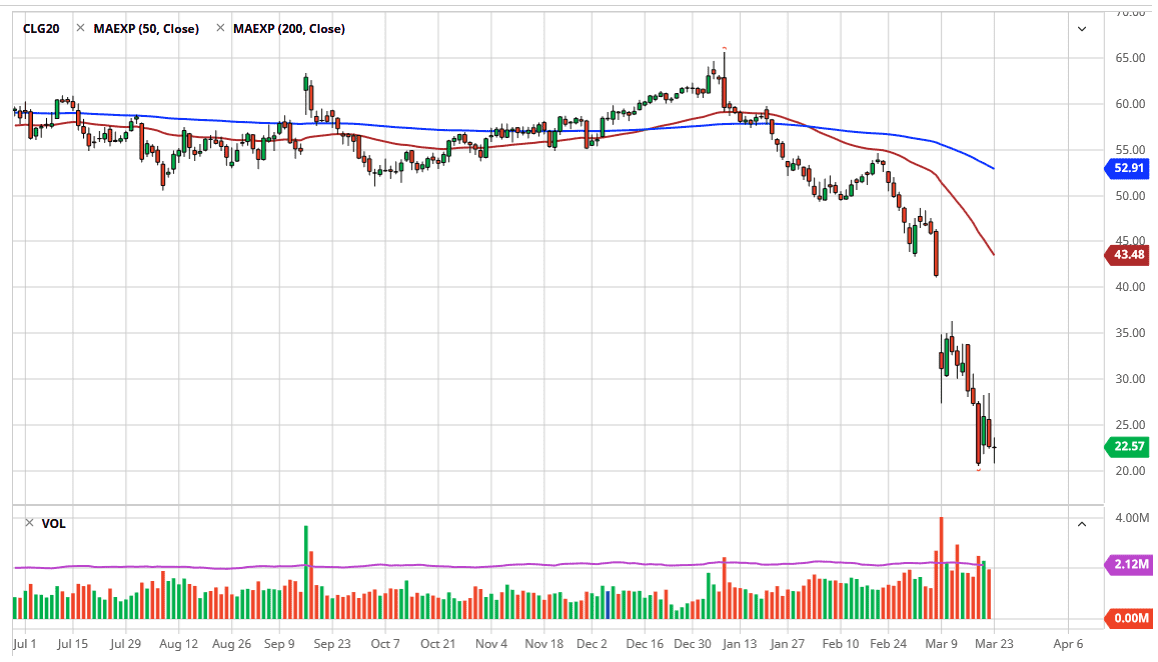

The West Texas Intermediate Crude Oil market initially fell during the trading session on Monday to kick off the week, as we continue to see a serious lack of demand for the commodity. However, the closer we got to the $20.00 level, the more buyers showed up to turn things back around and pick the market up. Ultimately, the candlestick for the day ended up being a bit of a hammer but I think this is going to be a short-term bounce more than anything else. There are a lot of structural issues when it comes to energy right now, most of which are anywhere near being able to be dealt with.

Taking a look at the candle, it looks as if we are trying to recover towards the $29 level. That’s an area where we have seen a bit of resistance previously, so it would make sense that the buyers would probably start to take profit in that general vicinity, just as a seller show up. When I look at the chart, the most striking thing of course is that the gap that kicked off the most recent selloff still hasn’t been filled. At this point, the market is likely to aim for that if we get some type of bullish news, but at this point it’s difficult to imagine what that news is going to be. The price war between Saudi Arabia and Russia will still rage, and I believe that probably needs to be taken out before oil can rally that much.

If the market turned around a break down below the $20.00 level, then it’s very possible that the market goes looking towards the $17.50 level, and then eventually the $15.00 level. If we start to see massive slowdowns in the economy like people are expecting, sometime during the month of April we will have filled most of the storage of the world and oil simply won’t be able to work off the inventory. At this point, I believe that rallies are to be sold into, starting at the $25 level, and again at the $29 level, followed by the $34 level. Ultimately, I think fading rallies will continue to be the best way to go until we get some type of fundamental announcement that suggests that the price war is over and of course demand will pick up.