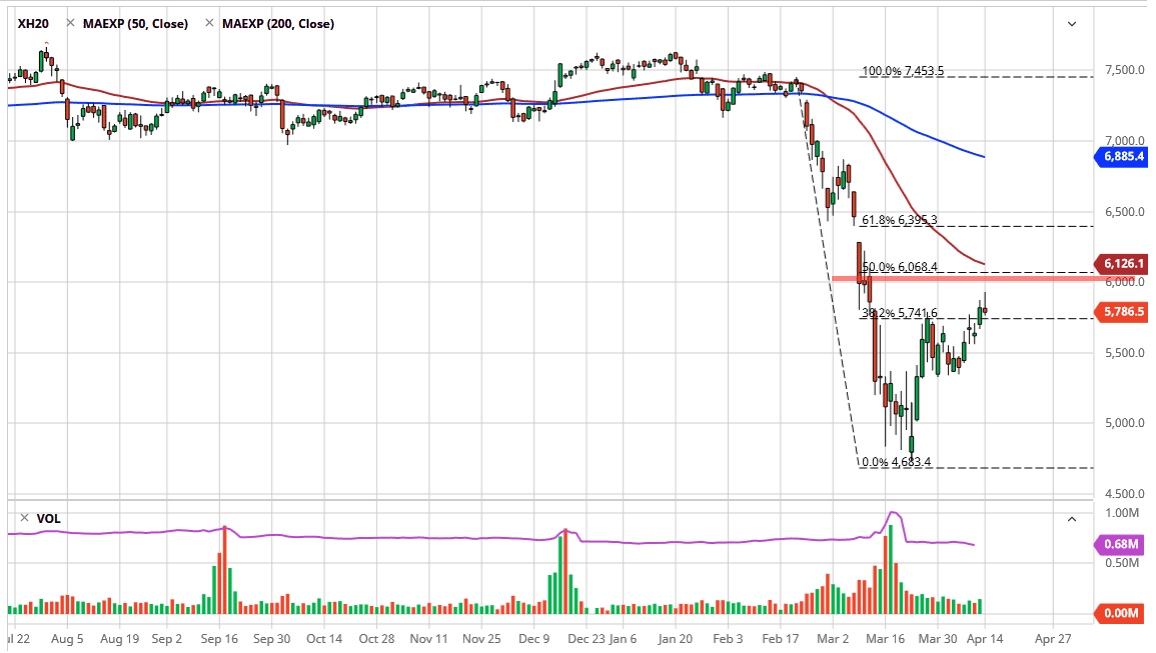

The 5100 initially tried to rally during the trading session on Tuesday but gave back gains as we get close to the 6000 level in the futures market. The fact that we ended up forming a shooting star suggests that we are running into a bit of exhaustion, as we had pierced a gap from previous trading, but then turned around to show signs of exhaustion. At this point, one would think that it makes quite a bit of sense that the market pulls back, as we had tested the 38.2% Fibonacci retracement level. At that point, the market probably goes looking towards the 5500 level underneath.

Alternately, a break above that of the shooting star of course is a bullish sign, but the 6000 level above could cause some resistance. At the 6125 handle, we have the 50 day EMA and between these two levels we have the 50% Fibonacci retracement level. In other words, the FTSE 100 may continue to go higher but I think it has a long road ahead of it in order to continue to the upside for a longer-term move. However, I also see the gap above at the 61.8% Fibonacci retracement level that would make quite a bit of sense as well, but it’s going to take a lot of effort to get there.

Pay attention equities around the world, because course the FTSE 100 will tend to follow. It has underperformed the S&P 500 a bit, but the two are starting to move in the same direction again. The S&P 500 also has the 61.8% Fibonacci retracement level above where there is a gap, but it has already tested the 50% Fibonacci retracement level. Ultimately, the FTSE 100 has been lagging, but it has been following the same directionality. In other words, there is the argument to be made that if the S&P 500 continues to power higher, you could buy the FTSE 100 in an attempt to grab onto something that will play “catch up” to the other stock indices around the world. However, it should be noted that the British economy is going to be under extreme pressure due to the fact that lockdown could last much longer than anticipated, and of course is that whole Brexit thing that nobody’s been paying attention to for the last two months. In other words, Great Britain has its work cut out for itself.