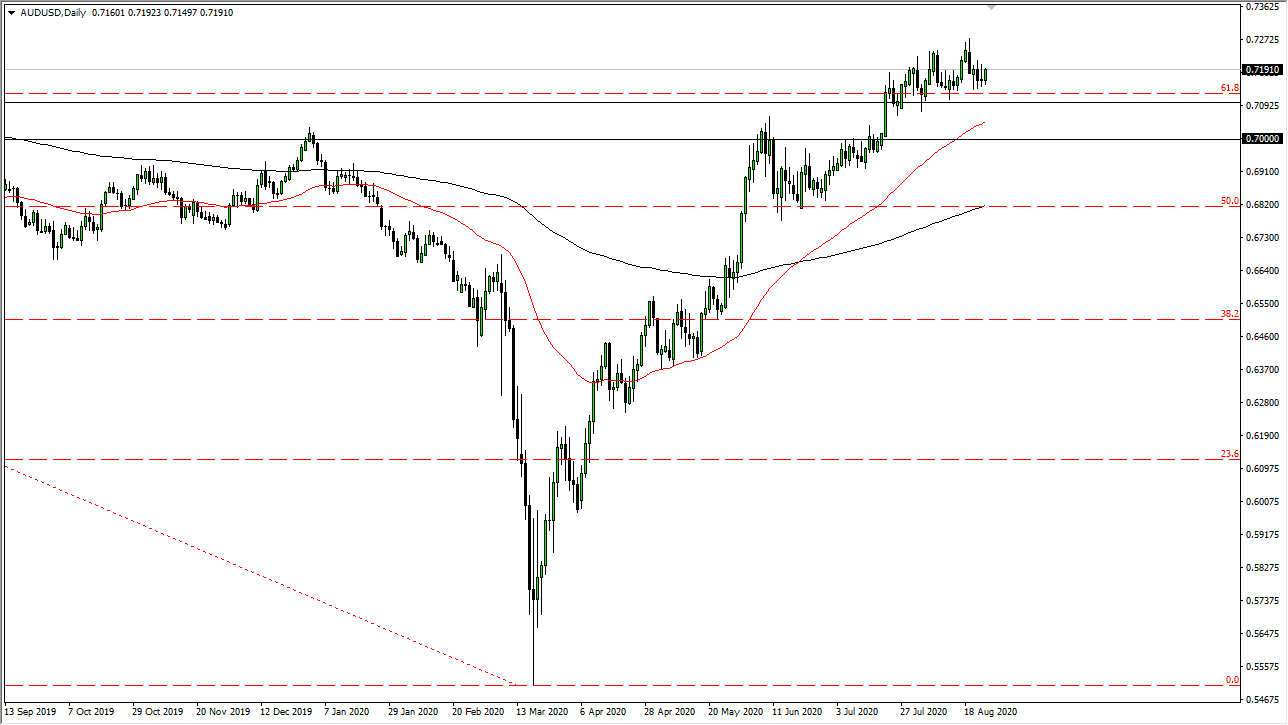

The Australian dollar has initially dipped during the trading session on Tuesday but then turned around to show signs of strength again. In fact, by the end of the day, the market is starting to reach towards the 0.72 level, an area that has been a bit difficult. Breaking above there opens up the possibility of reaching towards the 0.73 level, and then ultimately the 0.75 handle. I should probably point out that the scenario is my best case thought process. I believe that the market will eventually go looking towards higher levels, mainly due to the fact that the Federal Reserve is doing everything it can to loosen monetary policy and thereby bring down the value of the US dollar by extension.

To the downside, I believe that the 0.71 handle is the beginning of significant support that extends down to the 0.70 level. Because of this, I believe that there is plenty of areas underneath and should continue to offer support, not only in that general vicinity and for the structure of that area, but the 50 day EMA sitting right there. After that, the market also has plenty of support down at the 0.68 level. At that point, you would be testing the 200 day EMA so it makes quite a bit of sense that traders would be interested in buying that area as well. All things being equal, I believe that we are simply killing time in order to find enough momentum or at least an excuse to break out.

In fact, it is not until we break down below the 0.68 level that I would be concerned about the uptrend and start to think about shorting this market quite drastically. All things being equal though, I would anticipate that any move like that would have to be some type of major event. This would be a scenario where we suddenly found the markets in general “risk-off.” At this point in time, buying short-term pullbacks should be a buying opportunity, at least on short-term charts. Eventually, I think that it is only a matter of time before the market breaks out to the upside as this is a major area of confluence and clearing it would open up the possibility of a longer-term “buy-and-hold” type of scenario.