For three straight trading sessions, the EUR/USD pair stabilized around its highest level since September 2018, at the 1.1781 resistance, before settling around 1.1730 at the time of writing, ahead of the announcement of the results of the most important event for this week, which is the monetary policy decisions of the US Federal Reserve Bank later today. As markets monitor the possibility of providing more economic stimulus in light of the continued U.S lead in terms of coronavirus cases and death numbers. The pair's rise was halted as the dollar stabilized against other major currencies at oversold levels. Analysts were considering the possibility of a downward correction, with increased possibility given the evolution of Coronavirus.

The European single currency was preferred for trading during the months of June and July, thus stopping the path of the dollar's rise, amid the excitement over the European Union budget to recover from the coronavirus crisis, which provided the direction of a more policy-oriented approach. The July agreement, which has its roots in a proposal submitted by France and Germany in late May to offer grants and loans from the European Commission to countries affected by the pandemic, raised hopes that a monetary union matched by a financial union and a Eurozone better able to deal with crises in the future.

Derek Halpenny, Head of Research and Global Markets in Europe, Middle East, Africa, and International Securities at MUFG, said: “We are definitely entering into an extended region even though this may not have been convincing yet. But what we find most important about this Euro move is the lack of evidence of speculative leverage purchase.”

It appears that the 27 EU approval of the recovery fund last week played a pivotal role in the Euro achieving more than 2% gains. This, and the economic perceptions of a faster than others recovery from the coronavirus, were also a blessing for positive sentiments towards the European single currency.

The price of the Euro rose against the dollar by 9% from the trend bottom around the 1.08 support in late May to its highest level at 1.1780 during Monday's trading, although a lot of the rise also occurred during the period in which investors sold the dollar against every Other G10 currency. On the recent performance, Michael Evry, Global Strategist at Rapobank, said “Not bad for the bloc that sees the second-largest economy leave the European Union with no guarantee of anything other than the torn WTO’s terms of trade by the end of the year; Or to a region focused on tourism at a time when Spain is exposed to an increase in COVID-19 cases again, which prompted many countries to re-impose the embargo on those returning from there. We are only seeing some recent excess wounds - and the question is whether they are temporary or not."

The dollar has been selling aggressively since early June, which caused the DXY dollar index to drop to its lowest level since May 2018 this week, as the second wave of coronavirus infections threatened the recovery of the already affected economy at a time when the US central bank was printing more money, and when paired with signs of economic recovery and expectations of a possible coronavirus outbreak in Europe and elsewhere, investors have no good reason to leave the dollar completely.

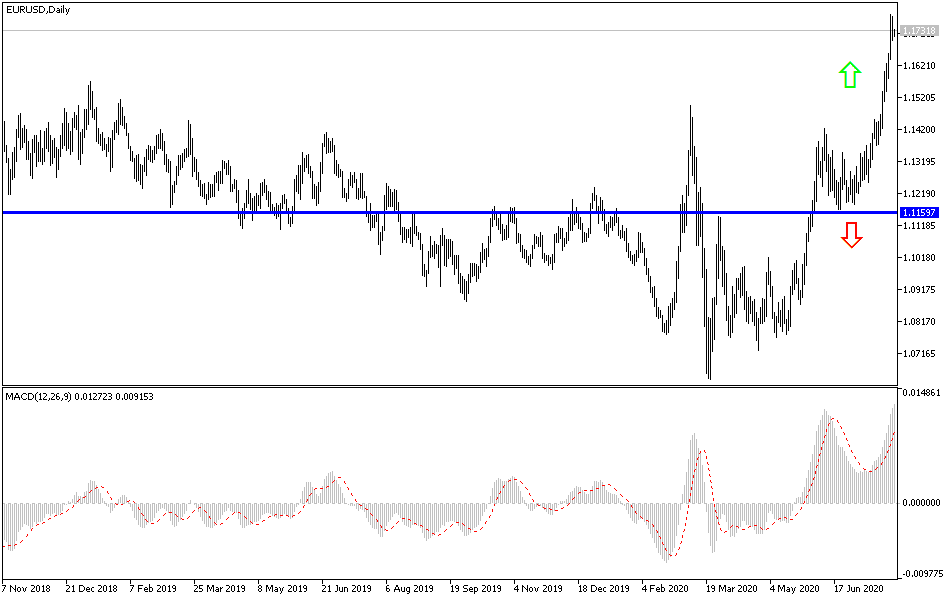

According to the technical analysis of the pair: The EUR/USD general trend is still in an upward correction range taking into consideration the arrival of technical indicators to strong overbought areas, and if the US Federal Reserve decisions come in contrast to the aspirations of the markets, the dollar may see this as an opportunity to swoop again and consequently the pair might drop towards support levels at 1.1660, 1.1590 and 1.1480, respectively, and breaking the last level, would bring back a stronger bear control. On the other hand, to complete the current course, and with stability above the 1.1800 resistance, we may reach the 1.2000 psychological resistance before the end of this important week's transactions.