The NASDAQ 100 initially pulled back to kick off the week on Monday, but as you can see, we have seen a significant move higher later in the day and more of a “risk on” type of move. This is a bit counterintuitive because if you listen to the news then you realize that the world is supposed to be on fire due to the US taking out an Iranian general. However, markets have already moved beyond that and it’s likely that we will continue to see a change in overall attitude yet again. This is an opportunity for those to find value that have not been able to take advantage of it, and now it looks like the overall trend is going to continue pushing higher.

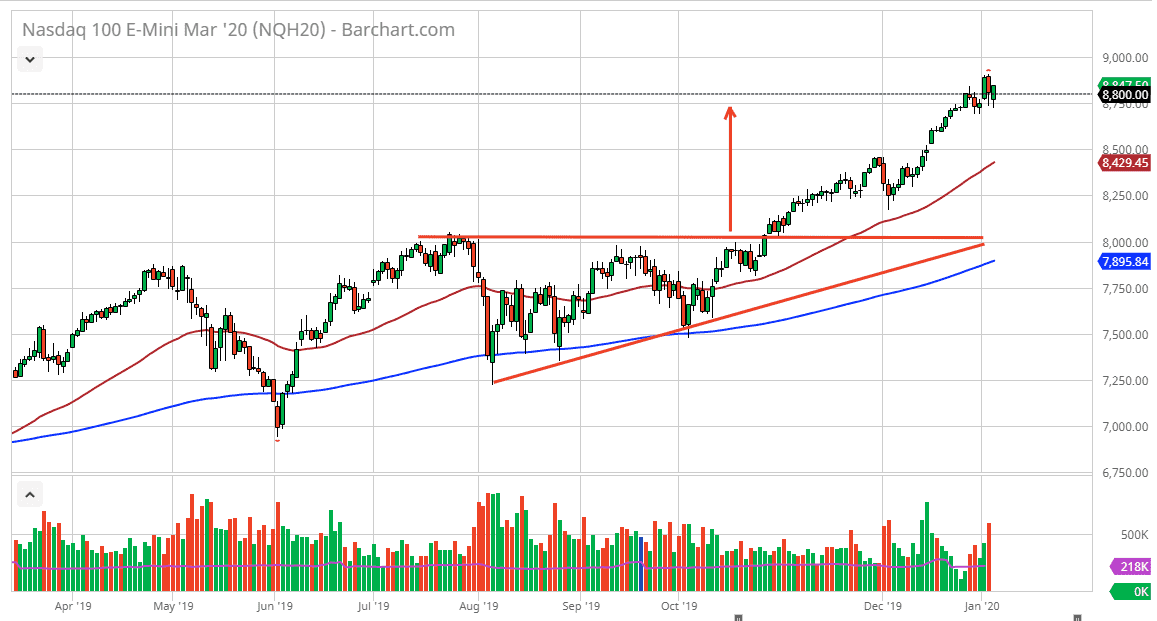

Looking at the chart, the 9000 level will be the next target, and it probably will cause a certain amount of resistance, but longer-term I do think that we will break through there. After all, the market has been in a strong uptrend for some time, so there’s no reason to think that it’s going to change anytime soon. After all, this market has seen buyers on every dip, and there’s no reason to think that it won’t happen yet again.

The 50 day EMA underneath should offer plenty of support, especially near the 8500 level. The 8000 level underneath will offer support, based upon the fact that was the top of an ascending triangle, and could define the overall trend. That being said, the market is very strong, and I do think that it is only a matter of time before buyers would come in to take advantage of value, as there is plenty of opportunity for people who are looking at the longer-term chart.

At this point, it’s very unlikely that the market falls apart, although there is the possibility that we get some type of negative headline out of the Iran/US situation. However, that is probably going to be short-lived as far as negativity is concerned, because quite frankly the market has already shown that it doesn’t care about these things longer-term. The Federal Reserve will continue to lift the markets, and it’s obvious that stock traders are starting to put money to work for the new year with that type of thinking in mind. Ultimately, I am bullish but I look for dips to take advantage of as we can’t fight this type of trend.