The silver markets gapped lower to kick off the trading session on Thursday as we may have gotten a little bit ahead of ourselves in the short term, and of course the US dollar gained a bit. Having said that, the US dollar sold off later in the day, and thereby allowed the precious metals markets to recover. What you do not see on the daily candlestick is the fact that the market rallied to fill the gap almost immediately, fell again, and then rallied again. This tells me there is significant resiliency underneath and silver should continue to attract a certain amount of buying pressure.

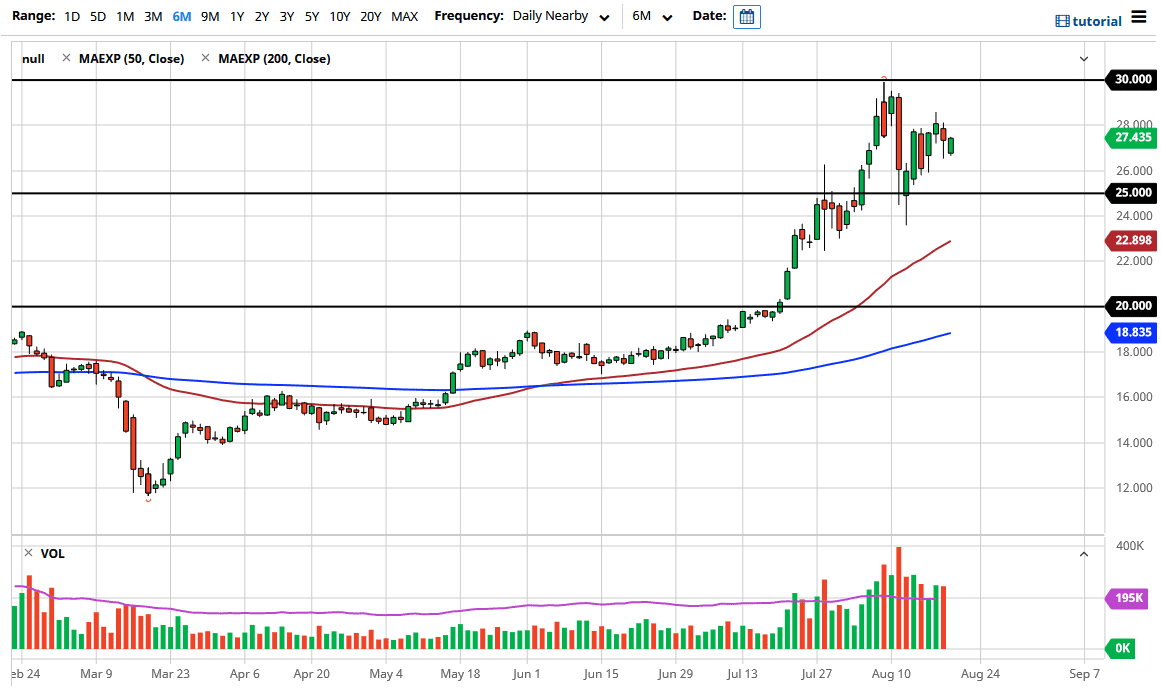

Looking at the situation, the Federal Reserve continues to flood the market with liquidity and therefore I think it makes quite a bit of sense that the US dollar loses strength over time. This of course helps silver markets as well as other precious metals markets, due to the fact that it takes more of those devalued greenbacks to buy an ounce. To the downside, I think there is a significant amount of support that starts at the $26 level, extending down to the $25 level. Furthermore, I also think that the 50 day EMA will come into play as support if we fall from here as well. Do not be wrong, I recognize that we may have just made a “lower high”, but I do not think that the trend is over.

The $25 level is obviously a large, round, psychologically significant figure, so I think there would be a lot of interest there as well. I do believe that silver has much further to go due to the quantitative easing that we are seen not only out of the Federal Reserve, but other central banks around the world. As long as that is the case, it certainly makes sense that we will see traders out there trying to preserve wealth by getting away from fiat currency. The $30 level above should be a target eventually, but the $28 level between here and there will offer a certain amount of resistance as well. Either way, I think that you continue to see value enter the market on pullbacks, as the market has been so bullish as of recent times. I have no interest in shorting, at least not in this present environment.