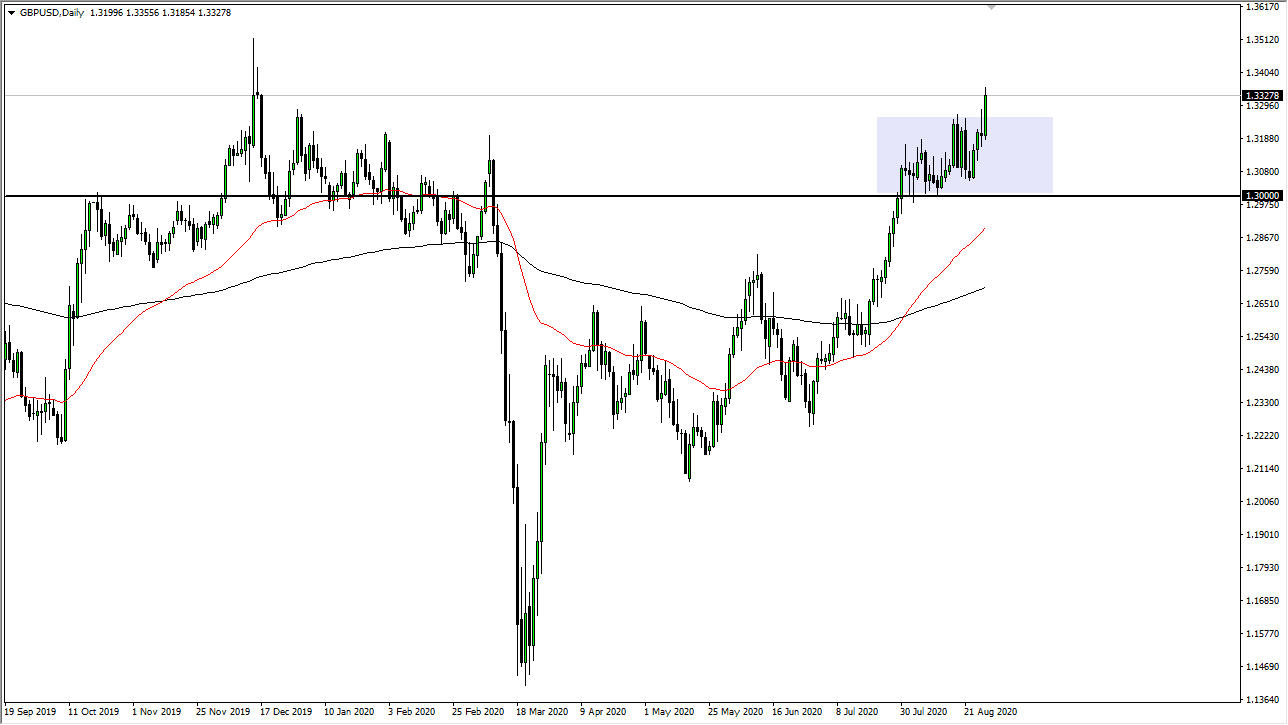

The British pound has broken out significantly during the trading session on Friday, slicing through the shooting star during the trading session on Thursday. This is a very bullish sign and it shows that the US dollar is going to continue to struggle. Ultimately, I do think that this pair goes to the 1.35 handle, and that we are going to see a rather quick move towards the target. The short-term pullback should be a buying opportunity, with the 1.33 level offering potential support underneath.

Looking at this chart, if we can break above the 1.35 handle, then it is likely that we could go even higher. Underneath, the 1.30 level should be massive support and I think that continues to be another major area to pay attention to. In that area I would be more than willing to jump in to this market and take advantage of “cheap pounds.” The 50 day EMA is heading towards that area, and I think it is only a matter of time before people would pay attention to that as well.

With Jerome Powell suggesting that the bar to raise interest rates is even higher than it used to be, this will continue to put downward pressure on the US dollar. This makes sense as interest rate policy is one of the biggest contributors to the value or lack of value in a currency. Ultimately, I think that this market continues to see an upward move, and therefore look at pullbacks as a bit of value and take advantage of these dips going forward. I think we are in the midst of a longer-term move, so therefore I have no interest in shorting and I think that given enough time we will see an impulsive move again. In fact, Friday is probably the beginning of the next massive move, which could last quite some time.

The UK is trying to get people back to work, so that will help as well. What is interesting to me is that the Brexit situation is still out there, yet nobody is willing to talk about it. In other words, we are completely forgetting that and looking right past it. This tells me that this market is all about the US dollar and what is going on with the greenback, so it is worth paying attention to that half of the equation more than anything else right now.