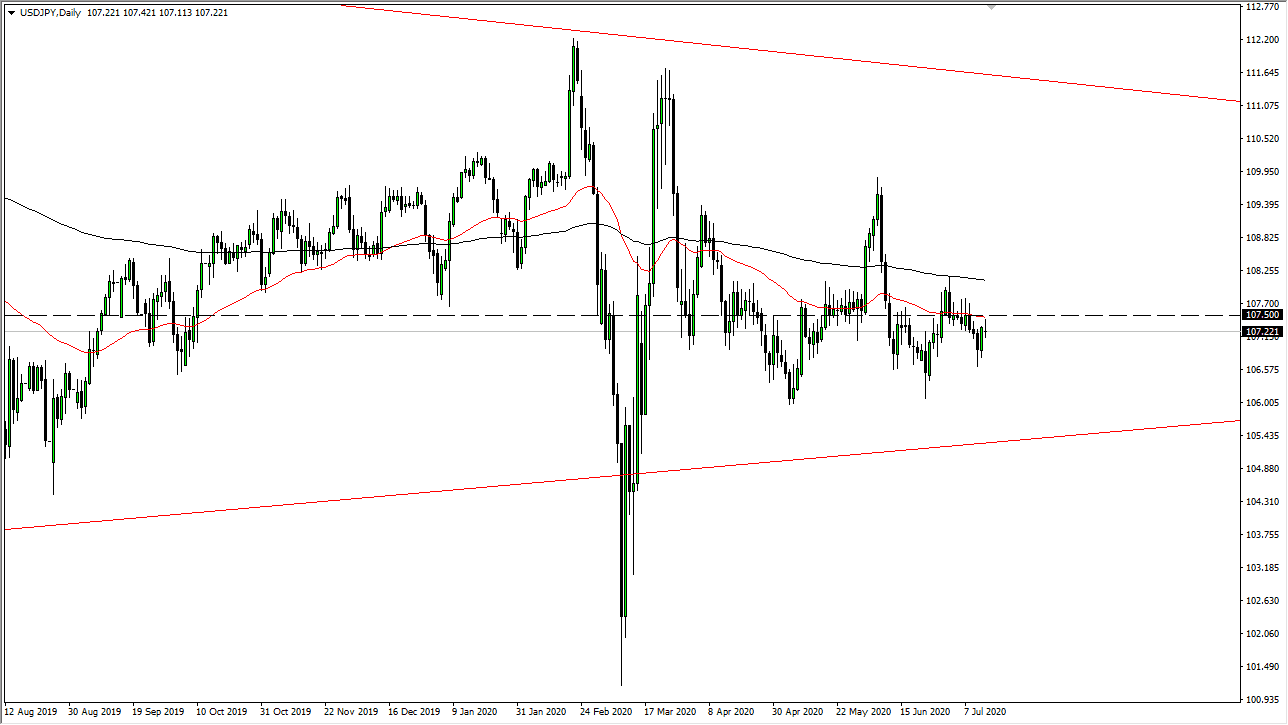

The US dollar initially rallied during the trading session on Tuesday but gave up some of the gains against the Japanese yen as we continue to see the 107.50 level cause a reaction in this market. This is also the scene of the 50 day EMA so it should not be a huge surprise that we ran into some trouble here. By pulling back the way it has, it looks as if the market is running out of steam again, and a breakdown below the lows of the trading session for Tuesday could very well open up a move down to the ¥106 level.

The ¥106 level is where we have seen a double bottom as of late, so do not be surprised at all to see that hold. However, if we were to break down below that level then it opens up a move towards the ¥105 level which has a lot of psychological importance built-in. A breakdown below that level then opens up the possibility of a move all the way down to the 100 to yen level, but it would take quite a bit of selling to make that happen.

To the outside we have the 200 day EMA currently trading around the 100 a point to zero yen level. If we can break above that, then it could open up a move towards the ¥110 level, as it would be very bullish. That being said, one possibility is that it would probably coincide with a massive “risk-on move” in a lot of equity markets. The other possibility is that if we rally it is due to the fact that the US dollar is picking up momentum against almost everything. As we live in a systematic trading world now, quite often the correlations all go to one, meaning that if there some panic somewhere else, they may jump in and start buying the US dollar against everything. All things being equal though, we are simply grinding around in a relatively tight consolidation area and therefore I think we continue to look at ¥107.50 as a bit of a magnet. If we were to break down significantly, I anticipate that the Bank of Japan would lose it since of humor with that type of move the closer we got to ¥100.