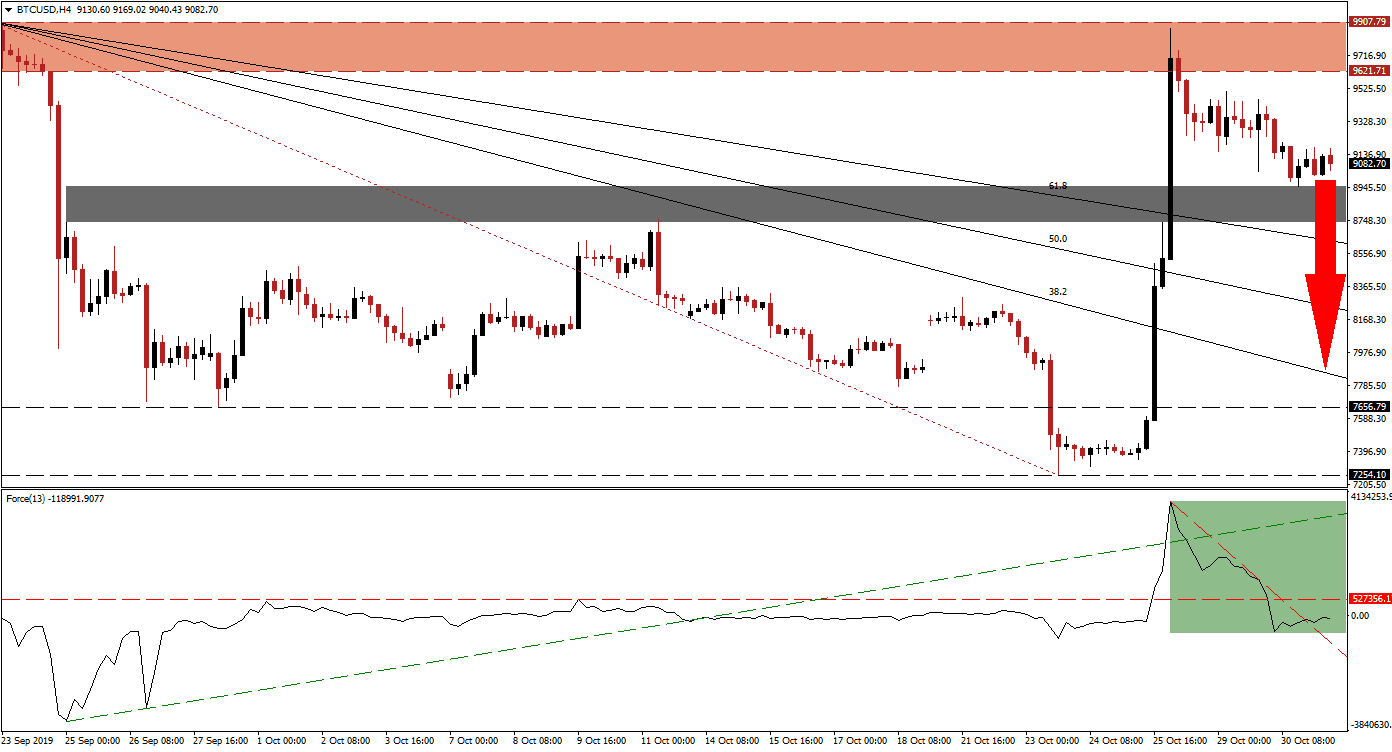

The Force Index, a next generation technical indicator, points towards the sharp loss in bullish momentum after the price spike briefly took it above its ascending support level before plunging below its horizontal support level and turning it into resistance. A steep descending resistance level emerged and while a minor sideways trend allowed the Force Index to pass above it as marked by the green rectangle, more downside is expected to follow. This could allow the BTC/USD to descend into its short-term support zone from where a breakdown could further extend a sell-off in this cryptocurrency pair.

While the aggressive rally took price action from its long-term support zone through its short-term resistance zone, which has been converted to support, and into its long-term resistance zone, a breakdown is expected to reverse BTC/USD. The increase in breakdown pressures could lead to a move below its short-term support zone, located between 8,738.63 and 8,951.00 as marked by the grey rectangle. As the entire Fibonacci Retracement Fan sequence has already moved below the short-term support zone, breakdown pressures have increased further. You can learn more about the Fibonacci Retracement Fan here.

Traders should monitor the intra-day low of 8,951.00 which marks the current low of the price action reversal as well as the top range of its short-term support zone; a move below it will mark another bearish development could initiate a breakdown sequence which will take BTC/USD down to its descending 38.2 Fibonacci Retracement Fan Support Level. The long-term support, located between 7,254.10 and 7,656.79, is situated just below it and the 38.2 Fibonacci Retracement Fan Support Level may lead price action into it.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 9,100.00

Take Profit @ 7,800.00

Stop Loss @ 9,475.00

Downside Potential: 130,000 pips

Upside Risk: 37,500 pips

Risk/Reward Ratio: 3.47

Volatility in the cryptocurrency market is a staple and a breakout in the Force Index above its horizontal resistance level may allow BTC/USD to ascend back into its resistance zone; this zone is located between 9,621.71 and 9,907.79 as marked by the red rectangle. A reversal from current levels could also provide enough bullish momentum for a breakout above its resistance zone, the next major to monitor is located between 10,601.89 and 10,891.60; this would take out the key psychological 10K resistance level.

BTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 9,575.00

Take Profit @ 10,650.00

Stop Loss @ 9,150.00

Upside Potential: 107,500 pips

Downside Risk: 42,500 pips

Risk/Reward Ratio: 2.53