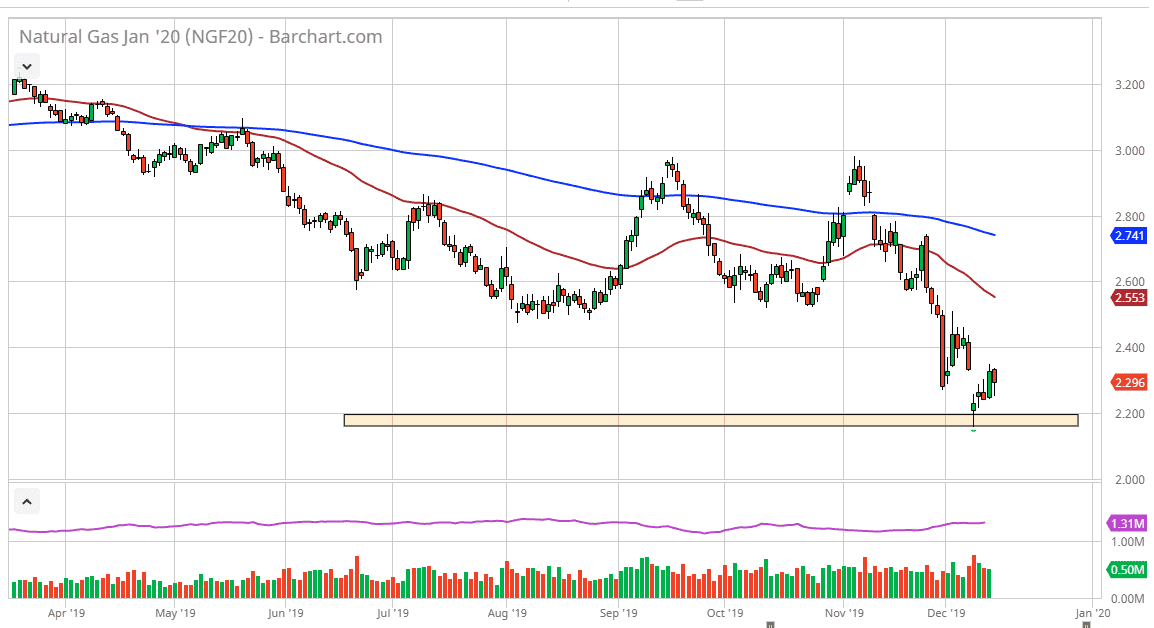

Natural gas markets fell initially during the trading session on Friday, reaching down towards the $2.25 level before bouncing significantly. This tested the bottom of the Thursday range, and then rallied again. On Thursday, we had filled a gap from the Monday trading session, so it’s not a huge surprise that there was selling at that gap. Having said that, we have been very resilient during the Friday session and it looks very likely that we continue to grind to the upside from here. Underneath, the $2.20 level has been massive support, as we have seen not only during this week, but previous times before that buyers are willing to step in. However, this is most certainly a downtrend that’s difficult to overcome, so even if we do break out to the upside due to seasonality, it won’t be easy.

To the upside, the $2.40 level is going to be resistance and if we can get above there that would be a very bullish sign. At that point, the market then goes looking towards the $2.50 level, followed by the $2.60 level. The candlestick for the trading session on Friday is somewhat telling, and the sense that there are plenty of buyers at the lower levels. To the upside, we could get a bit of momentum chasing if we get a cold weather report but it’s been difficult to overcome the massive amount of drilling that has occurred this year in the United States, as we have drilled 17% more this year than last. Having said that though, it’s only a matter of time before we spike higher based upon a short-term momentum trade. Having said that, we will then run into exhaustion and start selling as we have the cyclical selling come into play late January on an almost yearly basis. The winter snap higher is starting to run out of time, so if we don’t get it in the next few weeks this will have been a disastrous winter for natural gas suppliers. Ultimately, I do think that we get one more spike higher, and the question now is whether or not we get enough cold weather to truly break out. Things look pretty rough at this point though, so focusing on short-term trading is probably the best thing you can do. From the short term perspective, buying short and shallow dips probably continues to work.