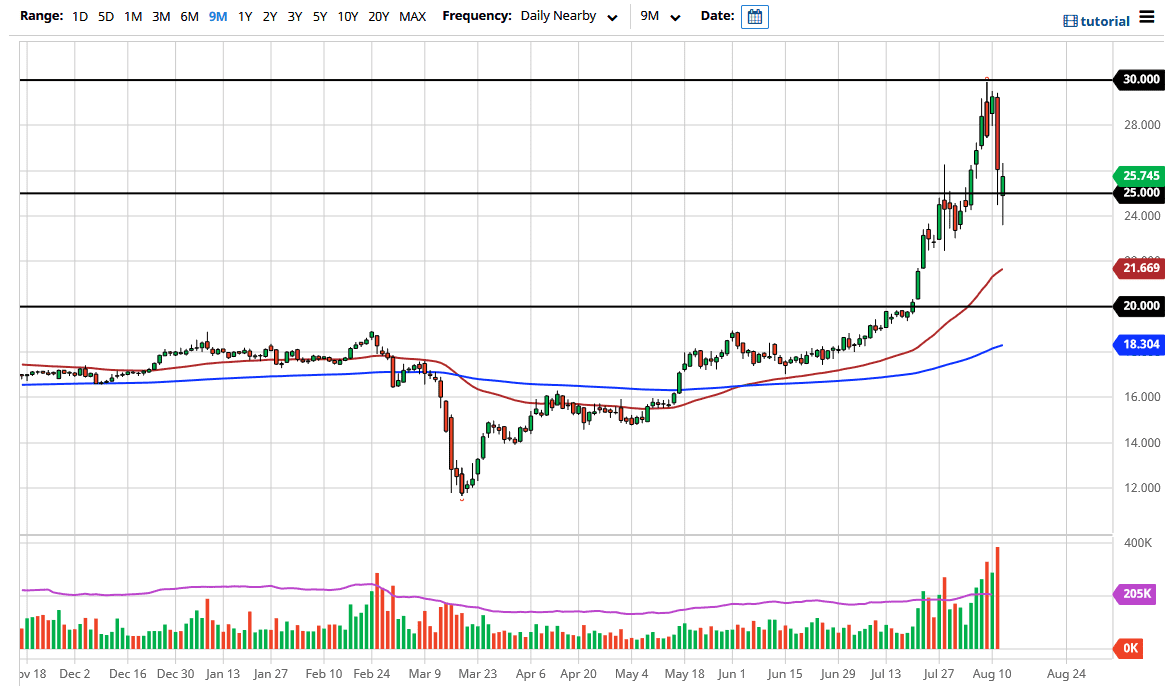

Silver markets were all over the place during the trading session on Wednesday after we had a horrific Tuesday session. By dipping below the $24 level, we had finally found enough buying pressure to turn around. The candlestick for the day is a bit of a hammer and that suggests that the buyers may continue to find value in this market and drive it higher. At this point, if we can break above the highs during the trading session on Wednesday, then we are likely to see silver try to get towards the $28 level rather quickly. After that, we are probably looking at the $30 level.

A breakdown below the bottom of the candlestick for the trading session would be negative, but there is a lot of support underneath there and therefore I would not be a seller but rather I would be looking for an opportunity to pick up value at lower levels. The 50 day EMA currently sits at $21.66, so it could be an area where buyers would also be interested. Regardless, I have no interest in trying to short silver because the Federal Reserve is doing everything it can to loosen monetary policy and that is very negative for the greenback. With the US dollar losing value, that means that we are likely to see precious metals continue to go to the upside. The shape of the candlestick is also bullish so I would have to think that will attract a certain amount of attention in and of itself.

The market has reached roughly 50% of the pullback from the move, so it is also another reason to think that the buyers might come back. All things being equal, I think we will go looking towards $30 given enough time, but it is going to take some time to get there. The recent selloff will have shaken a lot of confidence, so it makes sense that the rise towards the $30 level will probably take a bit more time than the breakdown did, so you will need to be patient obviously. However, the trend is very much in, and even though we saw such a massive breakdown on Tuesday, the reality is that has not changed even though the selloff will have scared a lot of people.