Here at Pepperstone we’ve seen increased client interest in the USD/CNH cross. Why? Well, along with perhaps soybeans and pork, CNH has been a remarkable read on the US-China trade war.

CNH is the offshore yuan, a version of the Chinese currency accessible to investors outside mainland China. The onshore yuan (CNY) remains subject to tight capital market controls.

It goes like this: When trade tensions escalate, CNH weakens against USD (USD/CNH higher) and broad financial markets are risk-off, although not for long as liquidity and FOMO kick in again as the dominant driver. When trade talks hint at a truce, optimism erupts, markets go risk-on, and the CNH strengthens. At this juncture, USD/CNH appears most sensitive to the idea of tariff rollbacks.

In recent weeks markets have played a tiring game of headline ping pong, as negotiations have sent mixed signals and the countries have struggled to ink a deal. China hinted at progress, while Trump announced he was in no hurry to cut a deal.

On Tuesday (AEDT) we heard that PRC Vice Premier Liu He had reached consensus with USTR Robert Lighthizer and Treasury Secretary Steven Mnuchin. On Wednesday morning Trump announced that trade talks are in “final throes” as negotiations near completion.

So what could the much awaited phase one trade deal look like? And how big a move in USD/CNH are we anticipating? As always, the devil is in the detail but whether we actually get the finer details on a longer-term agreement is obviously the subject of much debate.

Even if you’re reading this after a phase one trade deal, the below logic, while simplistic, sticks beyond phase one. Let’s consider three scenarios.

1. No ‘Phase One’ deal: risk-off, CNH down.

2. Complete deal: tariff rollback. Risk-on, CNH up, but an unlikely outcome.

3. Partial deal: no further tariffs.

While the timing is the subject of much debate, our most likely scenario is a partial deal signalling no - or modest - further tariffs - leaving markets idle with perhaps small CNH appreciation. Markets could take a more risk-on approach knowing further tariffs are off the cards, but trade barriers would remain, and we also have to consider how much is already priced - so we’d eye any narrative on the probability of a ‘Phase Two’ deal for meaningful progress.

CNH intertwined with other markets

A recent piece of mine Trade-driven treasuries, looked at the influence USD/CNH has on US 10-year treasury yields. The 10yr note represents the compensation required for holding long-term assets. With yields a whisker away from all-time lows, it’s a level that would have once indicated dismal investor confidence in inflation expectations and broader economic trends. However in this current dynamic, the long-end of the curve is also driven by other factors, including liquidity.

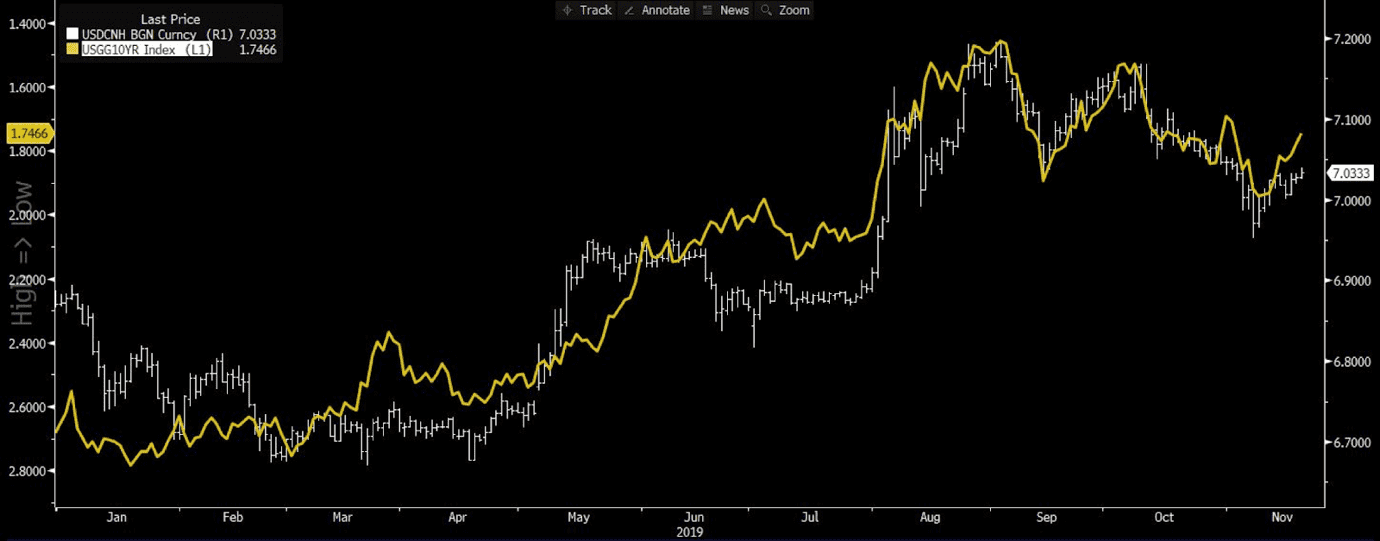

Caption: Year-to-date relationship between USDCNH (white) and US 10-year bond yields (yellow, inverted). Bond yields have fallen as CNH has weakened.

A year-to-date regression of daily USD/CNH (the independent variable) pricing against the daily 10-yr yield revealed a coefficient of determination of 0.854, telling us that price movement in USD/CNH explains 85.4% of the movement (variance) in 10-yr bond yields.

The correlation here is incredibly interesting as it’s hinged on the blurry trade outlook. Investment and business confidence dampened as the trade war dragged on - we feared recession at times - and yields dragged lower as USD/CNH kicked higher. If a phase-one deal eventuates and the trade outlook looks more certain, rising 10yr yields will indicate improving economic confidence.

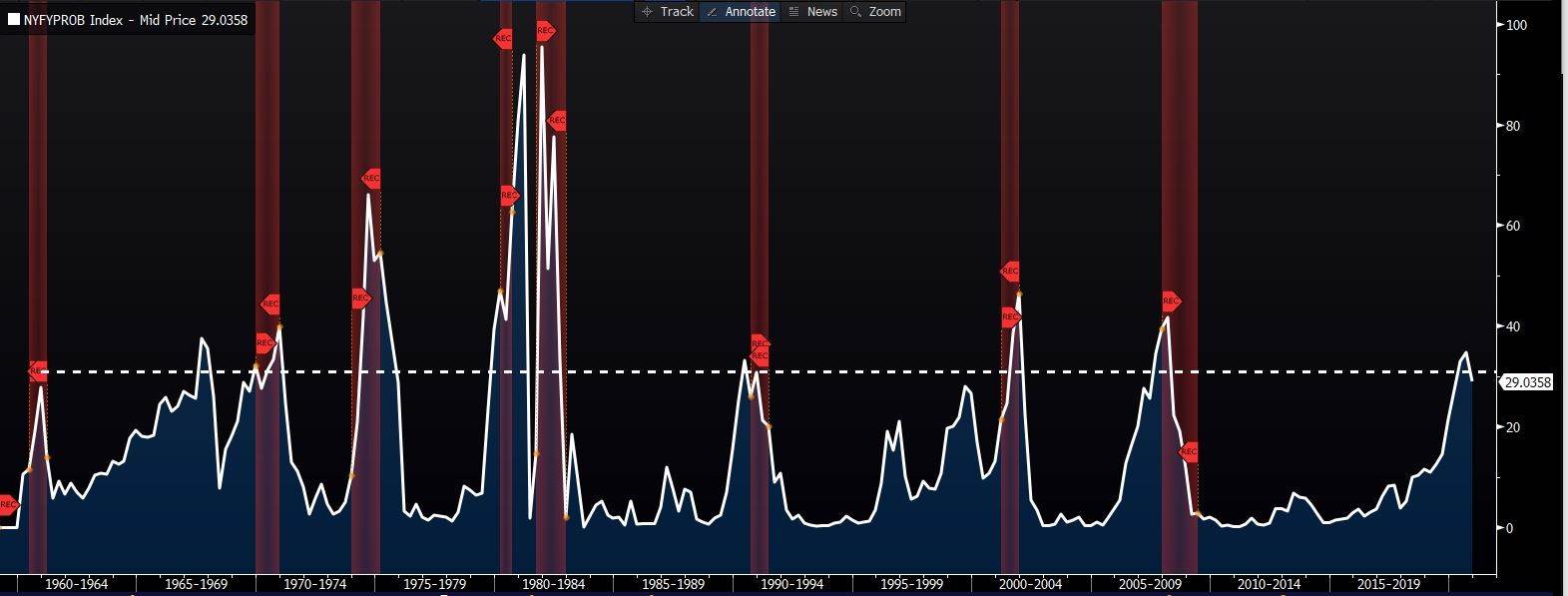

Caption: (New York Fed recession probability model 12 months out – the red shaded area represents period of recession)

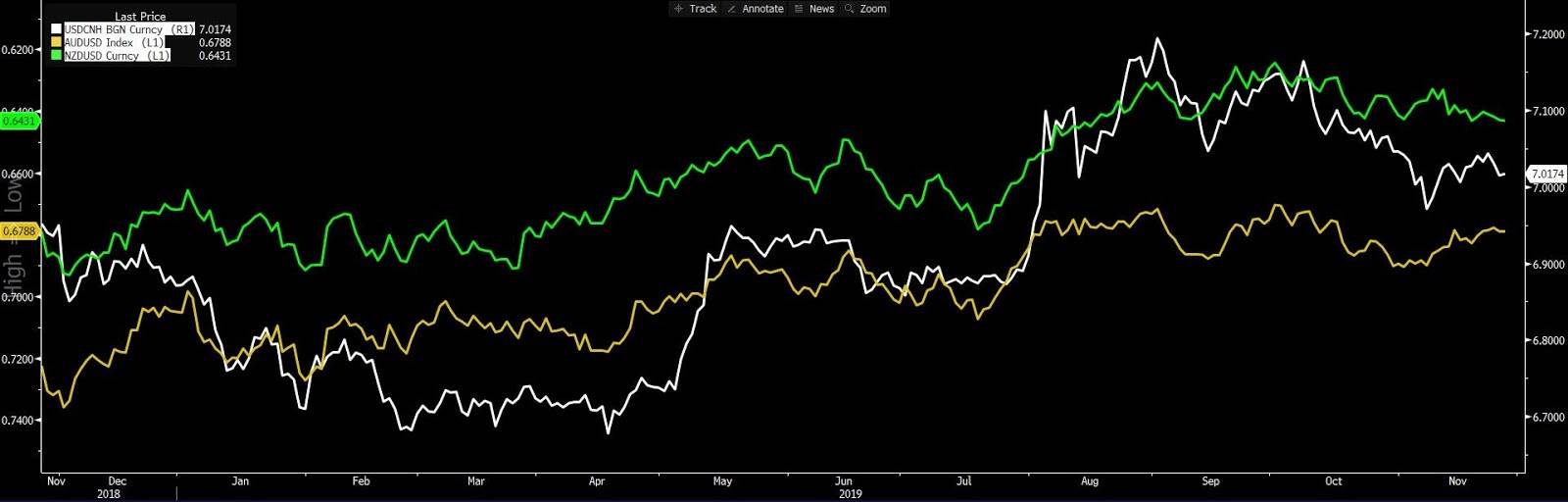

We also see a strong correlation between USD/CNH and China-dependent economies. I’ve looked at Australia and New Zealand, which rely heavily on exporting to the world’s largest population.

Year-to-date, the coefficient of determination between USD/CNH and AUD/USD is 0.849, with strong statistical significance. That’s a firm 84.9% correlation in price movement this year. When you consider other factors impacting the Australian economy - from a record low cash rate to a high unemployment - USD/CNH bears a considerable weight on AUD/USD price action. Of course, the dampened domestic data is in part a symptom of the dragging trade war.

The kiwi dollar proved even more sensitive to USD/CNH, with our trade proxy explaining 85.9% of the movement in the daily closing price of NZD/USD. Our biggest consideration is whether to trade USD/CNH, or one of the close proxies.

Caption: USDCNH (white) influences price action in NZDUSD (green, inverted) and AUDUSD (yellow, inverted). NZD and AUD have weakened alongside CNH.

Where to from here? Phase-one, 2020, and beyond

The fate of USD/CNH will be determined by trade talks. Even if we get a phase one deal, it’s only the first step. The trade war will drag into 2020 and possibly beyond, so we need to consider next year’s US election and the Democratic nominee that will run against Trump. Markets will consider the potential relationship between China and the Democratic candidate.

If China were to hold out for the election, hoping for a new occupant in the oval office, polls suggest they’re looking at Joe Biden or Elizabeth Warren.

Biden has criticised Trump for aggressive trade policies hurting American consumers and has instead suggested a union of economic partners to hold China accountable. China might see this as a softer stance. On the other hand, a Warren presidency could see climate change brought into trade negotiations, another sticking point (IP violations being another), making negotiations tougher for China.

Caption: USDCNH weekly chart. Fibonacci 38.2 retracement level at 7.046. Multi-month support at 6.9840.

Looking at the weekly chart, USD/CNH last week swung back up to the 38.2 Fibonacci retracement level of the August to November sell-off at 7.046.

This month’s low has found multi-month support at 6.9840, and price action has since held between support and the 38.2 Fib retracement. Until either is taken out, we haven’t got conviction and tug of war will likely make price action choppy. We await confirmation and details of the phase one deal.