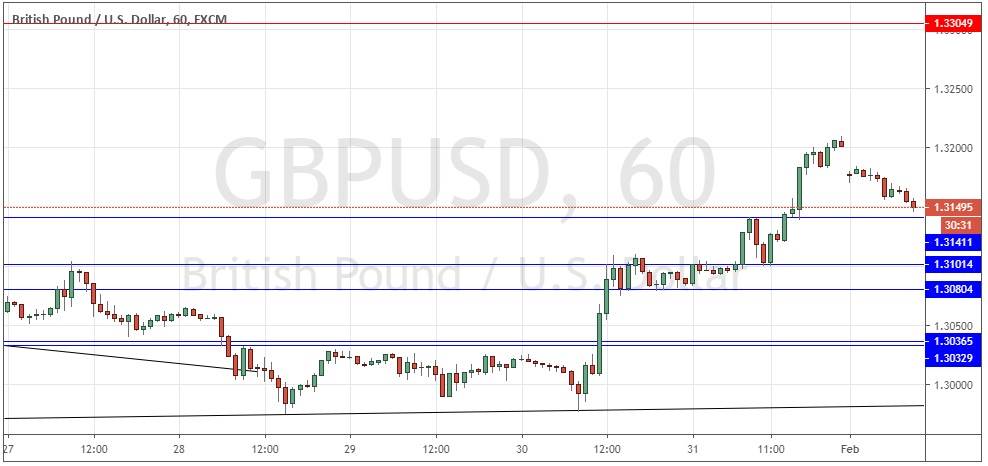

GBP/USD: Pivotal support level at 1.3141

Last Thursday’s signals were not triggered, as there was no bearish price action at any of the resistance levels which were reached that day.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trade Ideas

Go long following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3141, 1.3101, or 1.3080.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Thursday that the technical picture seemed more bearish now, with the price falling quite firmly to test the ascending trend line again. It looked quite likely that it would break down.

I was wrong, in fact that trend line not only held but produced a precise low before a very strong bullish move that broke to significant new high prices.

The picture is more bullish, and although many assets rose against the U.S. Dollar which sold off at the end of last week, the Pound was especially bullish. This was partly to do with the U.K. now finally being out of the E.U. and free to begin negotiating trade deals, so the Pound over the coming months will be driven a lot by how such negotiations progress.

Technically, there is a bearish retracement and the price is now coming to test the highest support level at 1.3141 which looks pivotal. If the price holds up here going into the early party of the London session and begins to rise firmly, this could produce a good long trade opportunity. I would take a bullish bias if this plays out over the first hour or maybe two hours of the London session.

There is plenty of room for the price to rise, with no key resistance level until 1.3305. There is nothing of high importance due today regarding the GBP. Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.

There is nothing of high importance due today regarding the GBP. Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.