Venturing into the trading of WTI Crude Oil is a choice to pursue one of the most volatile commodities in the world currently.

The Coronavirus pandemic has set off a firestorm in the energy sector as questions about demand, storage capacity and consumption have reached a zenith rarely seen before.

The cash price of West Texas Intermediate currently is around 32.00 USD via the July contract which as the most used forward contract is the primary cash price. An actual spot price does exist in the marketplace but it is generally disregarded and not used on trading platforms which allows retail traders to buy and sell the commodity via futures contracts prices.

Where can safety be found while trading WTI Crude Oil?

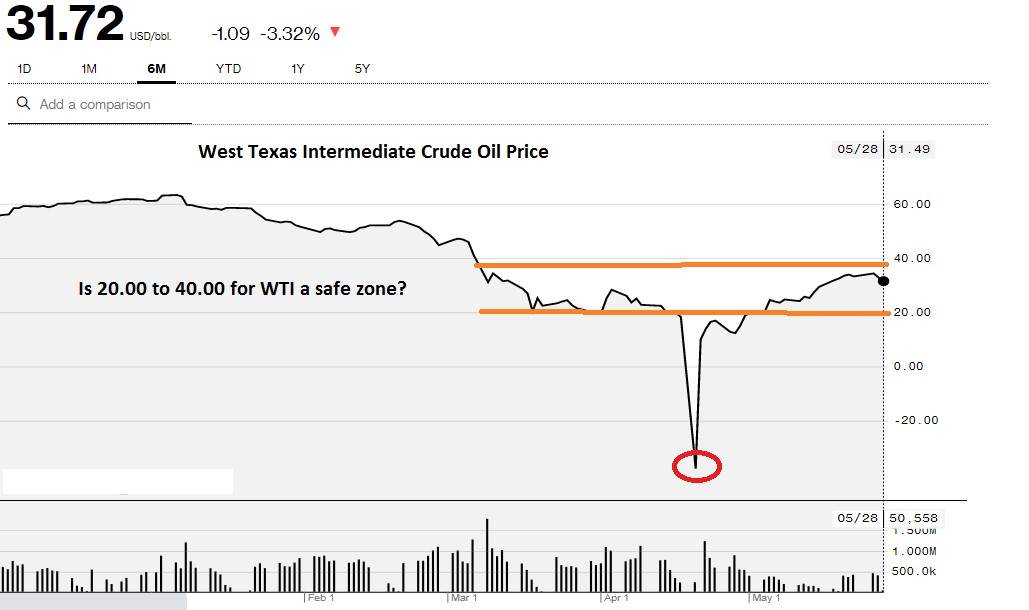

A look at the six-month chart above indicates that since the middle of March a zone – notice I do not call it a range – has been between 20.00 and 40.00 USD. The current price of the commodity has been relatively stable since the second week of May and has displayed an ability to gain value. If you are going use a measure as support, it could be justified to say 28.00 USD is a tipping point.

If the price of Crude Oil were to go below 28.00 USD it could prove to be a pivot, where institutions and traders decide real value should be lower again – which clearly happened in April. There are dangers within the Crude Oil market.

Saying volatility now exists in WTI Crude Oil would be a bit like calling a category 5 hurricane a minor event. After witnessing the WTI futures markets deteriorate and go negative on the 20th of April, some sanity has reentered the market place. However, questions persist as demand for WTI remains spotty and a recovery for consumption remains hard to quantify. If the price of Crude Oil were to go below 20.00 USD again another test of market confidence could ignite quickly.

Before the onslaught of Coronavirus the price of WTI was consistently selling near 60.00 USD a barrel. However, those ‘glory’ days may be gone for a while. Producers would be happy to achieve a price point of 40.00 USD and be able to achieve profitable revenues. The danger for producers particularly via the U.S shale industry is if prices go below 30.00 USD a barrel, which makes operating their companies difficult. It is important to remember Crude Oil in global supply remains abundant. Saudi Arabia and Russia have not reached a happy conclusion regarding their fight on production limits and both continue to produce vast amounts of the commodity.

A vast amount of supply in the WTI market remains an important component of the market and keeps the commodity extremely vulnerable to speculative plays via institutional traders. Storage worldwide for Crude Oil is at full capacity.

The question is who is going to purchase the commodity over the next month and this remains a difficult answer. Consumption via users remains weak as many manufacturers remain stagnant and their cheap energy supply is not in peril.

It appears WTI will remain under pressure throughout June as concerns remain prevalent in the marketplace regarding potential demand.

A price ratio of 28.00 to 34.00 USD seems to be a trading range at this time. Meaning if the price of WTI goes above 33.00 to 34.00 USD it could be an opportunity to sell the commodity while venturing a speculative notion the price of the commodity will go lower.

If WTI goes within the 29.00 to 30.00 USD range it looks to be an opportunity to buy the commodity and speculate an upside trend can be pursued to 32.00 USD or a touch higher.

WTI Crude Oil Outlook Summary for June 2020

Speculative price range for WTI Crude Oil is 28.00 to 34.00 USD during June

Support at 29.00 to 30.00 USD should be targeted by speculative ‘long’ buyers

Resistance at 33.00 to 34.00 USD should be targeted by speculative ‘short’ sellers