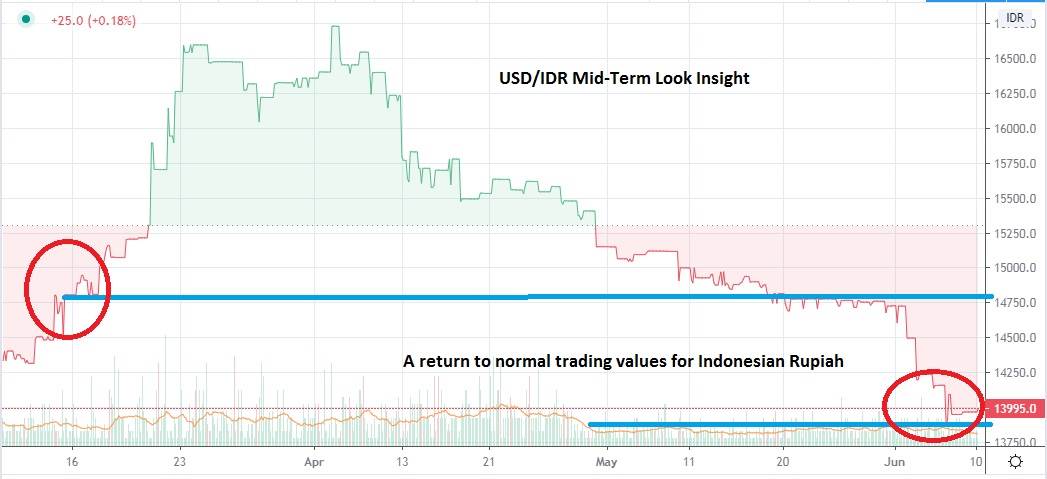

The IDR has actually moved back to a trading range which acted as its core value the past half-year, in fact, if you look at a year-long chart for the USD/IDR you will see that its current level looks positively normal.

However, taking a year-long perspective for the USD/IDR could prove costly. These are not normal economic conditions and traders need to keep in mind the volatility experienced the past three months could be sparked again if global market psychology turns fragile with a dose of bad news should it carry merit.

Speculators who are active in the USD/IDR are likely experienced traders. Traders just starting out with forex are not likely to venture into the Indonesian Rupiah unless they have some background knowledge which allows them to feel comfortable with the USD/IDR. Meaning if you are new to the Indonesian Rupiah you should be careful and you should be patient.

The Indonesian Rupiah in the short term is trading near vital support ratios and it must be remembered that volumes in the USD/IDR are not considered heavy. This means the IDR can appear to be moving violently even if in actuality trading is acting quite normal. You need to choose to stop losing and take profit targets carefully. The current support level of 13995.0 appears to be an important juncture. The next trading target below if you are looking for further strength from the Indonesian Rupiah should be around 13750.0. Which means you will be selling the USD against the IDR.

As written above the USD/IDR looks as if it has returned to a normal trading range which it has seen the past year. This trading juncture for the exotic pair means the Indonesian Rupiah may have achieved its current value and could test a potential reversal. Again, patience is needed when speculating on the USD/IDR and traders should use their leverage carefully. Speculators may be tempted to actually buy the USD/IDR around this current value which is testing important support with the belief the Indonesian Rupiah will give back some of its gains made the past week of trading. There appears to be ammunition to attempt a buying position of the USD/IDR and look for a climb towards resistance levels seen early last week.

Indonesian Ruipah Short-Term Outlook:

Current Resistance: 14750.0

Current Support: 13900.0

High Target: 15000.00

Low Target: 13000.0